Question: cements nents ions US Problem: In this problem your group will make a plan for retirement. Pick an occupation and visit the Occupational Outlook Handbook

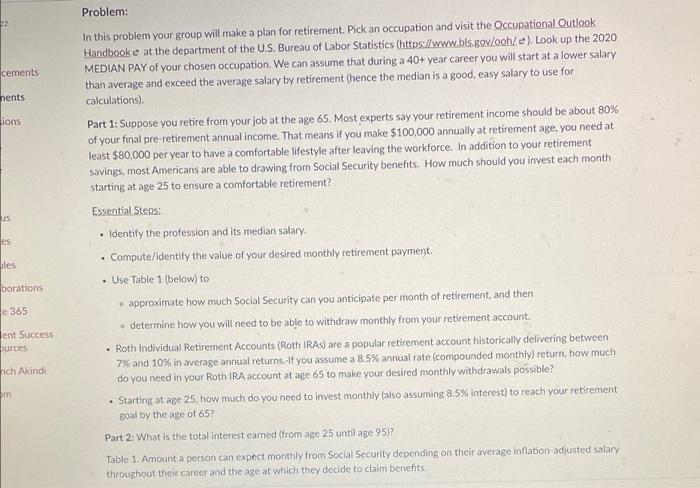

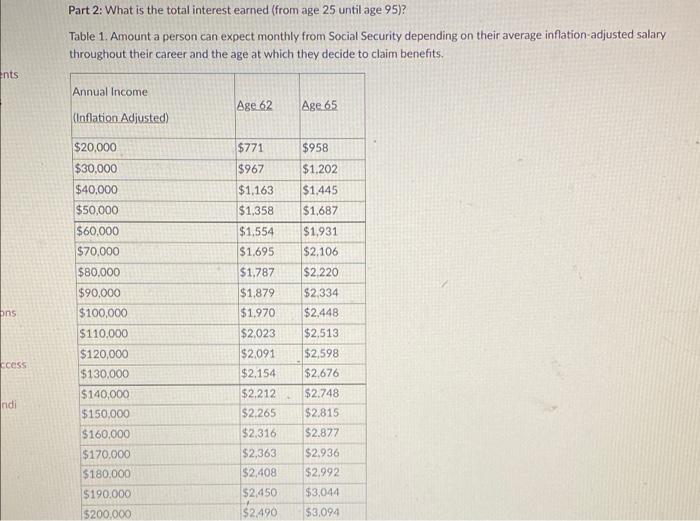

cements nents ions US Problem: In this problem your group will make a plan for retirement. Pick an occupation and visit the Occupational Outlook Handbook e at the department of the U.S. Bureau of Labor Statistics (https://www.bls.gov/ooh/e). Look up the 2020 MEDIAN PAY of your chosen occupation. We can assume that during a 40+ year career you will start at a lower salary than average and exceed the average salary by retirement (hence the median is a good, easy salary to use for calculations) Part 1: Suppose you retire from your job at the age 65. Most experts say your retirement income should be about 80% of your final pre-retirement annual income. That means if you make $100,000 annually at retirement age, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce. In addition to your retirement savings, most Americans are able to drawing from Social Security benefits. How much should you invest each month starting at age 25 to ensure a comfortable retirement? Essential Stens Identify the profession and its median salary, Compute/identify the value of your desired monthly retirement payment . Use Table 1 (below) to approximate how much Social Security can you anticipate per month of retirement, and then determine how you will need to be able to withdraw monthly from your retirement account Roth Individual Retirement Accounts (Roth IRAs) are a popular retirement account historically delivering between 7% and 10% in average annual returns. If you assume a 8.5% annual rate (compounded monthly) return, how much do you need in your Roth IRA account at age 65 to make your desired monthly withdrawals possible? . Starting at age 25. how much do you need to invest monthly Calso assuming 8.5% interest) to reach your retirement goal by the age of 65? es Liles borations e 365 ent Success burces nch Alandi Part 2: What is the total interest earned (from age 25 until age 95)? Table 1. Amount a person can expect monthly from Social Security depending on their average inflation-adjusted salary throughout their career and the age at which they decide to claim benefits Part 2: What is the total interest earned (from age 25 until age 95)? Table 1. Amount a person can expect monthly from Social Security depending on their average inflation-adjusted salary throughout their career and the age at which they decide to claim benefits. nts Annual Income Age 62 Age 65 (Inflation Adjusted) $771 $967 $958 $1,202 $1,445 $1,687 $1.163 $1,358 $1,554 $1,931 $1.695 $2.106 $1,787 $2,220 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 $160,000 $2,334 ons ccess $1,879 $1.970 $2.023 $2,091 $2,154 $2.212 $2,265 $2.316 $2,363 $2,408 ndi $2,448 $2,513 $2,598 $2,676 $2.748 $2,815 $2.877 $2.936 $2.992 $3,044 $3,094 $170.000 $180,000 $190,000 $2,450 $2.490 $200.000 cements nents ions US Problem: In this problem your group will make a plan for retirement. Pick an occupation and visit the Occupational Outlook Handbook e at the department of the U.S. Bureau of Labor Statistics (https://www.bls.gov/ooh/e). Look up the 2020 MEDIAN PAY of your chosen occupation. We can assume that during a 40+ year career you will start at a lower salary than average and exceed the average salary by retirement (hence the median is a good, easy salary to use for calculations) Part 1: Suppose you retire from your job at the age 65. Most experts say your retirement income should be about 80% of your final pre-retirement annual income. That means if you make $100,000 annually at retirement age, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce. In addition to your retirement savings, most Americans are able to drawing from Social Security benefits. How much should you invest each month starting at age 25 to ensure a comfortable retirement? Essential Stens Identify the profession and its median salary, Compute/identify the value of your desired monthly retirement payment . Use Table 1 (below) to approximate how much Social Security can you anticipate per month of retirement, and then determine how you will need to be able to withdraw monthly from your retirement account Roth Individual Retirement Accounts (Roth IRAs) are a popular retirement account historically delivering between 7% and 10% in average annual returns. If you assume a 8.5% annual rate (compounded monthly) return, how much do you need in your Roth IRA account at age 65 to make your desired monthly withdrawals possible? . Starting at age 25. how much do you need to invest monthly Calso assuming 8.5% interest) to reach your retirement goal by the age of 65? es Liles borations e 365 ent Success burces nch Alandi Part 2: What is the total interest earned (from age 25 until age 95)? Table 1. Amount a person can expect monthly from Social Security depending on their average inflation-adjusted salary throughout their career and the age at which they decide to claim benefits Part 2: What is the total interest earned (from age 25 until age 95)? Table 1. Amount a person can expect monthly from Social Security depending on their average inflation-adjusted salary throughout their career and the age at which they decide to claim benefits. nts Annual Income Age 62 Age 65 (Inflation Adjusted) $771 $967 $958 $1,202 $1,445 $1,687 $1.163 $1,358 $1,554 $1,931 $1.695 $2.106 $1,787 $2,220 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 $160,000 $2,334 ons ccess $1,879 $1.970 $2.023 $2,091 $2,154 $2.212 $2,265 $2.316 $2,363 $2,408 ndi $2,448 $2,513 $2,598 $2,676 $2.748 $2,815 $2.877 $2.936 $2.992 $3,044 $3,094 $170.000 $180,000 $190,000 $2,450 $2.490 $200.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts