Question: Ch 0 3 : Homework Problems - Financial Statements, Tools, and Budgets Do the Math 3 - 6 Budgeting and Income Projections Leyia and Larry

Ch : Homework Problems Financial Statements, Tools, and Budgets

Do the Math

Budgeting and Income Projections

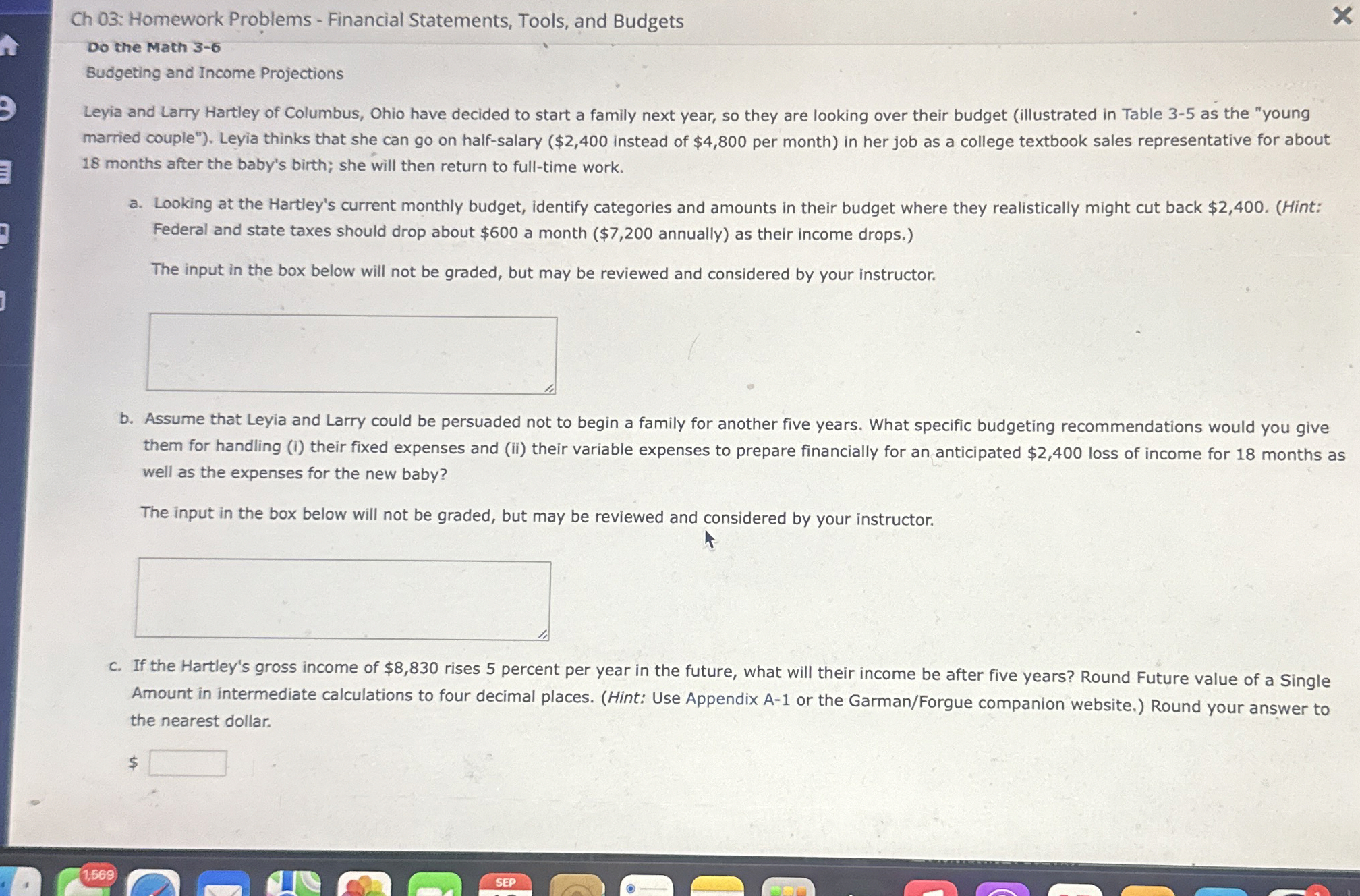

Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget illustrated in Table as the "young

married couple" Leyia thinks that she can go on halfsalary $ instead of $ per month in her job as a college textbook sales representative for about

months after the baby's birth; she will then return to fulltime work.

a Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $Hint:

Federal and state taxes should drop about $ a month $ annually as their income drops.

The input in the box below will not be graded, but may be reviewed and considered by your instructor.

b Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give

them for handling i their fixed expenses and ii their variable expenses to prepare financially for an anticipated $ loss of income for months as

well as the expenses for the new baby?

The input in the box below will not be graded, but may be reviewed and considered by your instructor.

c If the Hartley's gross income of $ rises percent per year in the future, what will their income be after five years? Round Future value of a Single

Amount in intermediate calculations to four decimal places. Hint: Use Appendix A or the GarmanForgue companion website. Round your answer to

the nearest dollar.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock