Question: Cash Flow Estimation Example 1: You are considering feel you can sell 100,000 of these products per year with expanding your your product line. You

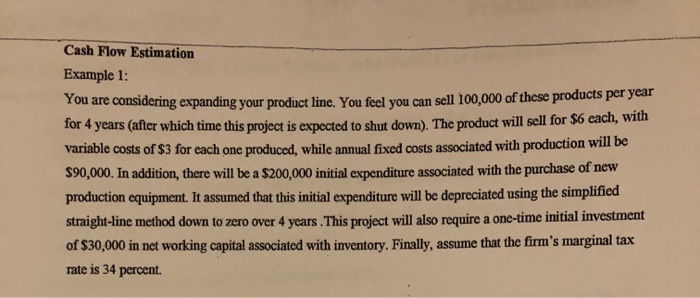

Cash Flow Estimation Example 1: You are considering feel you can sell 100,000 of these products per year with expanding your your product line. You for 4 years (after which time this project is expected to shut down). The product will sell for $6 each, variable costs of $3 for each one produced, while annual fixed costs associated with production will be $90,000. In addition, there will be a $200,000 initial expenditure associated with the purchase of new production equipment.It assumed that this initial expenditure will be depreciated using the simplificd straight-line method down to zero over 4 years.This project will also require a one-time initial investment of $30,000 in net working capital associated with inventory. Finally, assume that the firm's marginal tax rate is 34 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts