Question: Cast Iron Fabrication allocates manufacturing overhead to each job using departmental overhead rates. The company's operations are divided into a casting department and a finishing

Cast Iron Fabrication allocates manufacturing overhead to each job using departmental overhead rates. The company's operations are divided into a casting department and a finishing department. The casting department uses a departmental overhead rate of per machine hour, while the finishing department uses a departmental overhead rate of per direct labor hour. Job A216 used the following direct labor hours and machine hours in the two departments:

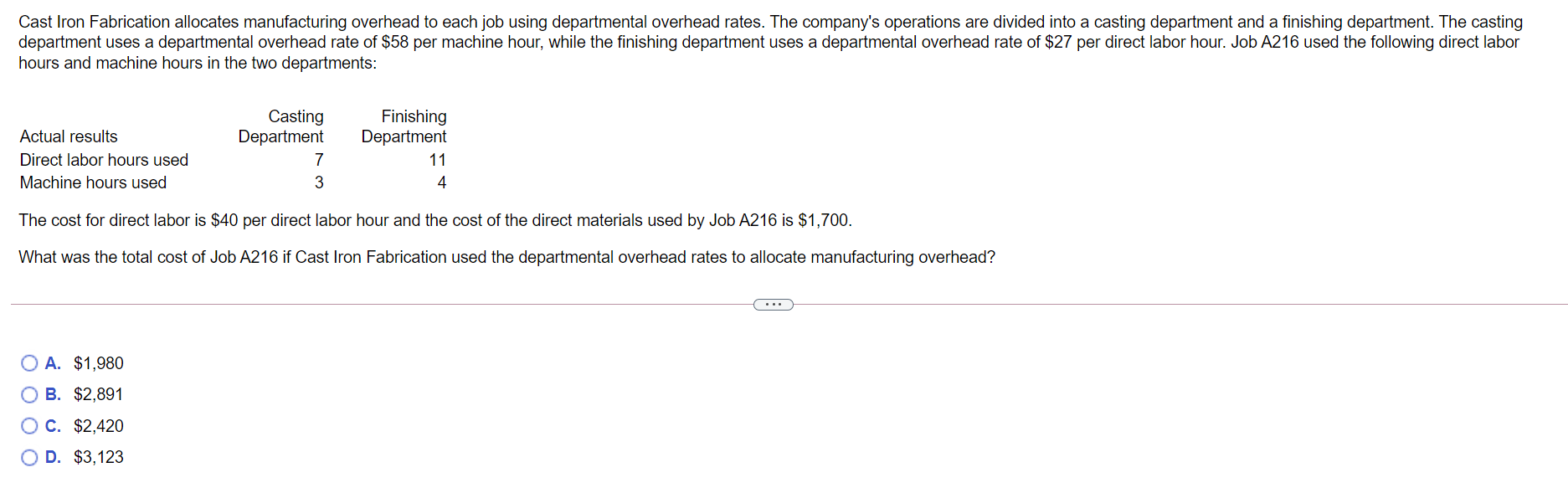

Cast Iron Fabrication allocates manufacturing overhead to each job using departmental overhead rates. The company's operations are divided into a casting department and a finishing department. The casting department uses a departmental overhead rate of $58 per machine hour, while the finishing department uses a departmental overhead rate of $27 per direct labor hour. Job A216 used the following direct labor hours and machine hours in the two departments: Actual results Direct labor hours used Machine hours used Casting Department 7 3 Finishing Department 11 4 The cost for direct labor is $40 per direct labor hour and the cost of the direct materials used by Job A216 is $1,700. What was the total cost of Job A216 if Cast Iron Fabrication used the departmental overhead rates to allocate manufacturing overhead? A. $1,980 OB. $2,891 OC. $2,420 OD. $3,123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts