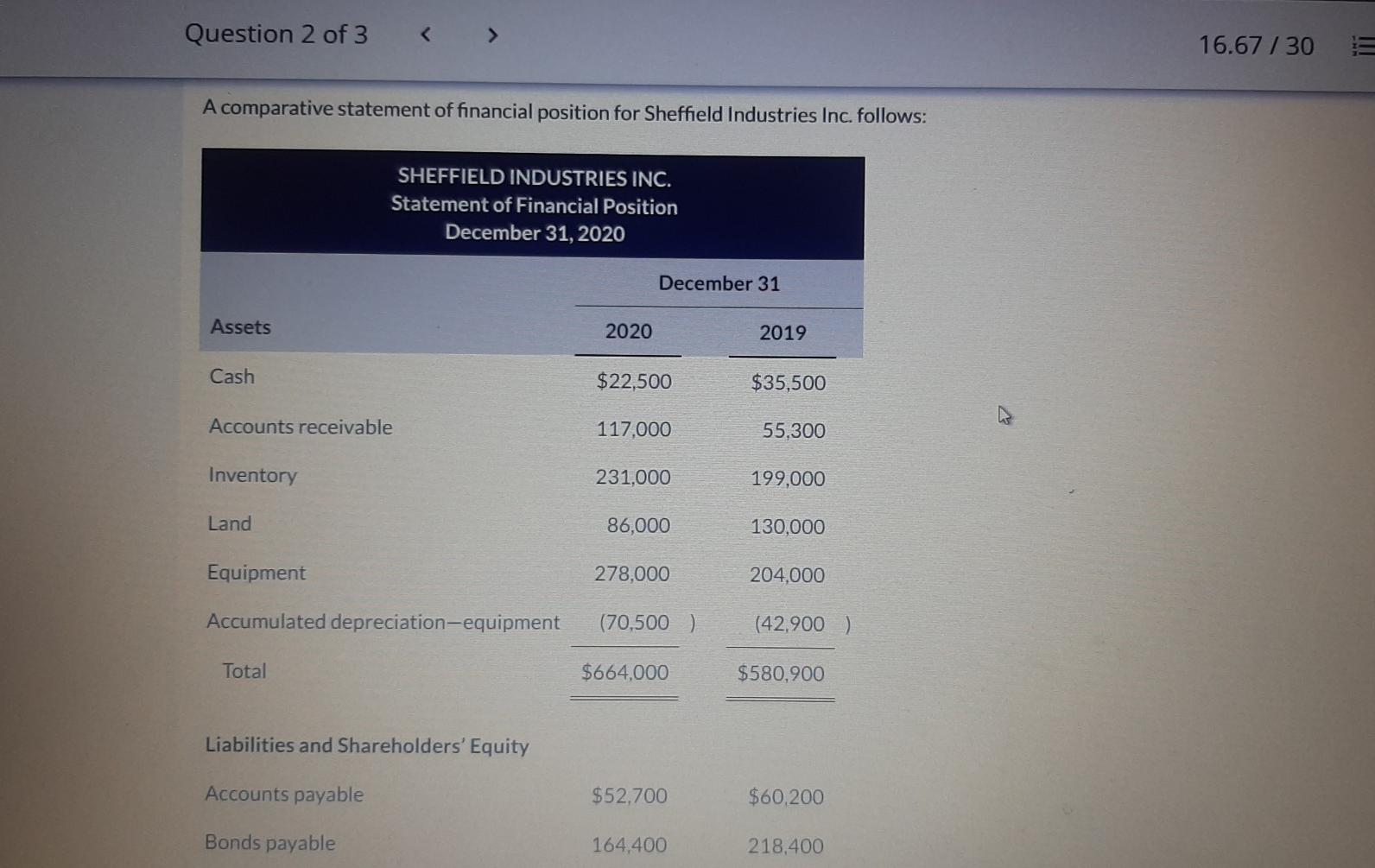

Question: Cash Flow using indirect method: Question 2 of 3 16.67 / 30 A comparative statement of financial position for Sheffield Industries Inc. follows: SHEFFIELD INDUSTRIES

Cash Flow using indirect method:

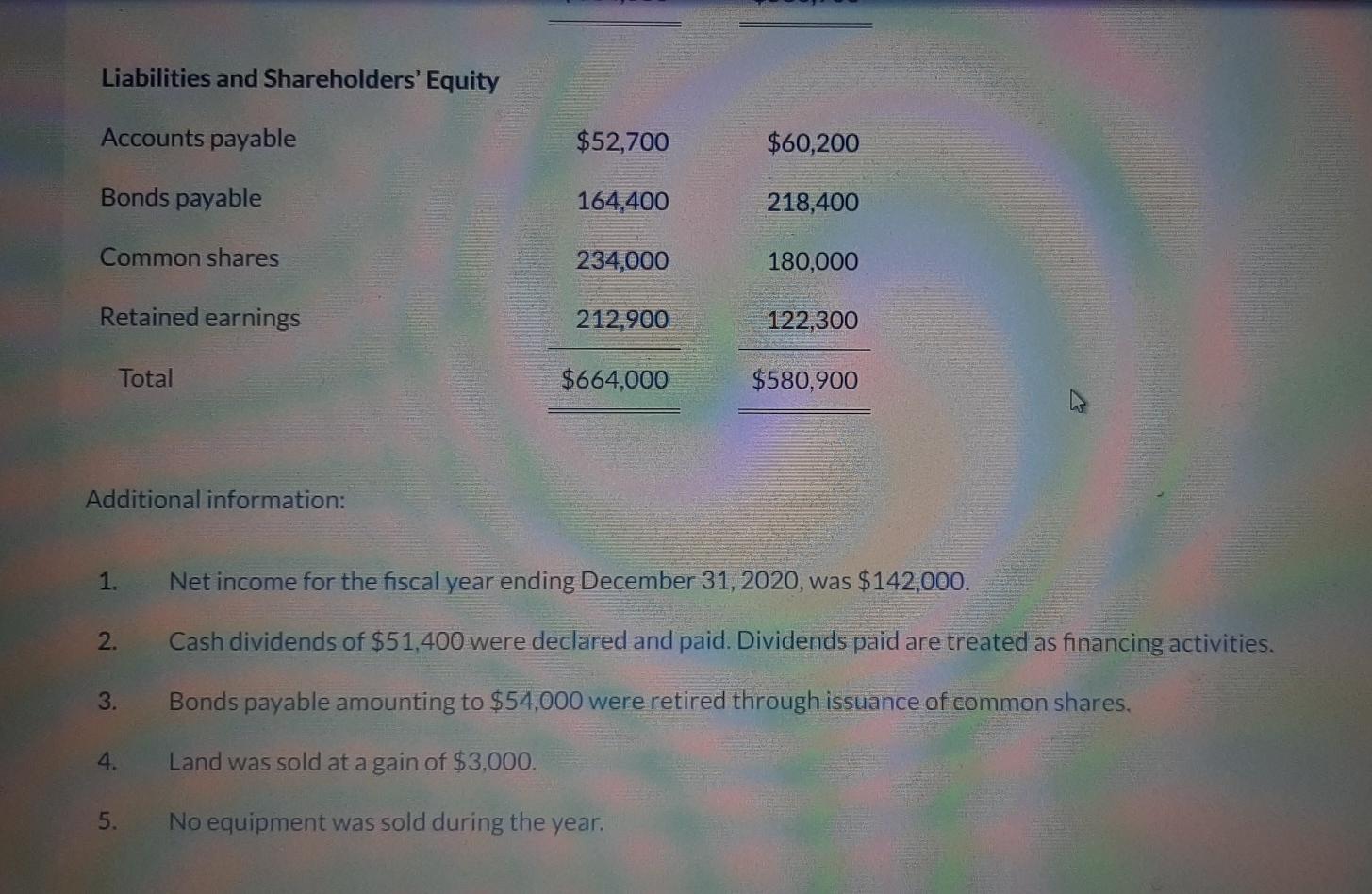

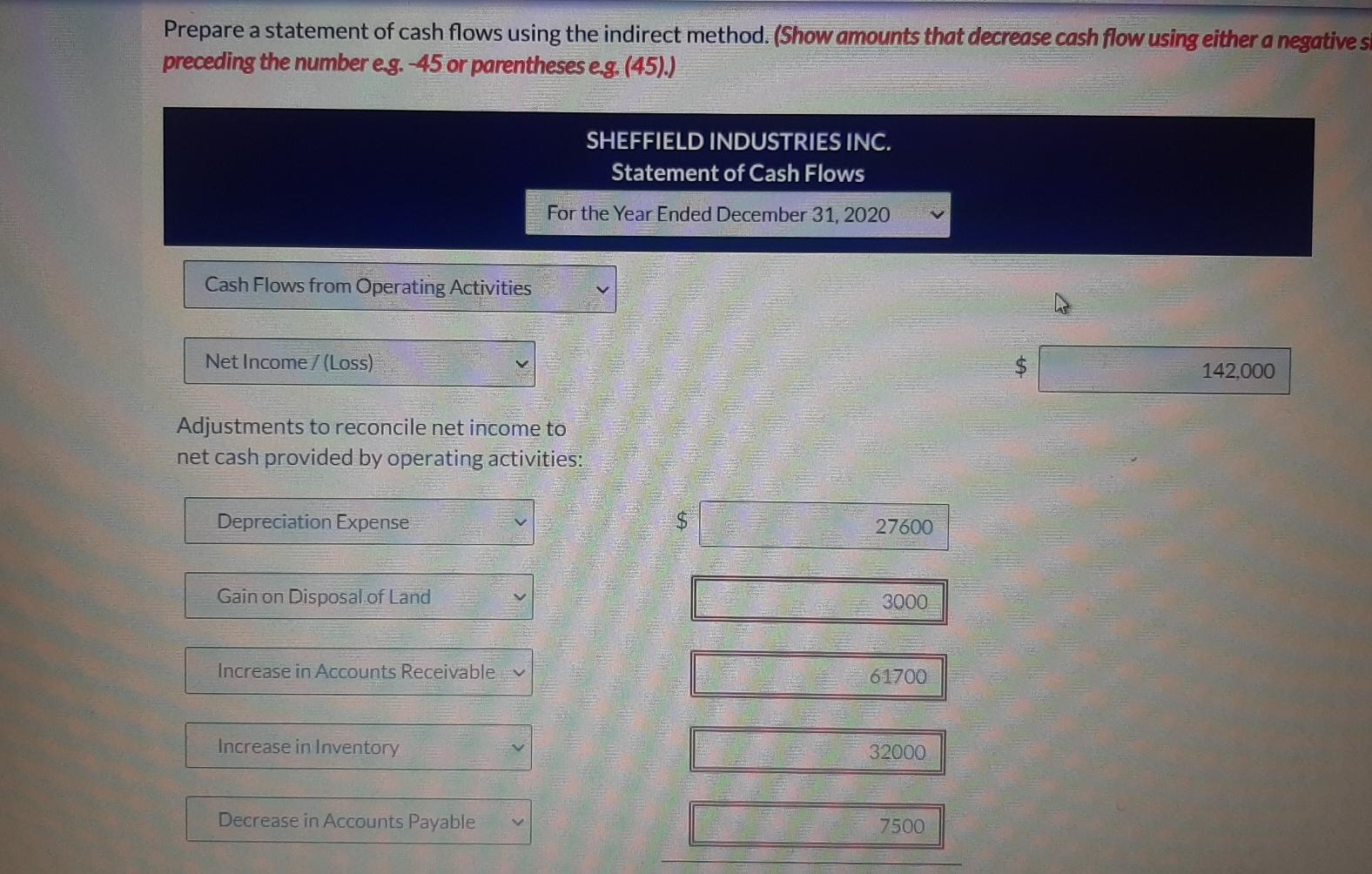

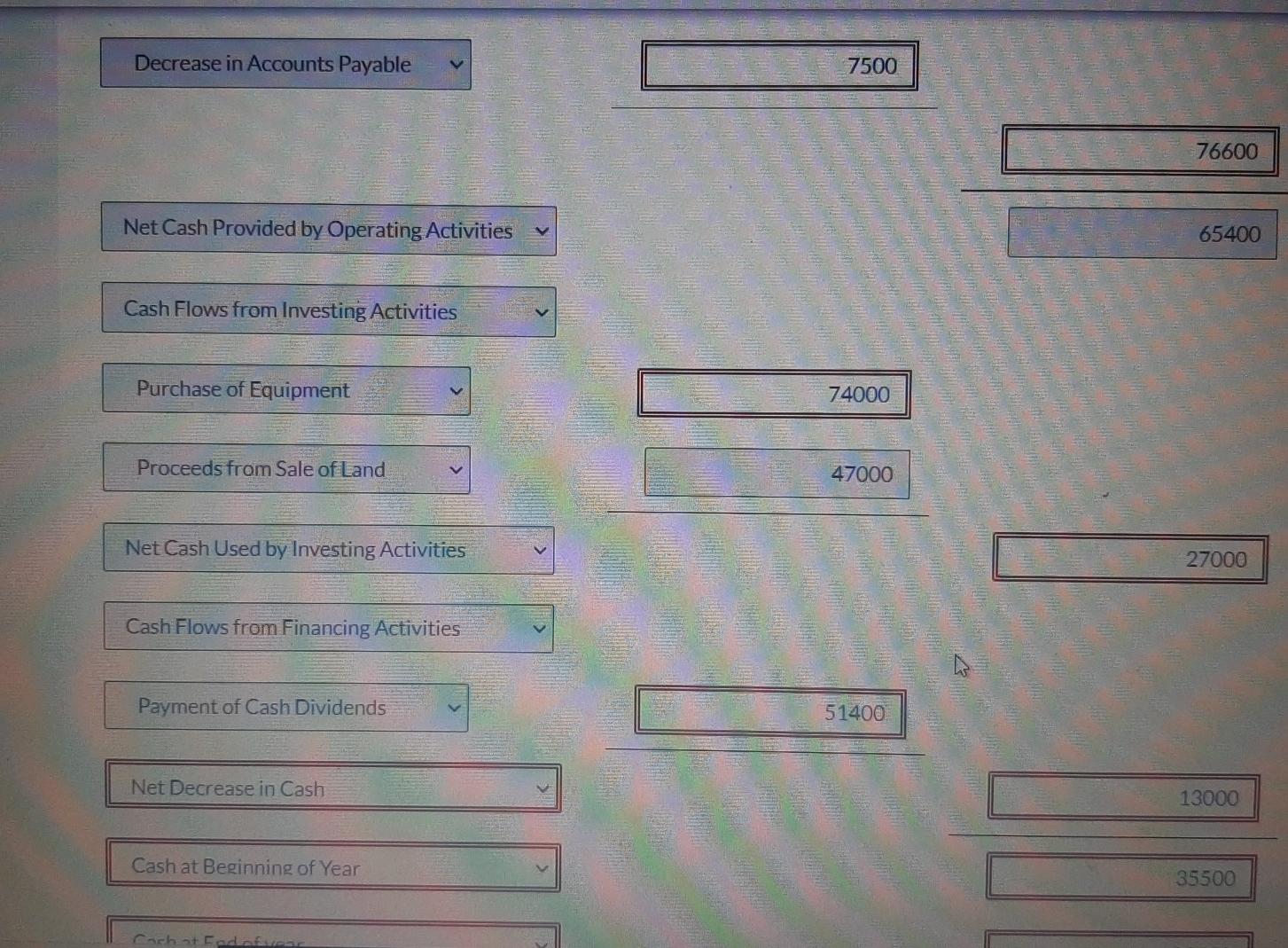

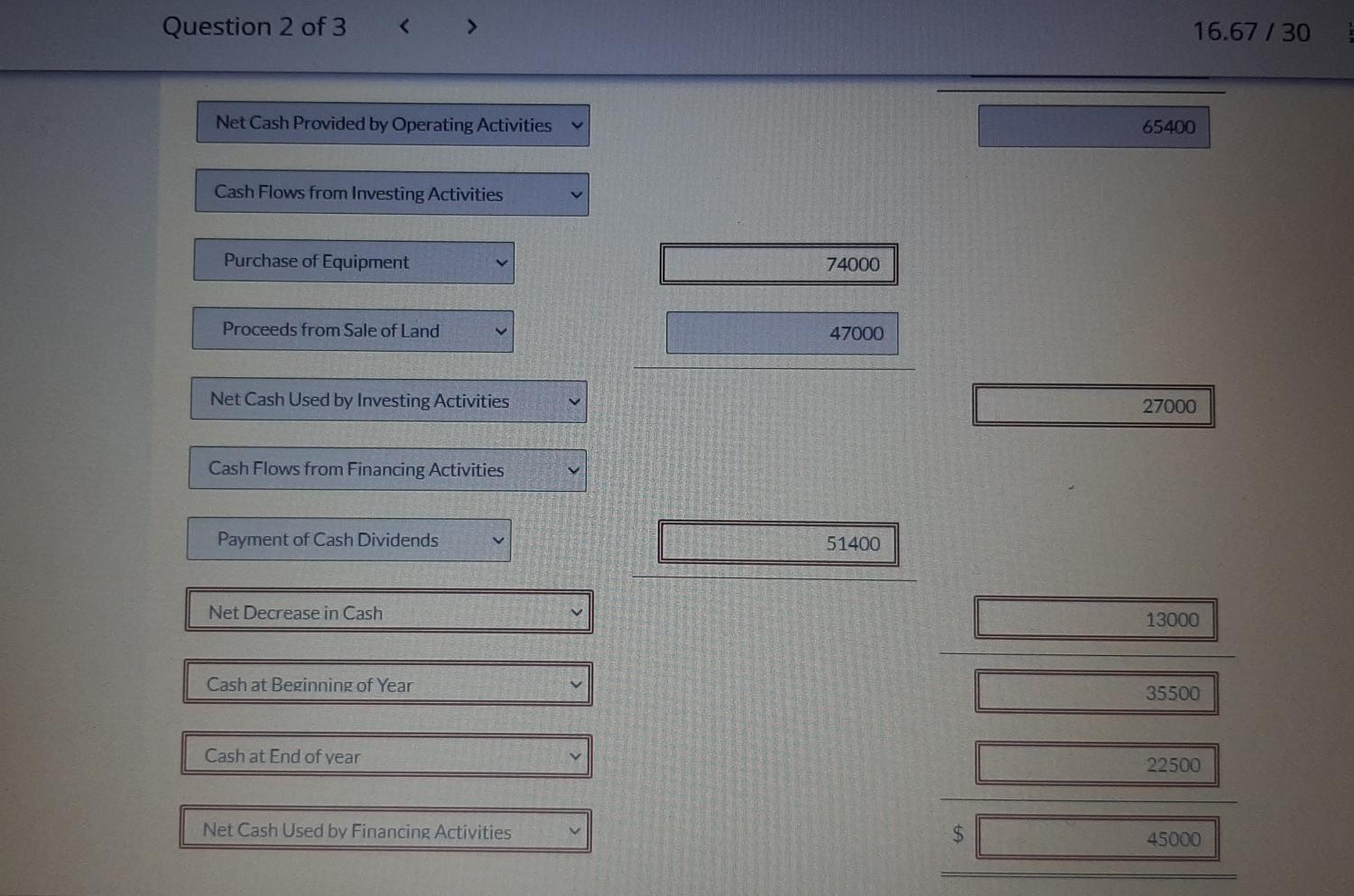

Question 2 of 3 16.67 / 30 A comparative statement of financial position for Sheffield Industries Inc. follows: SHEFFIELD INDUSTRIES INC. Statement of Financial Position December 31, 2020 December 31 Assets 2020 2019 Cash $22,500 $35,500 Accounts receivable 117,000 55,300 Inventory 231,000 199,000 Land 86,000 130,000 Equipment 278.000 204,000 Accumulated depreciation-equipment (70,500) (42,900) Total $664,000 $580,900 Liabilities and Shareholders' Equity Accounts payable $52.700 $60,200 Bonds payable 164,400 218,400 Liabilities and Shareholders' Equity Accounts payable $52,700 $60,200 Bonds payable 164,400 218,400 Common shares 234,000 180,000 Retained earnings 212,900 122,300 Total $664,000 $580,900 Additional information: 1. Net income for the fiscal year ending December 31, 2020, was $142,000. 2. Cash dividends of $51,400 were declared and paid. Dividends paid are treated as financing activities. 3. Bonds payable amounting to $54,000 were retired through issuance of common shares. 4. Land was sold at a gain of $3,000. 5. No equipment was sold during the year. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow using either a negatives preceding the number eg.-45 or parentheses eg. (45).) SHEFFIELD INDUSTRIES INC. Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income (Loss) A 142.000 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Expense 27600 Gain on Disposal of Land 3000 Increase in Accounts Receivable 61700 Increase in Inventory 32000 Decrease in Accounts Payable 7500 Decrease in Accounts Payable 7500 76600 Net Cash Provided by Operating Activities 65400 Cash Flows from Investing Activities Purchase of Equipment 74000 Proceeds from Sale of Land 47000 Net Cash Used by Investing Activities 27000 Cash Flows from Financing Activities Payment of Cash Dividends 51400 Net Decrease in Cash 13000 Cash at Beginning of Year 35500 Cachat End afvoor Question 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts