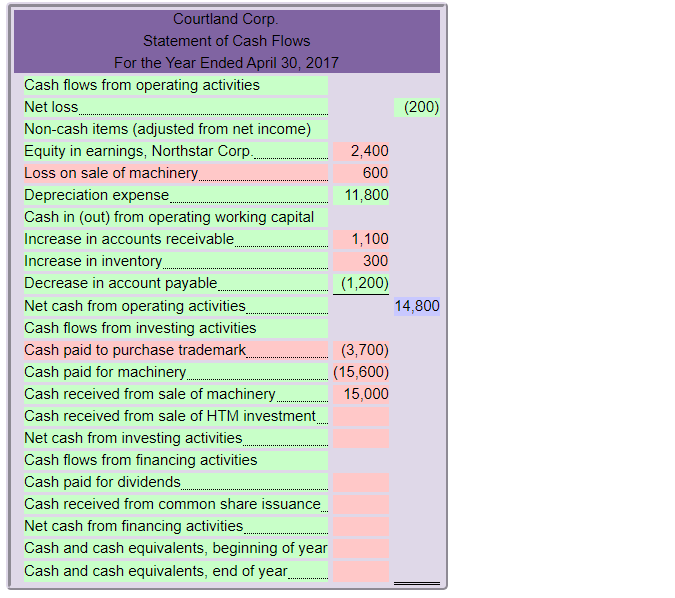

Question: Cash flows from operating activities (Lines 1-11) Net loss (Line 2) You have completed this part correctly. Non-cash items (adjusted from net income) (Lines 3-6)

Cash flows from operating activities (Lines 1-11)

Net loss (Line 2) You have completed this part correctly.

Non-cash items (adjusted from net income) (Lines 3-6) Line 4: 'Equity in earnings, Northstar Corp.' should be ($4,600), but you have not entered this. This will cost you 1 mark. Line 5: 'Loss on sale of machinery' does not belong on this statement of cash flows. This will cost you 2 marks. You should have included 'Gain on sale of machinery' in this section. This will cost you 2 marks. You should have included 'Gain on sale of long-term investment' in this section. This will cost you 2 marks.

Cash in (out) from operating working capital (Lines 7-10) Line 8: You have entered the correct amount for Increase in accounts receivable, but it should have been negative. This will cost you 1 mark. Line 9: You have entered the correct amount for Increase in inventory, but it should have been negative. This will cost you 1 mark.

Line 11: Net cash from operating activities should be $3,600, but you have not entered this. However, your answer is consistent with the entries you listed in this section so you will not lose any marks. Cash flows from investing activities (Lines 12-17) Line 13: 'Cash paid to purchase trademark' does not belong on this statement of cash flows. This will cost you 2 marks. Line 14: 'Cash paid for machinery' should be ($14,000), but you have not entered this. This will cost you 1 mark. Line 15: 'Cash received from sale of machinery' should be $15,200, but you have not entered this. This will cost you 1 mark. Line 16: 'Cash received from sale of HTM investment' should be $4,600, but you have left this blank. This will cost you 1 mark. You should have included 'Cash paid to purchase copyright' in this section. This will cost you 2 marks. You should have included 'Cash dividends received, equity investment, Northstar Corp.' in this section. This will cost you 2 marks. Line 17: You have not entered the Net cash from investing activities amount. This will cost you 1 mark. Cash flows from financing activities (Lines 18-21) Line 19: 'Cash paid for dividends' should be ($18,800), but you have left this blank. This will cost you 1 mark. Line 20: 'Cash received from common share issuance' should be $11,000, but you have left this blank. This will cost you 1 mark. You should have included 'Cash paid for retirement of the company's shares' in this section. This will cost you 2 marks. Line 21: You have not entered the Net cash from financing activities amount. This will cost you 1 mark. Net increase (decrease) in cash and cash equivalents Could not locate this section. This will cost you 2 marks. Cash and cash equivalents, beginning of year (Line 22) Line 22: 'Cash and cash equivalents, beginning of year' should be $16,900, but you have left this blank. This will cost you 1 mark. Cash and cash equivalents, end of year (Line 23) Line 23: You have not entered the Total Cash and cash equivalents, end of year amount. This will cost you 1 mark.

Please explain to me the mistakes with the calculations presented:

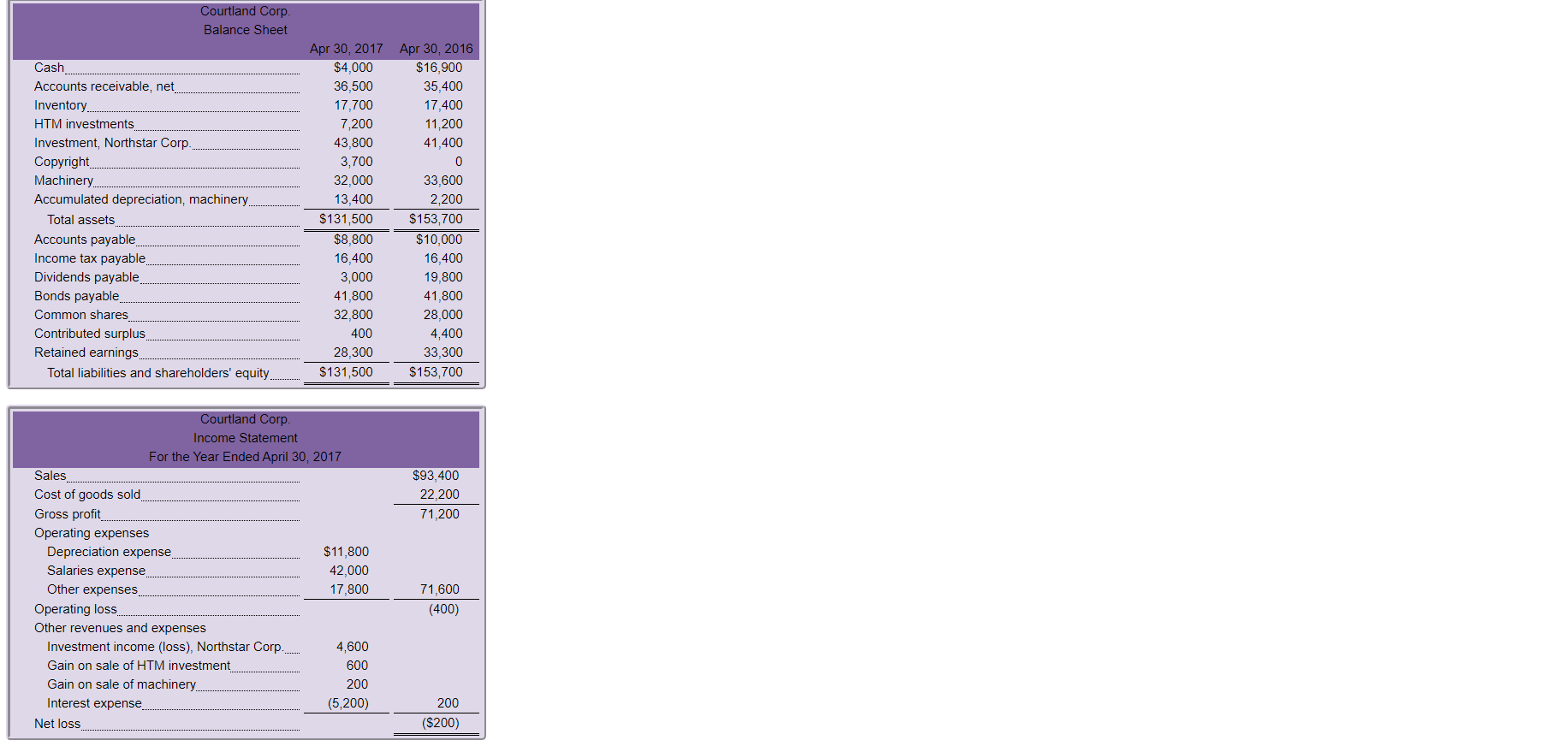

Courtland Corp. Balance Sheet Cash Accounts receivable, net Inventory. HTM investments Investment, Northstar Corp Copyright Machinery Accumulated depreciation, machinery. Total assets Accounts payable Income tax payable Dividends payable Bonds payable Common shares Contributed surplus Retained earnings Total liabilities and shareholders' equity. Apr 30, 2017 $4,000 36,500 17,700 7,200 43,800 3,700 32,000 13,400 $131,500 $8,800 16,400 3,000 41,800 32,800 400 28,300 $131,500 Apr 30, 2016 $ 16,900 35,400 17,400 11,200 41,400 0 33,600 2,200 $153,700 $10,000 16,400 19,800 41,800 28,000 4,400 33,300 $153,700 $93,400 22,200 71,200 Courtland Corp. Income Statement For the Year Ended April 30, 2017 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $11,800 Salaries expense 42,000 Other expenses 17,800 Operating loss Other revenues and expenses Investment income (loss), Northstar Corp. 4,600 Gain on sale of HTM investment 600 Gain on sale of machinery 200 Interest expense. (5,200) Net loss 71,600 (400) 200 ($200) Courtland Corp. Statement of Cash Flows For the Year Ended April 30, 2017 Cash flows from operating activities Net loss (200) Non-cash items (adjusted from net income) Equity in earnings, Northstar Corp. 2,400 Loss on sale of machinery 600 Depreciation expense 11,800 Cash in (out) from operating working capital Increase in accounts receivable 1,100 Increase in inventory.. 300 Decrease in account payable (1,200) Net cash from operating activities 14,800 Cash flows from investing activities Cash paid to purchase trademark (3,700) Cash paid for machinery (15,600) Cash received from sale of machinery 15,000 Cash received from sale of HTM investment Net cash from investing activities Cash flows from financing activities Cash paid for dividends. Cash received from common share issuance. Net cash from financing activities Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year. Courtland Corp. Balance Sheet Cash Accounts receivable, net Inventory. HTM investments Investment, Northstar Corp Copyright Machinery Accumulated depreciation, machinery. Total assets Accounts payable Income tax payable Dividends payable Bonds payable Common shares Contributed surplus Retained earnings Total liabilities and shareholders' equity. Apr 30, 2017 $4,000 36,500 17,700 7,200 43,800 3,700 32,000 13,400 $131,500 $8,800 16,400 3,000 41,800 32,800 400 28,300 $131,500 Apr 30, 2016 $ 16,900 35,400 17,400 11,200 41,400 0 33,600 2,200 $153,700 $10,000 16,400 19,800 41,800 28,000 4,400 33,300 $153,700 $93,400 22,200 71,200 Courtland Corp. Income Statement For the Year Ended April 30, 2017 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $11,800 Salaries expense 42,000 Other expenses 17,800 Operating loss Other revenues and expenses Investment income (loss), Northstar Corp. 4,600 Gain on sale of HTM investment 600 Gain on sale of machinery 200 Interest expense. (5,200) Net loss 71,600 (400) 200 ($200) Courtland Corp. Statement of Cash Flows For the Year Ended April 30, 2017 Cash flows from operating activities Net loss (200) Non-cash items (adjusted from net income) Equity in earnings, Northstar Corp. 2,400 Loss on sale of machinery 600 Depreciation expense 11,800 Cash in (out) from operating working capital Increase in accounts receivable 1,100 Increase in inventory.. 300 Decrease in account payable (1,200) Net cash from operating activities 14,800 Cash flows from investing activities Cash paid to purchase trademark (3,700) Cash paid for machinery (15,600) Cash received from sale of machinery 15,000 Cash received from sale of HTM investment Net cash from investing activities Cash flows from financing activities Cash paid for dividends. Cash received from common share issuance. Net cash from financing activities Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts