Question: Ch 0 2 : Assignment - Financial Statements, Cash Flow, and Taxes 2 . Balance sheet The balance sheet provides a snapshot of the financial

Ch : Assignment Financial Statements, Cash Flow, and Taxes

Balance sheet

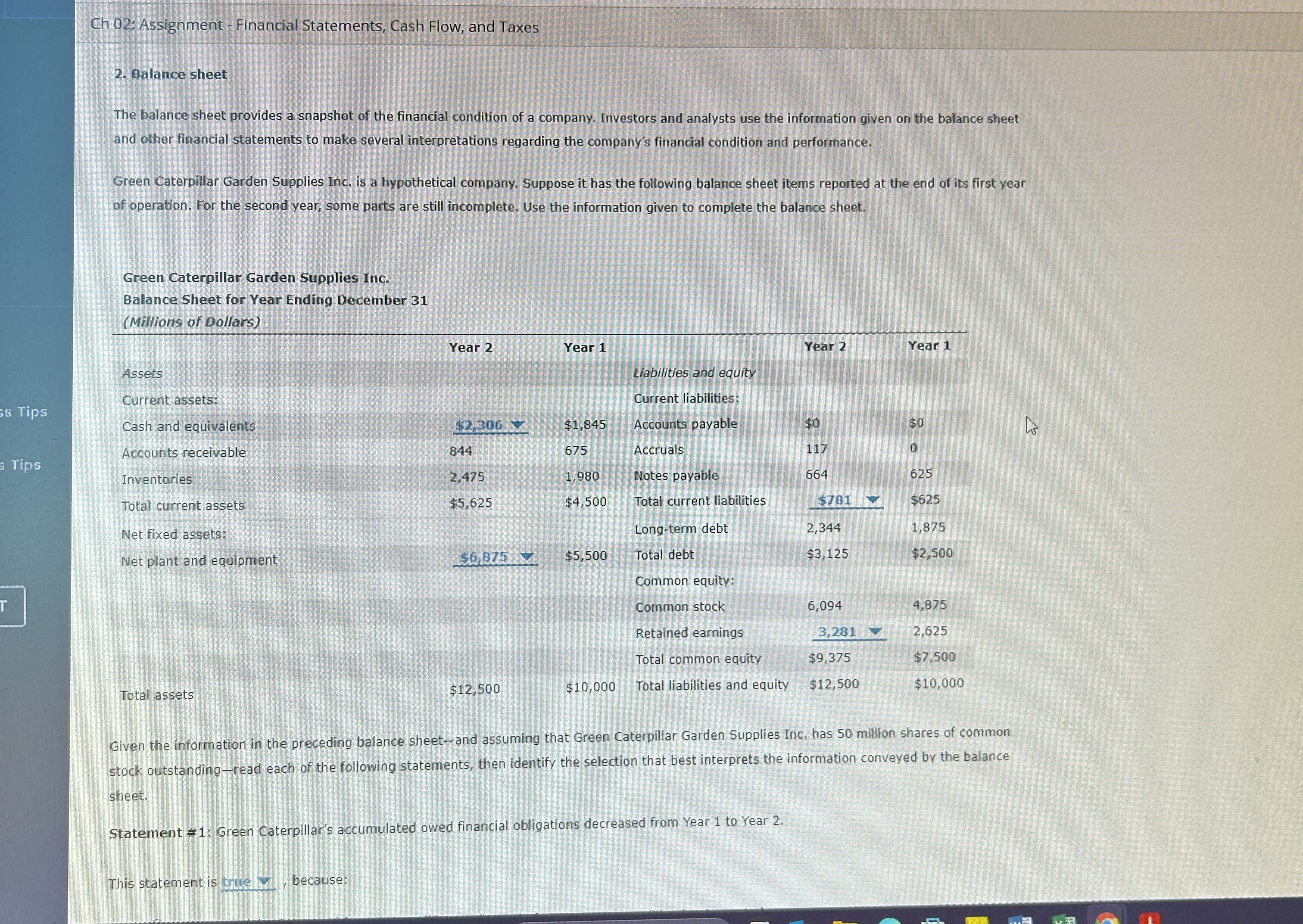

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance.

Green Caterpillar Garden Supplies Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet.

Green Caterpillar Garden Supplies Inc.

Balance Sheet for Year Ending December

Millions of Dollars

Given the information in the preceding balance sheetand assuming that Green Caterpillar Garden Supplies Inc. has million shares of common stock outstandingread each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet.

Statement #: Green Caterpillar's accumulated owed financial obligations decreased from Year to Year

This statement i because:Financial Statements, Cash Flow, and Taxes

Accruals actually increased from $ in Year to $ million at the end of Year

Statement #: On December of Year Green Caterpillar Garden Supplies Inc. had $ million of actual money that it could have spent immediately.

This statement is true because:

The funds recorded in Green Caterpillar's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately.

Green Caterpillar's Year cash and equivalents balance is $ million.

The funds recorded in Green Caterpillar's cash and equivalents account represents funds that are either cash or can be converted into cash almost immediately.

ss Tips

Statement #: The book value per share of Green Caterpillar's stock in Year was $

This statement is incorrect because:

The pershare book value is calculated by dividing the company's total common equity by the number of outstanding shares of common stock.

The pershare book value is calculated by dividing the company's total debt by the number of outstanding shares of common stock.

The pershare book value is calculated by dividing the company's total assets by the number of outstanding shares of common stock.

Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Green Caterpillar Garden Supplies Inc:s balance sheet is consistent with US Generally Accepted Accounting Principles GAAP

The company's debts should be listed in order of their liquidity.

The company's debts are listed in the order in which they are to be repaid.

The company's debts should be listed from those carrying the largest balance to those with the smallest balance.ss Tips

Statement #: The book value per share of Green Caterpillar's stock in Year was $

This statement is incorrect because:

The pershare book value is calculated by dividing the company's total common equity by the number of outstanding shares of common stock.

The pershare book value is calculated by dividing the company's total debt by the number of outstanding shares of common stock.

The pershare book value is calculated by dividing the company's total assets by the number of outstanding shares of common stock.

Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Green Caterpillar Garden Supplies Inci's balance sheet is consistent with US Generally Accepted Accounting Principles GAAP

The company's debts should be listed in order of their liquidity.

The company's debts are listed in the order in which they are to be repaid.

The company's debts should be listed from those carrying the largest balance to those with the smallest balance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock