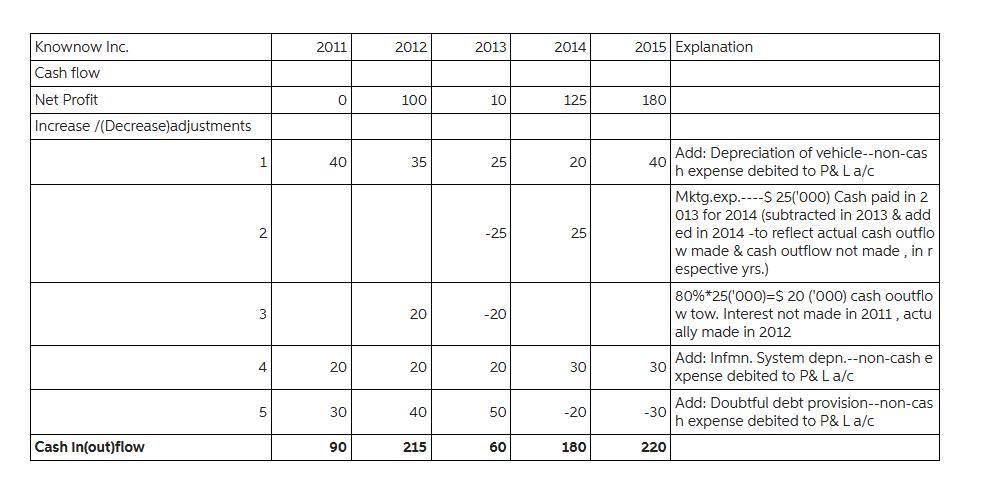

Question: Please look at the table below. Comparing Knownows Cash Flow over the entire period of five years to their total profit for these five years

Please look at the table below. Comparing Knownow’s Cash Flow over the entire period of five years to their total profit for these five years – what could be said of their business model and behaviour in total? Please mention at least two reasons for your opinion!

Knownow Inc. Cash flow Net Profit Increase /(Decrease)adjustments Cash In(out)flow 1 2 3 4 5 2011 0 40 20 30 90 2012 100 35 20 20 40 215 2013 10 25 -25 -20 20 50 60 2014 125 20 25 30 -20 180 2015 Explanation 180 40 -30 Add: Depreciation of vehicle--non-cas h expense debited to P& L a/c 220 Mktg.exp. ----S 25('000) Cash paid in 2 013 for 2014 (subtracted in 2013 & add ed in 2014 -to reflect actual cash outflo w made & cash outflow not made, in r espective yrs.) 30 Add: Infmn. System depn.--non-cash e xpense debited to P&L a/c 80%*25('000)=$ 20 ('000) cash ooutflo w tow. Interest not made in 2011, actu ally made in 2012 Add: Doubtful debt provision--non-cas h expense debited to P& La/c

Step by Step Solution

3.29 Rating (146 Votes )

There are 3 Steps involved in it

To analyze Knownow Incs business model and behavior based on the comparison of their cash flow and n... View full answer

Get step-by-step solutions from verified subject matter experts