Question: CENGAGE MINDTAP Q Search this course Assignment 9: Chapter 9 End-of-Chapter Problems X Back to Assignment Attempts Keep the Highest / 10 10. Problem 9.15

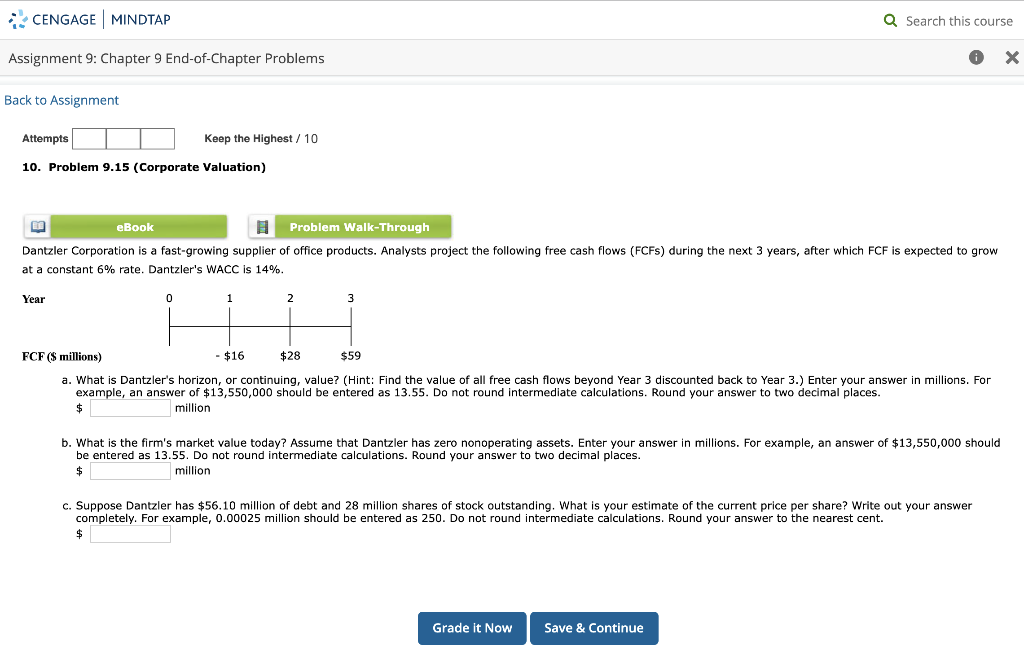

CENGAGE MINDTAP Q Search this course Assignment 9: Chapter 9 End-of-Chapter Problems X Back to Assignment Attempts Keep the Highest / 10 10. Problem 9.15 (Corporate Valuation) EL eBook Problem Walk-Through Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 6% rate. Dantzler's WACC is 14%. Year 0 1 2 3 FCF ($ millions) $16 $28 $59 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million b. What is the firm's market value today? Assume that Dantzler has zero nonoperating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round intermediate calculations. Round your answer to two decimal places. $ million c. Suppose Dantzler has $56.10 million of debt and 28 million shares of stock outstanding. What is your estimate of the current price per share? Write out your answer completely. For example, 0.00025 million should be entered as 250. Do not round intermediate calculations. Round your answer to the nearest cent. $ Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts