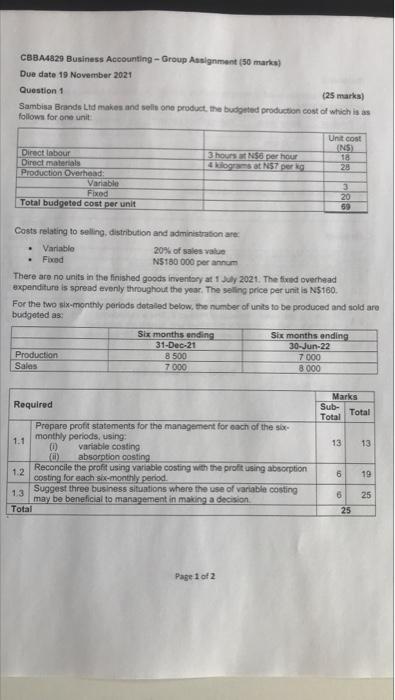

Question: CBBA429 Business Accounting - Group Assignment (50 marks Due date 19 November 2021 Question 1 (25 marks) Sambisa Brands Lid makes and sells on product.

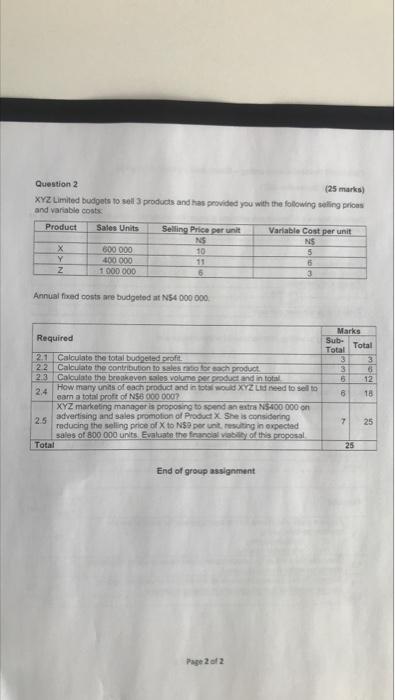

CBBA429 Business Accounting - Group Assignment (50 marks Due date 19 November 2021 Question 1 (25 marks) Sambisa Brands Lid makes and sells on product. the budgeted production cost of which is as follows for one unit Unit cost INS Direct labour 3 hours $6 per hour 18 Direct materials 4 kilogram at N57 per 28 Production Overhead: Variable 3 Fixed 20 Total budgeted cost per unit 69 1 Costs relating to selling, distribution and administration are Variable 20% of sales value Fbad N$180 000 per annum There are no units in the finished goods inventory at 1 July 2021. The fixed overhead expenditure is spread evenly throughout the year. The selling price per unit is N$160. For the two six-monthly periods detaled below, the number of units to be produced and sold are budgeted as: Six months ending Six months onding 31-Dec-21 30-Jun-22 Production 8 500 7 000 Sales 7 000 8 000 Required Marks Sub- Total Total 13 13 Prepare profit statements for the management for each of the store 1.1 monthly periods, using: 00 variable costing (0) absorption costing Reconcile the profit using variable costing with the profit using absorption costing for each six-monthly period. 1.3 Suggest three business situations where the use of variable costing may be beneficial to management in making a decision Total 1.2 6 19 6 25 25 Page 1 of 2 Question 2 (25 marks XYZ Limited budgets to sell products and has provided you with the following selling pris and variable costs Product Sales Units Selling Price per unit Variable Co per unit NS NS 600 000 10 5 Y 400 000 11 6 Z 1 000 000 6 3 Annual fixed costs are budgeted at N54 000 000 Required Marks Sub- Total Total 3 3 5 5 -12 8 18 21 Calculate the total budgeted profit 22 Calculate the contribution to sales for each product 2.3 Calculate the breakeven sales volume product and in total 2,4 How many units of each product and into would XYZ need to sell to cam a total poft of NS5 000 000? XYZ marketing manager is proposing to spend an extra $ 400 000 on 25 advertising and sales promotion of Product X She is considering reducing the selling price of X to Nepotting in expected sales of 800 000 units Evaluate the financial ability of this proposal 7 25 Total 25 End of group assignment Page 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts