Question: CellG, is considering two mutually exclusive projects. Project 1 requires an investment of R40,000, while Project 2 requires an investment of R30,000. Cash revenues and

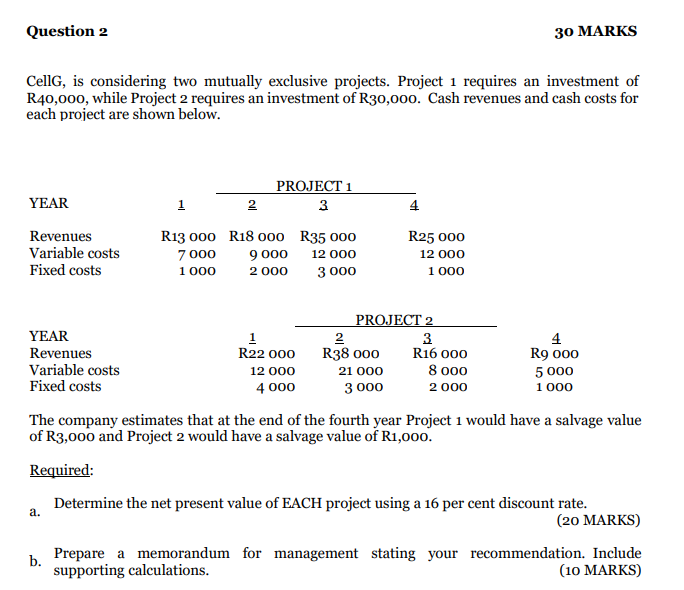

CellG, is considering two mutually exclusive projects. Project 1 requires an investment of R40,000, while Project 2 requires an investment of R30,000. Cash revenues and cash costs for each project are shown below:

The company estimates that at the end of the fourth year Project 1 would have a salvage value of R3,000 and Project 2 would have a salvage value of R1,000.

Determine the net present value of EACH project using a 16 per cent discount rate. (20 MARKS).

Prepare a memorandum for management stating your recommendation. Include detailed supporting calculations.

Question 2 30 MARKS Celly, is considering two mutually exclusive projects. Project 1 requires an investment of R40,000, while Project 2 requires an investment of R30,000. Cash revenues and cash costs for each project are shown below. YEAR PROJECT 1 23 1 Revenues Variable costs Fixed costs R13 000 R18 000 R35 000 7 000 9 000 12 000 1000 2 000 3 000 R25 000 12 000 1 000 PROJECT 2 YEAR 2 3 Revenues R22 000 R38 000 R16 000 R9000 Variable costs 12 000 21 000 8 000 5 000 Fixed costs 4000 3 000 2 000 1 000 The company estimates that at the end of the fourth year Project 1 would have a salvage value of R3,000 and Project 2 would have a salvage value of R1,000. Required: a. Determine the net present value of EACH project using a 16 per cent discount rate. (20 MARKS) b. Prepare a memorandum for management stating your recommendation. Include supporting calculations. (10 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts