Question: Cash Flow Estimation and Risk Analysis. Free Cash Flows Given a project's expected cash flows, it is easy to calculate its NPV, IRR, MIRR, payback,

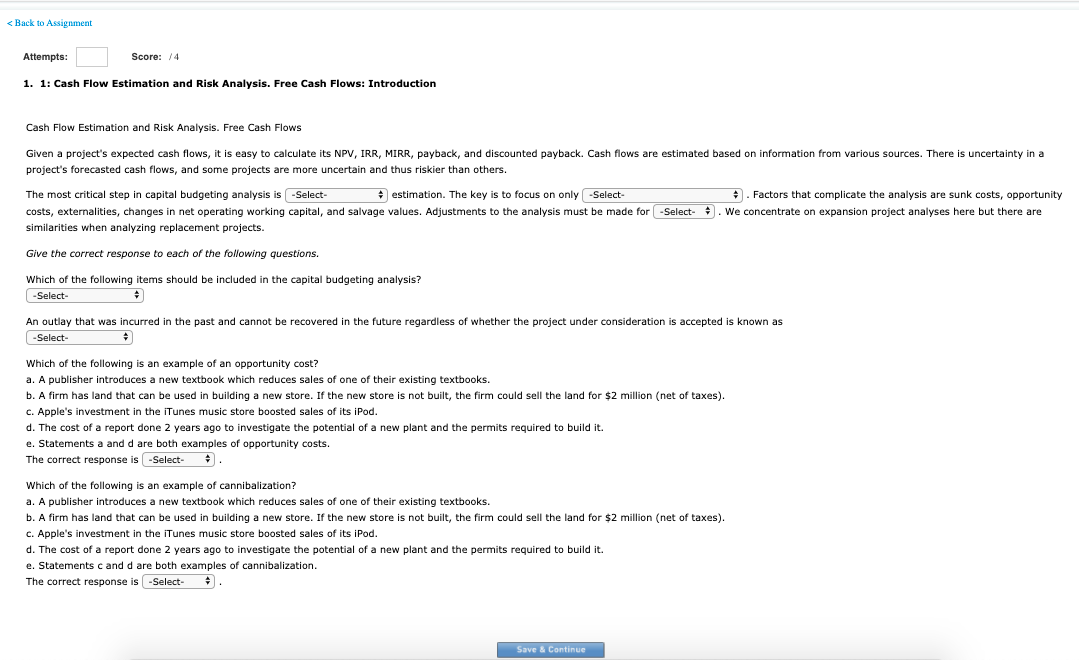

| Cash Flow Estimation and Risk Analysis. Free Cash Flows Given a project's expected cash flows, it is easy to calculate its NPV, IRR, MIRR, payback, and discounted payback. Cash flows are estimated based on information from various sources. There is uncertainty in a project's forecasted cash flows, and some projects are more uncertain and thus riskier than others. The most critical step in capital budgeting analysis is -Select-net incomecash flowaccounting incomeItem 1 estimation. The key is to focus on only -Select-relevant net incomeincremental accounting incomeincremental cash flowsItem 2 . Factors that complicate the analysis are sunk costs, opportunity costs, externalities, changes in net operating working capital, and salvage values. Adjustments to the analysis must be made for -Select-inflationinterestdividendsItem 3 . We concentrate on expansion project analyses here but there are similarities when analyzing replacement projects. Give the correct response to each of the following questions. Which of the following items should be included in the capital budgeting analysis? -Select-a. Sunk costsb. Interest paymentsc. Dividend paymentsd. Opportunity costsItem 4 An outlay that was incurred in the past and cannot be recovered in the future regardless of whether the project under consideration is accepted is known as -Select-a. Opportunity costb. Externalityc. Sunk costd. CannibalizationItem 5 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts