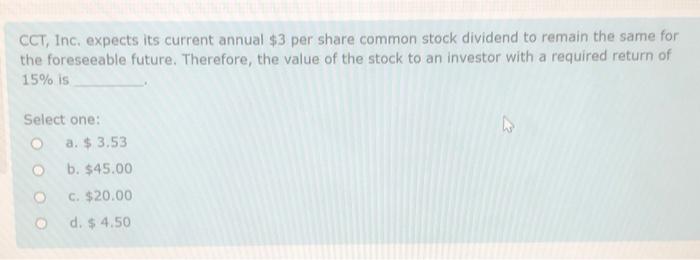

Question: CCT, Inc. expects its current annual $3 per share common stock dividend to remain the same for the foreseeable future. Therefore, the value of the

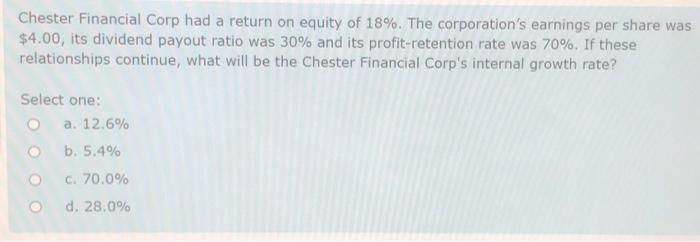

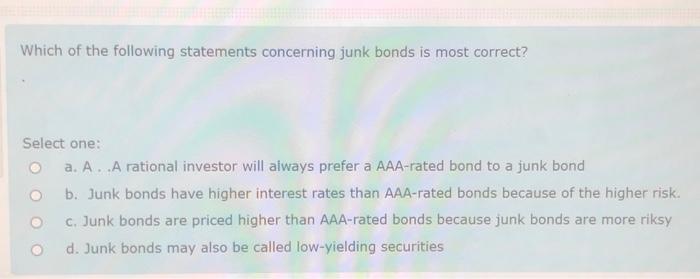

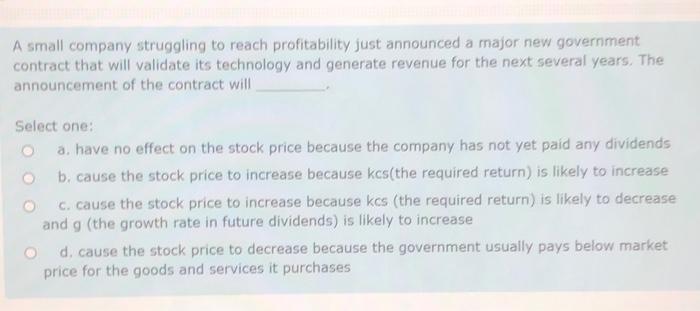

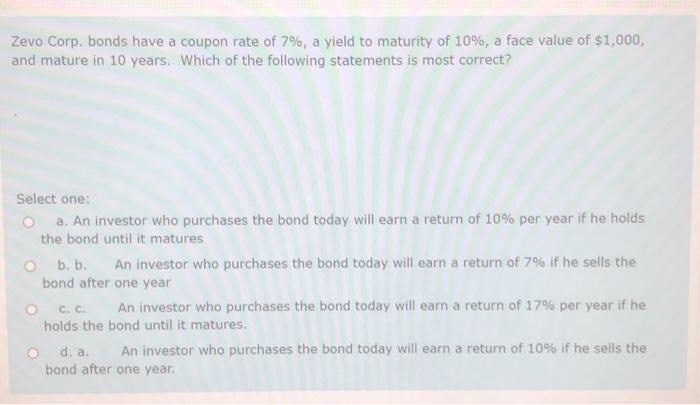

CCT, Inc. expects its current annual $3 per share common stock dividend to remain the same for the foreseeable future. Therefore, the value of the stock to an investor with a required return of 15% is Select one: a $ 3.53 @ b. $45.00 C. $20.00 d. $ 4.50 Chester Financial Corp had a return on equity of 18%. The corporation's earnings per share was $4.00, its dividend payout ratio was 30% and its profit-retention rate was 70%. If these relationships continue, what will be the Chester Financial Corp's internal growth rate? Select one: a. 12.6% O b. 5.4% C. 70.0% d. 28.0% Which of the following statements concerning junk bonds is most correct? Select one: a. A. A rational investor will always prefer a AAA-rated bond to a junk bond b. Junk bonds have higher interest rates than AAA-rated bonds because of the higher risk. C. Junk bonds are priced higher than AAA-rated bonds because junk bonds are more riksy d. Junk bonds may also be called low-yielding securities A small company struggling to reach profitability just announced a major new government contract that will validate its technology and generate revenue for the next several years. The announcement of the contract will Select one: a. have no effect on the stock price because the company has not yet paid any dividends b, cause the stock price to increase because kes(the required return) is likely to increase c. cause the stock price to increase because kes (the required return) is likely to decrease and g (the growth rate in future dividends) is likely to increase d. cause the stock price to decrease because the government usually pays below market price for the goods and services it purchases Zevo Corp. bonds have a coupon rate of 7%, a yield to maturity of 10%, a face value of $1,000, and mature in 10 years. Which of the following statements is most correct? Select one: O a. An investor who purchases the bond today will earn a return of 10% per year if he holds the bond until it matures b. b. An investor who purchases the bond today will earn a return of 7% if he sells the bond after one year O C. c An investor who purchases the bond today will earn a return of 17% per year if he holds the bond until it matures. d. a An investor who purchases the bond today will earn a return of 10% if he sells the bond after one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts