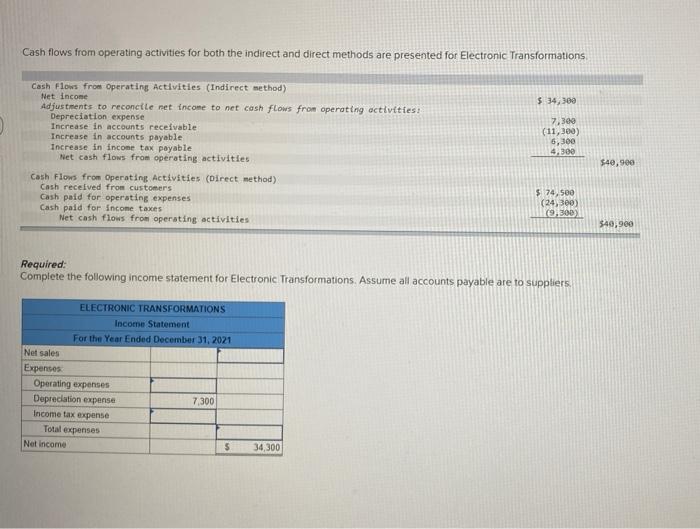

Question: Cash flows from operating activities for both the indirect and direct methods are presented for Electronic Transformations 5 34,300 Cash Flows from operating Activities (Indirect

Cash flows from operating activities for both the indirect and direct methods are presented for Electronic Transformations 5 34,300 Cash Flows from operating Activities (Indirect method) Net income Adjustments to reconcile net income to net cash flows from operating activities: Depreciation expense Increase in accounts receivable Increase in accounts payable Increase in income tax payable Net cash flows from operating activities 7,300 (11,380) 6,300 4,300 $49,900 Cash Flows from Operating Activities (Direct method) Cash received from customers Cash paid for operating expenses Cash paid for income taxes Net cash flows from operating activities $ 74,500 (24,300) 0,300 340,980 Required: Complete the following income statement for Electronic Transformations. Assume all accounts payable are to suppliers ELECTRONIC TRANSFORMATIONS Income Statement For the Year Ended December 31, 2021 Net sales Expenses Operating expenses Depreciation expense 7.300 Income tax expense Total expenses Net Income 5 34,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts