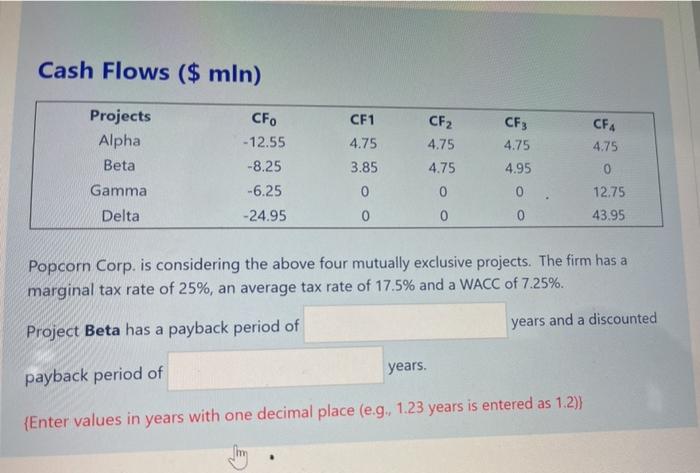

Question: Cash Flows ($ mln) CF2 CF1 4.75 CF3 CFA Projects Alpha Beta Gamma Delta CF0 - 12.55 -8.25 -6.25 4.75 0 3.85 0 4.75 4.75

Cash Flows ($ mln) CF2 CF1 4.75 CF3 CFA Projects Alpha Beta Gamma Delta CF0 - 12.55 -8.25 -6.25 4.75 0 3.85 0 4.75 4.75 0 0 4.75 4.95 0 0 12.75 -24.95 0 43.95 Popcorn Corp. is considering the above four mutually exclusive projects. The firm has a marginal tax rate of 25%, an average tax rate of 17.5% and a WACC of 7.25%. Project Beta has a payback period of years and a discounted years. payback period of {Enter values in years with one decimal place (e.g., 1.23 years is entered as 1.2)}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts