Question: Cash Flows This part will ask you to perform a detailed analysis of Take - Two s cash flows for the year ended March 3

Cash Flows

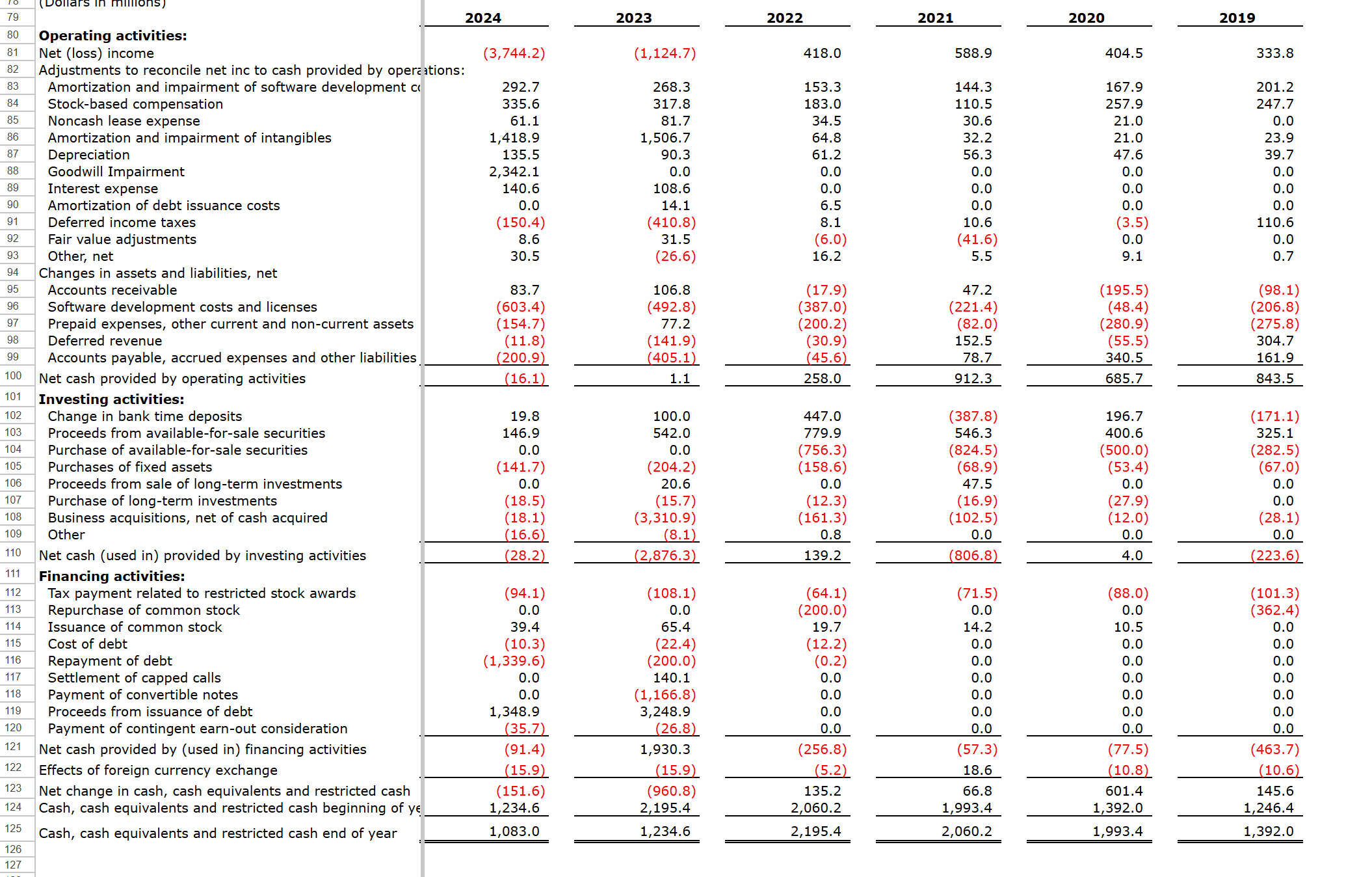

This part will ask you to perform a detailed analysis of TakeTwos cash flows for the year ended March and a summary analysis of TakeTwos cash flows for the fiveyear period ended March

For the year ended March identify material differences between reported operating cash flow and sustainable operating cash flow, if any. Also, in your team's opinion, how strong is TakeTwos sustainable cash flow from operations and its sustainable free cash flow?

Note: Operating cash flow is affected by income from operations and the adjustments for noncash revenue and expense, but operating cash flow is also affected by the change in operating assets and liabilities eg accounts receivable, inventory, accounts payable, etc. Cash may be increased, for example, by the collection of accounts receivable in excess of current year sales or by not paying accounts payable.

If for example, the cash generated from not paying accounts payable is considered excessive, or not normal or not sustainable ie the company must pay accounts payable eventually and the current year adjustment is far in excess of what could be considered normal you will need to adjust operating cash flow to remove the excess amount related to accounts payable in order to understand the sufficiency of operating cash flow. The adjusted operating cash flow is sustainable operating cash flow.

Develop an overall summary of the key elements of TakeTwos investing and financing cash flows for the year ended March This is less about calculating the numbers and more about analyzing and evaluating what the numbers tell you, and the conclusions you can reach from the financial statements.

Discuss the overall trends in TakeTwos cash flows for the five years ended March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock