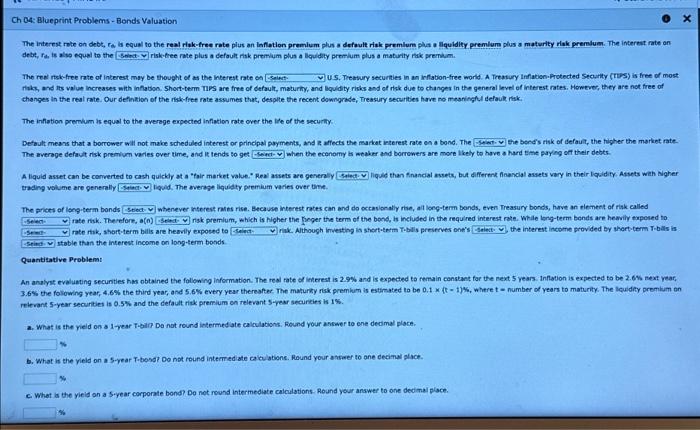

Question: Ch 04: Blueprint Problems - Bonds Valuation The Interest rate on debt, ra, is equal to the real risk-free rate plus an inflation premium plus

detr, rin is alvo equal to the risk-tree rate plus a defoult nak premlum plus a louldity premium plus a maturity fik premium. The res risk-free rate of interest may be thoupht of as the inkerest rate ea The inflation premium is equal to the average expected infation rate over the life of the securtiy: Detault means that a borrower will not make scheduled interest or principal payments, and z affects the markat interest rate en a bond. The the bends risk of defaut, the hipher the market rateThe average defaut risk premium varies over time, ahd it tends so get when the economy is webler and borrowers are more lkely to hove a hard time parying of their debts. A liquid asset can be converted to cash quichly at a "fair market value." Real assets are generally hiqua than financial assets, but cifferenk financial assets vary in their logidity Assets wah Nigher trading volume are penerally lovid, The everase liguidty permium varies over bme. The pricts of loep-term bonds whenever knterest rates rise. Because interest rates can and do occasionally rise, al long-term bonds, even Treasury bonds, have an element of risk ealled rate nik. Therefore, a(o) risk premium, which is higher the preger the term of the bond, is included in the required interest rate. While long-term bends are hemily erposed to rate rik, short-term bilis are heavlly exposed to riak. Although imvesting is shertuterm Tublis preserves one's the interest income provided by thert-term T-bals is stable than the interevt income on long-term boods. Quantitative Problem: relevant 5 -year secunties is 0.5% and the default riak premium on relevant 5 - vear securcies is 1%. a. What is the yield on a 1 pear fabin Da not round intermed ate calculabions. Round your answer to ene dedimal place. b. What is the yield on a S-year T-bond Do not round intemed ate calculatione. Round your anseref to ane decinal plack. c. What is the yieid on a s.year corporate bond? De not round intermediate calculations Round your answer to one decimal place. detr, rin is alvo equal to the risk-tree rate plus a defoult nak premlum plus a louldity premium plus a maturity fik premium. The res risk-free rate of interest may be thoupht of as the inkerest rate ea The inflation premium is equal to the average expected infation rate over the life of the securtiy: Detault means that a borrower will not make scheduled interest or principal payments, and z affects the markat interest rate en a bond. The the bends risk of defaut, the hipher the market rateThe average defaut risk premium varies over time, ahd it tends so get when the economy is webler and borrowers are more lkely to hove a hard time parying of their debts. A liquid asset can be converted to cash quichly at a "fair market value." Real assets are generally hiqua than financial assets, but cifferenk financial assets vary in their logidity Assets wah Nigher trading volume are penerally lovid, The everase liguidty permium varies over bme. The pricts of loep-term bonds whenever knterest rates rise. Because interest rates can and do occasionally rise, al long-term bonds, even Treasury bonds, have an element of risk ealled rate nik. Therefore, a(o) risk premium, which is higher the preger the term of the bond, is included in the required interest rate. While long-term bends are hemily erposed to rate rik, short-term bilis are heavlly exposed to riak. Although imvesting is shertuterm Tublis preserves one's the interest income provided by thert-term T-bals is stable than the interevt income on long-term boods. Quantitative Problem: relevant 5 -year secunties is 0.5% and the default riak premium on relevant 5 - vear securcies is 1%. a. What is the yield on a 1 pear fabin Da not round intermed ate calculabions. Round your answer to ene dedimal place. b. What is the yield on a S-year T-bond Do not round intemed ate calculatione. Round your anseref to ane decinal plack. c. What is the yieid on a s.year corporate bond? De not round intermediate calculations Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts