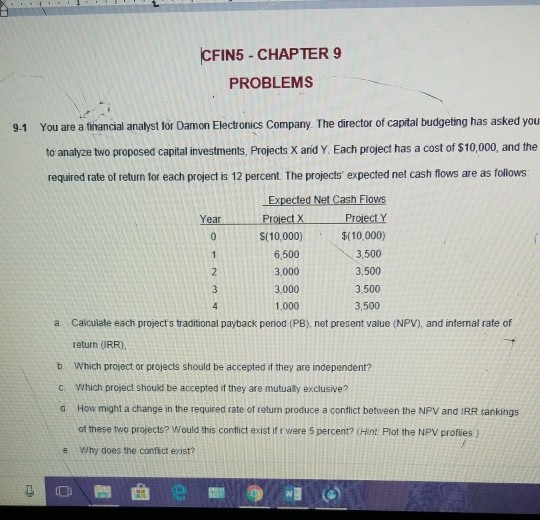

Question: CFIN5- CHAPTER 9 PROBLEMS 9-1 You are a financial analyst for Damon Electronics Company. The director of capital budgeting has asked you to analyze two

CFIN5- CHAPTER 9 PROBLEMS 9-1 You are a financial analyst for Damon Electronics Company. The director of capital budgeting has asked you to analyze two proposed capital investments, Projects X anid Y. Each project has a cost of $10,000, and the required rate of return for each project is 12 percent. The projects' expected net cash flows are as follows Expected Net Cash Flows Project X S(10,000) 6,500 3,000 3.000 1,000 ProjectY $(10,000) 3,500 3,500 3,500 3,500 a Calculate each projects traditional payback period (PB), net present value (NPV), and internal rate of return (RR) b Which project or projects should be accepted if they are independent? c Which project should be accepted it they are mutually exclusive? d How might a change in the required rate of return produce a conflict between the NPV and IRR tankings of these two projects? Would this contict exist it r were 5 percent? (Hint Plot the NPV profiles) e Why does the confict exist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts