Question: Ceramic Structures has experienced rapid growth over the past several years. Sales are expected to grow at 15% per year for the next three years.

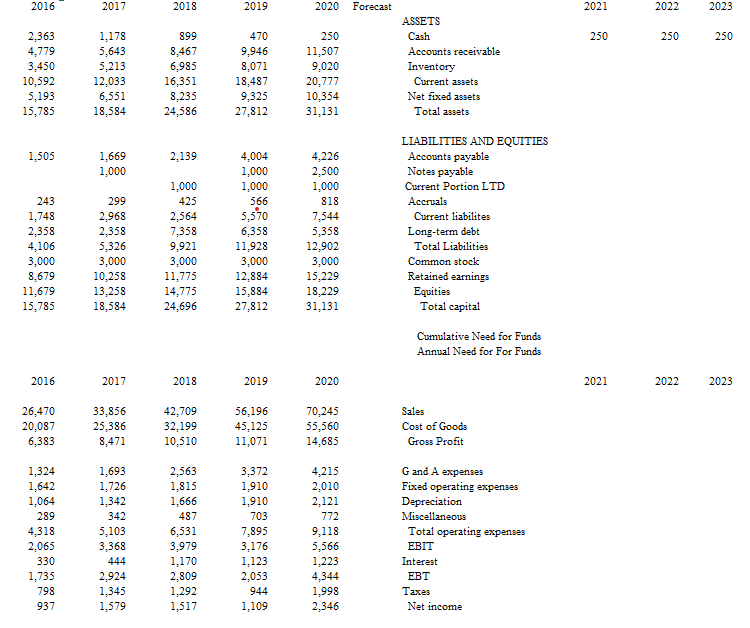

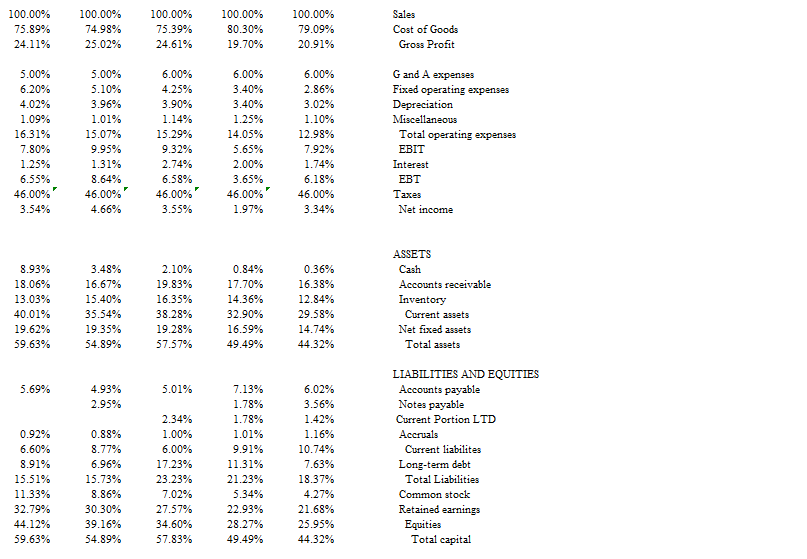

Ceramic Structures has experienced rapid growth over the past several years. Sales are expected to grow at 15% per year for the next three years. Sales growth has been fueled by aggressive pricing as well as increased use of ceramics in high performance engines. Asset growth has been financed by internal funds as well as the increased use of debt. At the end of 2018, the debt was restructured with a new 10% seven-year loan with principal payments of $1 million per year. In addition a $1.5 million working capital line was negotiated in 2017. It was increased to $2.5 million in 2019 and $3.5 million in 2020. Interest is charged at prime + 1%. (For class, we will use 9%.)

Cash balances will be kept around $250,000 and the credit line will average $2 million.

1. Prepare pro-forma statements for Ceramic and determine their need for funds for the years 2021-2023.

2. Why is there a need for funds when Ceramic is generating a profit?

3. If expected sales growth fell to 8% per year, what would be Ceramics need for funds?

4. What would happen to Ceramics need for funds if accounts receivable increased to 25% of sales?

2016 2,363 4,779 3,450 10,592 5,193 15,785 1,505 243 1,748 2,358 4,106 3,000 8,679 11,679 15,785 2016 26,470 20,087 6,383 1,324 1,642 1,064 289 4,318 2,065 330 1,735 798 937 2017 1,178 5,643 5,213 12,033 6,551 18,584 1,669 1,000 299 2,968 2,358 5,326 3,000 10,258 13,258 18,584 2017 33,856 25,386 8,471 1,693 1,726 1,342 342 5,103 3,368 444 2,924 1,345 1,579 2018 899 8,467 6,985 16,351 8,235 24,586 2,139 1,000 425 2,564 7,358 9,921 3,000 11,775 14,775 24,696 2018 42,709 32,199 10,510 2,563 1,815 1,666 487 6,531 3,979 1,170 2,809 1,292 1,517 2019 470 9,946 8,071 18,487 9,325 27,812 4,004 1,000 1,000 566 5,570 6,358 11,928 3,000 12,884 15,884 27,812 2019 56,196 45,125 11,071 3,372 1,910 1,910 703 7,895 3,176 1,123 2,053 944 1,109 2020 Forecast 250 11,507 9,020 20,777 10,354 31,131 4,226 2,500 1,000 818 7,544 5,358 12,902 3,000 15,229 18,229 31,131 2020 70,245 55,560 14,685 4,215 2,010 2,121 772 9,118 5,566 1,223 4,344 1,998 2,346 ASSETS Cash Accounts receivable Inventory Current assets Net fixed assets Total assets LIABILITIES AND EQUITIES Accounts payable Notes payable Current Portion LTD Accruals Current liabilites Long-term debt Total Liabilities Common stock Retained earnings Equities Total capital Cumulative Need for Funds Annual Need for For Funds Sales Cost of Goods Gross Profit G and A expenses Fixed operating expenses Depreciation Miscellaneous Total operating expenses EBIT Interest EBT Taxes Net income 2021 250 2021 2022 250 2022 2023 250 2023 100.00% 75.89% 24.11% 5.00% 6.20% 4.02% 1.09% 16.31% 7.80% 1.25% 6.55% 46.00% 3.54% 8.93% 18.06% 13.03% 40.01% 19.62% 59.63% 5.69% 0.92% 6.60% 8.91% 15.51% 11.33% 32.79% 44.12% 59.63% 100.00% 74.98% 25.02% 5.00% 5.10% 3.96% 1.01% 15.07% 9.95% 1.31% 8.64% 46.00% 4.66% 3.48% 16.67% 15.40% 35.54% 19.35% 54.89% 4.93% 2.95% 0.88% 8.77% 6.96% 15.73% 8.86% 30.30% 39.16% 54.89% 100.00% 75.39% 24.61% 6.00% 4.25% 3.90% 1.14% 15.29% 9.32% 2.74% 6.58% 46.00% 3.55% 2.10% 19.83% 16.35% 38.28% 19.28% 57.57% 5.01% 2.34% 1.00% 6.00% 17.23% 23.23% 7.02% 27.57% 34.60% 57.83% 100.00% 80.30% 19.70% 6.00% 3.40% 3.40% 1.25% 14.05% 5.65% 2.00% 3.65% 46.00% 1.97% 0.84% 17.70% 14.36% 32.90% 16.59% 49.49% 7.13% 1.78% 1.78% 1.01% 9.91% 11.31% 21.23% 5.34% 22.93% 28.27% 49.49% 100.00% 79.09% 20.91% 6.00% 2.86% 3.02% 1.10% 12.98% 7.92% 1.74% 6.18% 46.00% 3.34% 0.36% 16.38% 12.84% 29.58% 14.74% 44.32% 6.02% 3.56% 1.42% 1.16% 10.74% 7.63% 18.37% 4.27% 21.68% 25.95% 44.32% Sales Cost of Goods Gross Profit G and A expenses Fixed operating expenses Depreciation Miscellaneous Total operating expenses EBIT Interest EBT Taxes Net income ASSETS Cash Accounts receivable Inventory Current assets Net fixed assets Total assets LIABILITIES AND EQUITIES Accounts payable Notes payable Current Portion LTD Accruals Current liabilites Long-term debt Total Liabilities Common stock Retained earnings Equities Total capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts