Question: Cash flows from a new project are expected to be $4,000,$6,000,$8,000, and $12,000 over the next 4 years, respectively. Assuming an initial cost of $14,000

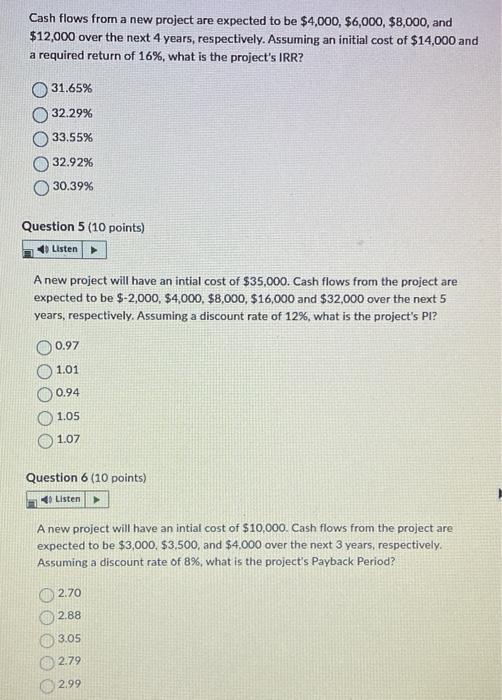

Cash flows from a new project are expected to be $4,000,$6,000,$8,000, and $12,000 over the next 4 years, respectively. Assuming an initial cost of $14,000 and a required return of 16%, what is the project's IRR? 31.65%32.29%33.55%32.92%30.39% Question 5 (10 points) A new project will have an intial cost of $35,000. Cash flows from the project are expected to be $2,000,$4,000,$8,000,$16,000 and $32,000 over the next 5 years, respectively. Assuming a discount rate of 12%, what is the project's Pl? 0.97 1.01 0.94 1.05 1.07 Question 6 (10 points) A new project will have an intial cost of $10,000. Cash flows from the project are expected to be $3,000,$3.500, and $4,000 over the next 3 years, respectively. Assuming a discount rate of 8%, what is the project's Payback Period? \begin{tabular}{|r|} \hline 2.70 \\ \hline 2.88 \\ \hline 3.05 \\ \hline 2.79 \\ \hline 2.99 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts