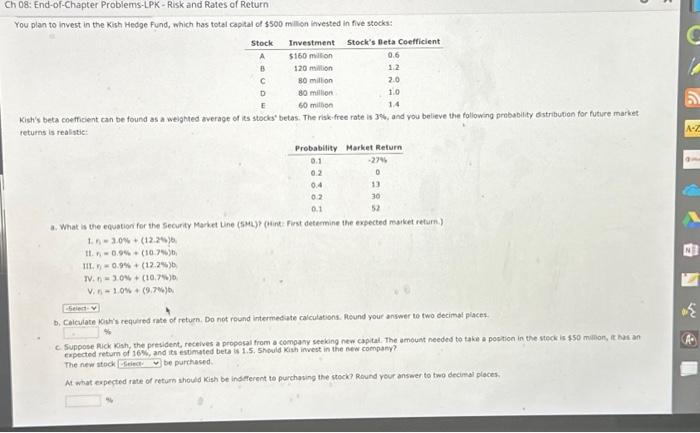

Question: Ch 08: End-of-Chapter Problems-LPK - Risk and Rates of Return You plan to invest in the Kish Hedge Fund, which has total capital of $500

a. What is the equation for the Securty Market Line (fML)? (hint: First determine the expected muiket return.) 1.n=3.0%+(12.24)6 11. fi=0.9%+(10.765)b1 18. F1=0.9%+(12.2%)b, Nin=3.0%+(10.7%)0 V,f=1.0%+(9,7%)b b. Calculate Kouhis required rate of return. Do not round intermediate calculations. Aleund your answer to two decimal piaces c. Suppose Puck Kish, the president, receives a propasal from a company seeking new capital. The amount needes to take a poction in the steck is 450 multon, it hat an. expected retum of 16%, and its estimated bets is 1.5,5 hould Kish invest in the new company? The new stock be purchased. At what eapected rate of retion should Kish be indfferent to purchasing the stock? Rovnd yeur anseer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts