Question: Ch 0 8 : End - of - Chapter Problems - LPK - Risk and Rates of Return You plan to invest in the Kish

Ch : EndofChapter ProblemsLPK Risk and Rates of Return

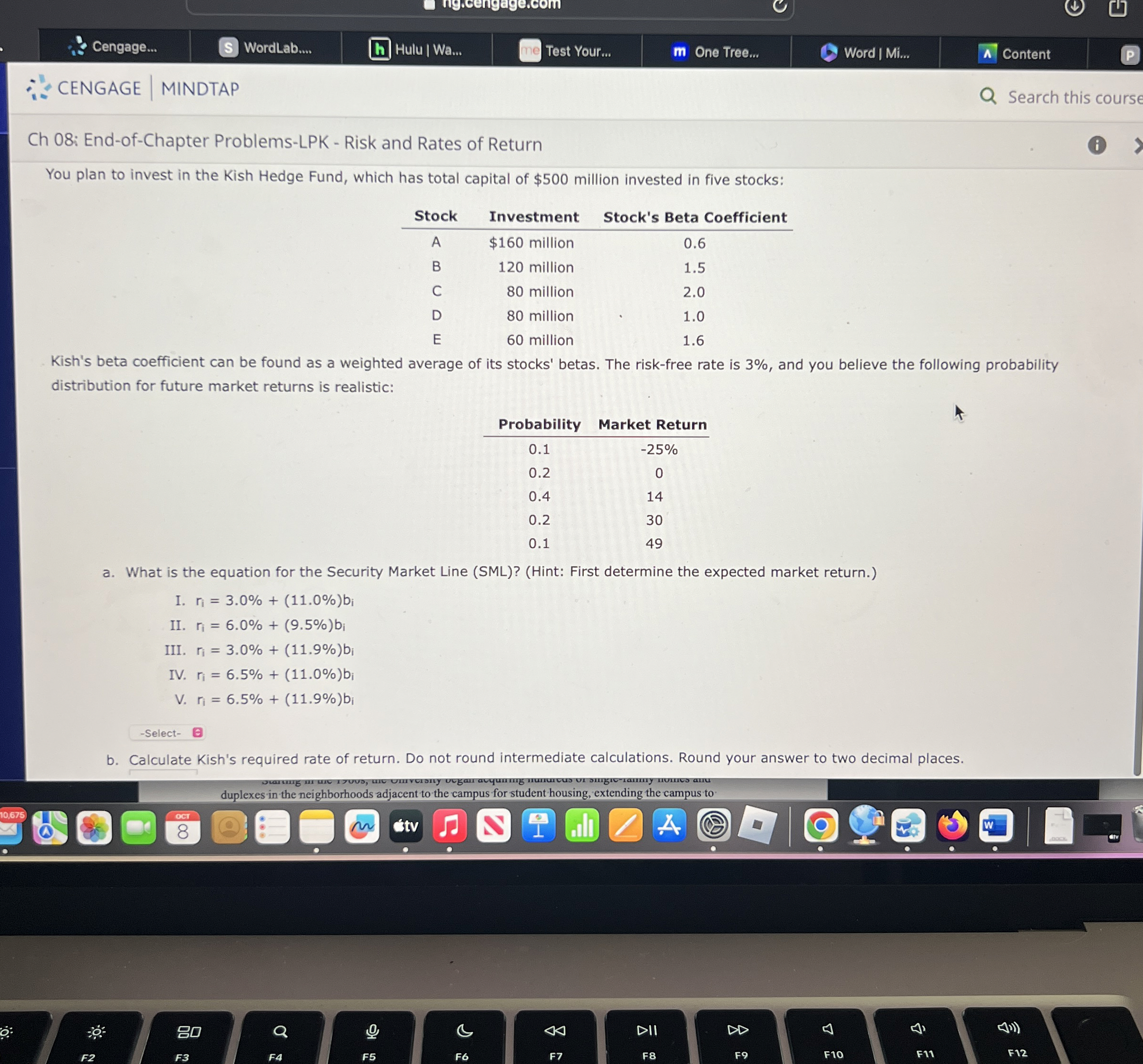

You plan to invest in the Kish Hedge Fund, which has total capital of $ million invested in five stocks:

Kish's beta coefficient can be found as a weighted average of its stocks' betas. The riskfree rate is and you believe the following probability

distribution for future market returns is realistic:

a What is the equation for the Security Market Line SMLHint: First determine the expected market return.

I.

II

III.

IV

V

b Calculate Kish's required rate of return. Do not round intermediate calculations. Round your answer to two decimal places.

CSuppose Rick Kish, the president, recieves a proposal from a company seeking new capital. The amount needed to take a position in the stock is $ million, it has an expected return of and its estimated beta is Should kish invest in the new company? Should the new stock be purchased or not purcahsed?

D At what expected rate of return should kish be indifferent to purchasing the stock?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock