Question: Ch 0 3 : Assignment - Risk and Return: Part II The points on the line r R F M Z represent: Portfolios with the

Ch : Assignment Risk and Return: Part II

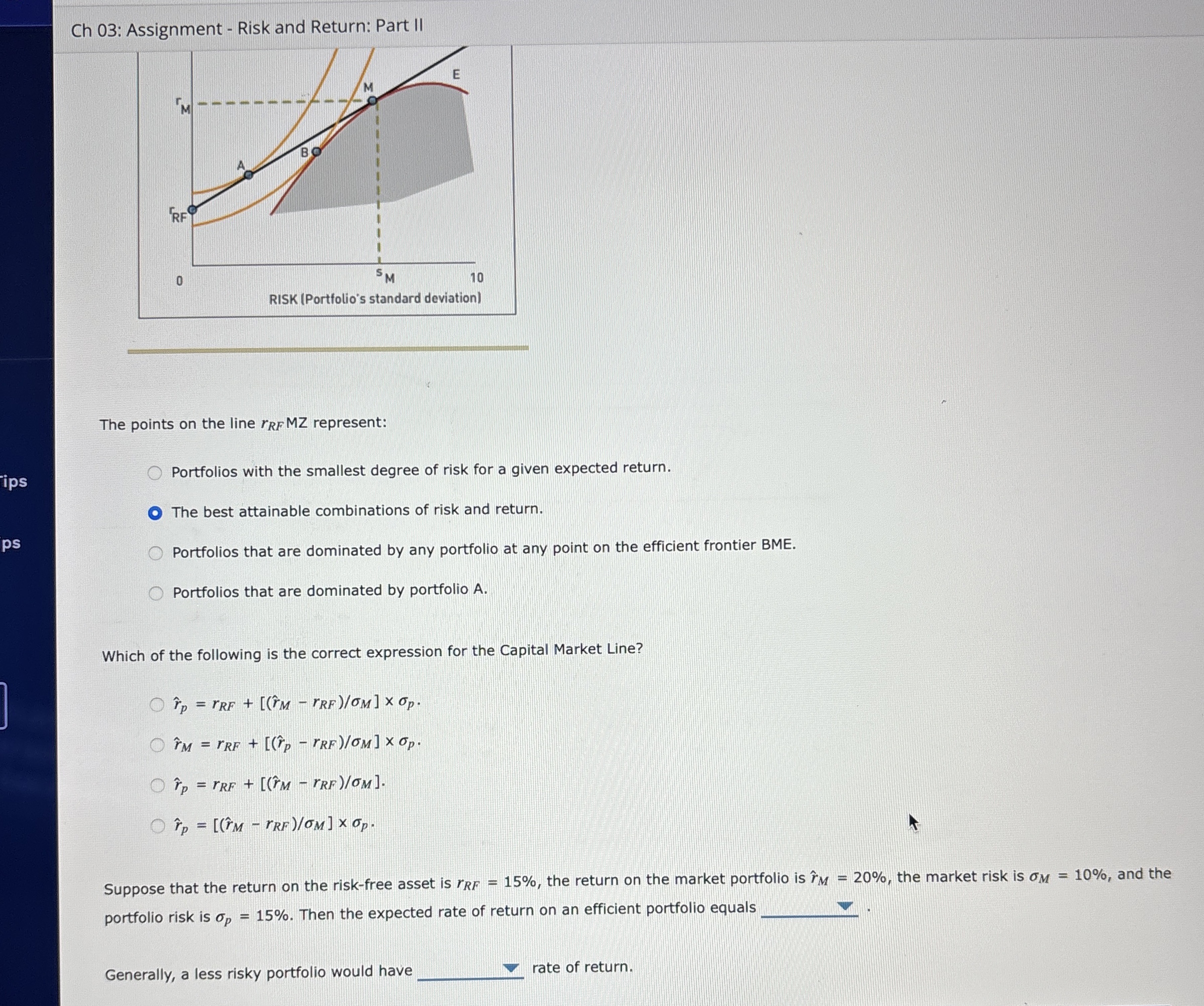

The points on the line represent:

Portfolios with the smallest degree of risk for a given expected return.

The best attainable combinations of risk and return.

Portfolios that are dominated by any portfolio at any point on the efficient frontier BME.

Portfolios that are dominated by portfolio A

Which of the following is the correct expression for the Capital Market Line?

hat

hat

hat

hat

Suppose that the return on the riskfree asset is the return on the market portfolio is hat the market risk is and the portfolio risk is Then the expected rate of return on an efficient portfolio equal

Generally, a less risky portfolio would have rate of return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock