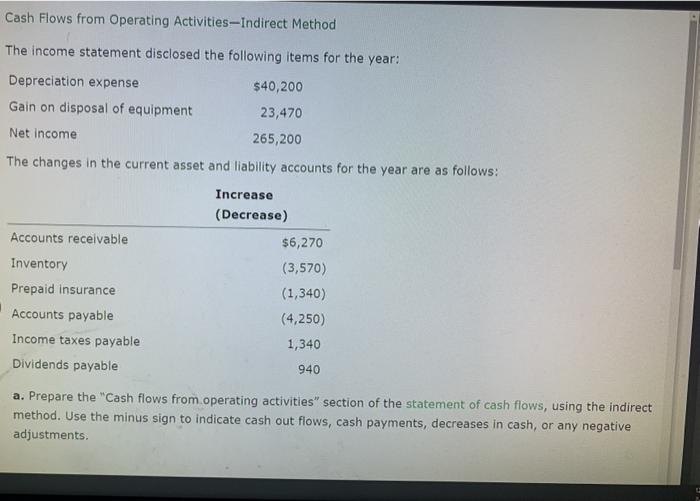

Question: Cash Flows from Operating Activities-Indirect Method The income statement disclosed the following items for the year: Depreciation expense $40,200 Gain on disposal of equipment 23,470

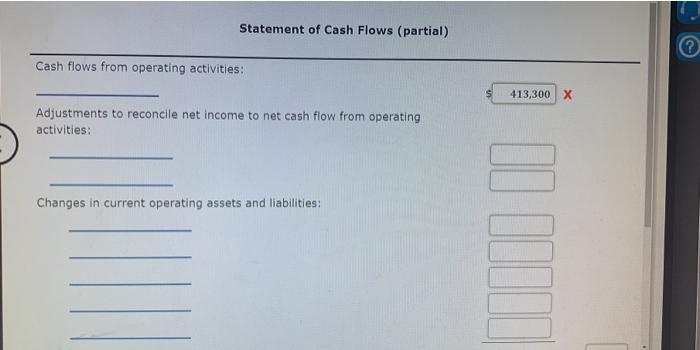

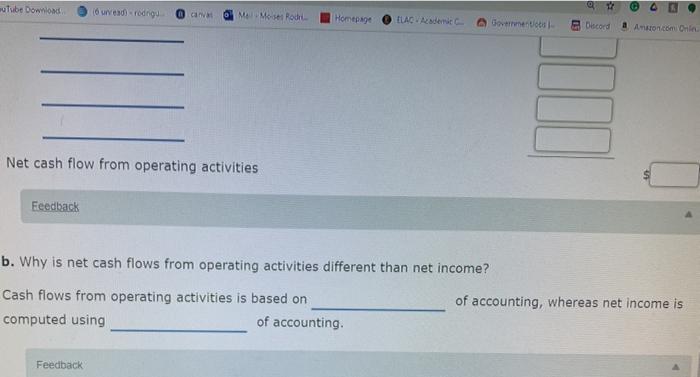

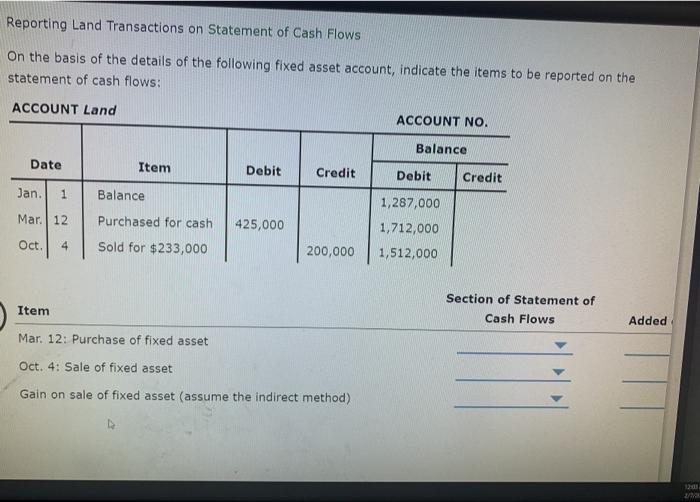

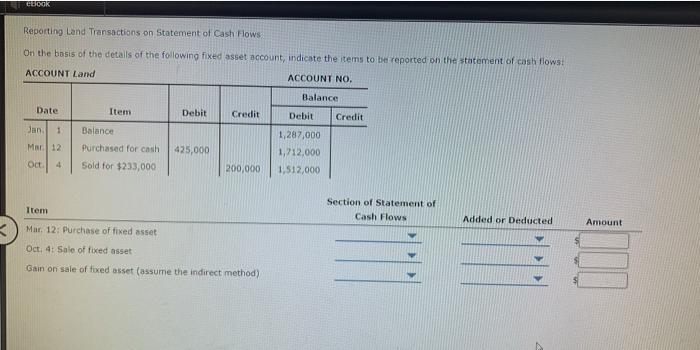

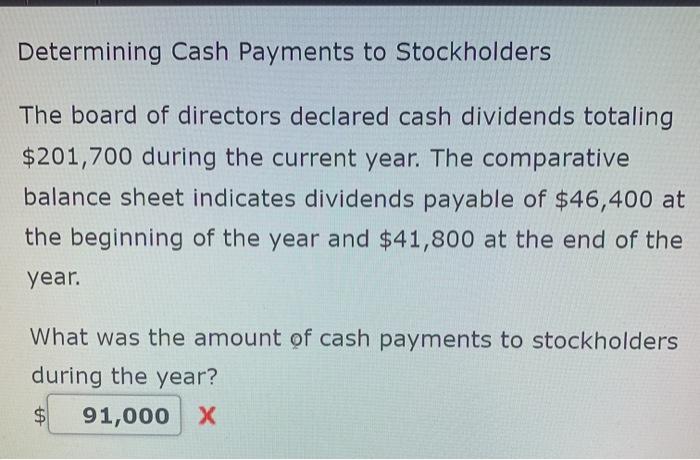

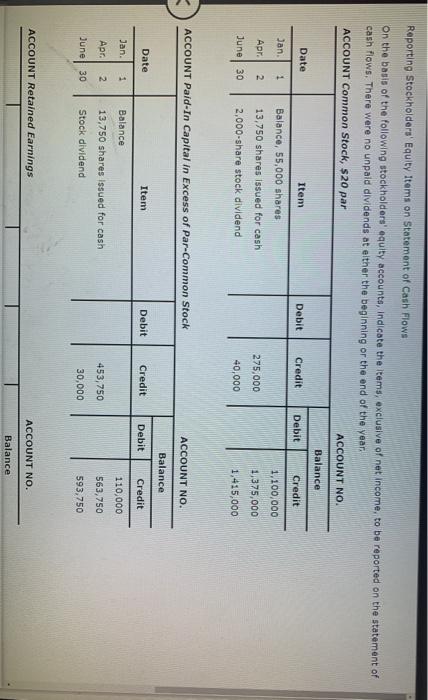

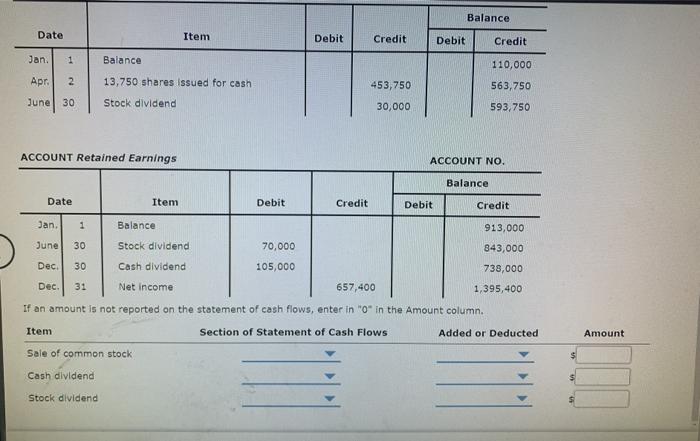

Cash Flows from Operating Activities-Indirect Method The income statement disclosed the following items for the year: Depreciation expense $40,200 Gain on disposal of equipment 23,470 Net income 265,200 The changes in the current asset and liability accounts for the year are as follows: Increase (Decrease) Accounts receivable $6,270 Inventory (3,570) Prepaid insurance (1,340) Accounts payable (4,250) Income taxes payable 1,340 Dividends payable 940 a. Prepare the "Cash flows from operating activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments Statement of Cash Flows (partial) Cash flows from operating activities: 413,300 X Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: wuTube Download (6 read.rodrgu ca Moses Rodrl Homepage ELADA Government Oecord a Andron.com Online Net cash flow from operating activities Feedback b. Why is net cash flows from operating activities different than net income? Cash flows from operating activities is based on computed using of accounting of accounting, whereas net income is Feedback Reporting Land Transactions on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance Mar. 12 Purchased for cash 425,000 1,287,000 1,712,000 1,512,000 Oct. 4 Sold for $233,000 200,000 Item Section of Statement of Cash Flows Added Mar. 12: Purchase of fixed asset Oct. 4: Sale of fixed asset Gain on sale of fixed asset (assume the indirect method) 120 BOOK Reporting Land Transactions on Statement of Cash Flows On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows: ACCOUNT Land ACCOUNT NO. Date Balance Debit Credit Debit Credit Jan 1 Item Balance Purchased for cash Sold for $233,000 Mor12 425,000 1,287,000 1,212,000 1,512,000 Oct 4 200,000 Item Section of Statement of Cash Flows Added or Deducted Amount Mar. 12: Purchase of fixed asset Oct. 4. Sale of fixed asset Gain on sale of foxed asset (assume the indirect method) Determining Cash Payments to Stockholders The board of directors declared cash dividends totaling $ 201,700 during the current year. The comparative balance sheet indicates dividends payable of $46,400 at the beginning of the year and $41,800 at the end of the year. What was the amount of cash payments to stockholders during the year? $ 91,000 X Reporting Stockholders' Equity Items on Statement of Cash Flows On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year ACCOUNT Common Stock, $20 par ACCOUNT NO Balance Date Item Debit Credit Debit Credit Jan 1 Balance, 55,000 shares Apr 2 13,750 shares Issued for cash 1,100,000 1,375,000 275,000 June 30 2,000-share stock dividend 40,000 1,415,000 ACCOUNT Pald-In Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 110,000 Apr. 2 453,750 563,750 13,750 shares issued for cash Stock dividend June 30 30,000 593,750 ACCOUNT Retained Earnings ACCOUNT NO. Balance Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 110,000 Apr. 2 13,750 shares issued for cash 453,750 563,750 593,750 June 30 Stock dividend 30,000 ACCOUNT Retained Earnings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 913,000 June 30 Stock dividend 843,000 70,000 105,000 Dec. 30 Cash dividend 738,000 1,395,400 Dec. 31 Net Income 657,400 If an amount is not reported on the statement of cash flows, enter in "o" in the Amount column. Item Section of Statement of Cash Flows Added or Deducted Amount Sale of common stock Cash dividend Stock dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts