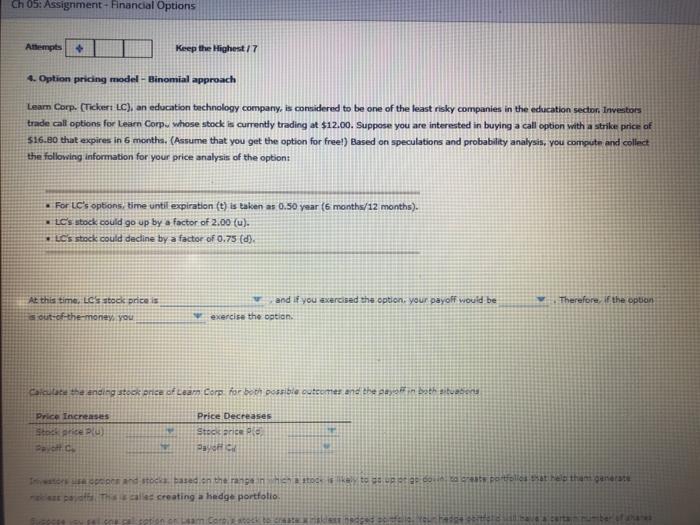

Question: Ch 05: Assignment - Financial Options Attempts Keep the Highest/7 4. Option pricing model - Binomial approach Learn Corp. (Ticker LC), an education technology company

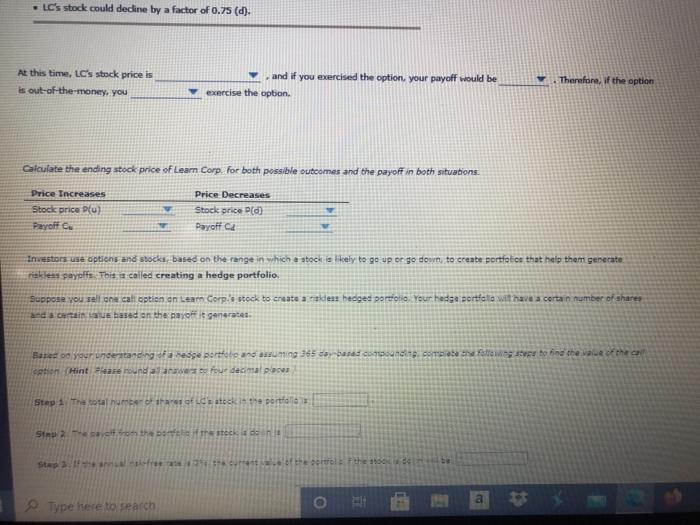

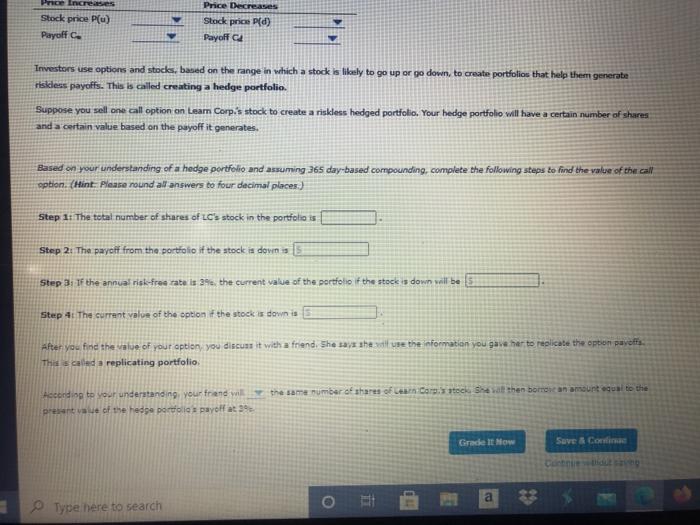

Ch 05: Assignment - Financial Options Attempts Keep the Highest/7 4. Option pricing model - Binomial approach Learn Corp. (Ticker LC), an education technology company is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp whose stock is currently trading at $12.00. Suppose you are interested in buying a call option with a strike price of 516.80 that expires in 6 months. (Assume that you get the option for free!) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: For LC's options, time until expiration (t) is taken as 0.50 year (6 months/12 months). LC's stock could go up by a factor of 2.00 (u). C's stock could decline by a factor of 0.75 (d) Therefore if the option At this time. C's stock price is s out of the money you and if you exercised the option your payoff would be exercise the option Calculate the anding stock price of Learn Corp. for both possible outcomes and the institute Price Increases Stockgriepu BC Price Decreases Stoccare PHIC The And stock based on the rangaisto papillested that generate pad The creating a hedge portfolio pletion of Liam Cartoon Fata LC's stock could decline by a factor of 0.75 (d). At this time, LC's stock price is is out-of-the-money, you and if you exercised the option, your payoff would be exercise the option. Therefore, if the option Calculate the ending stock price of Learn Corp. for both possible outcomes and the payoff in both situations. Price Increases Stock price Plu) Payoff Price Decreases Stock price (d) Payoff C Investors use options and stocks based on the range in which a stock is Hoely to ge up or go down to create portfolios that help them generate riekless payoffs. This was called creating a hedge portfolio Suppose you sell one cal obtien an Learn Corp's stock to create a dess hedges profolio Yeur hedge sorteile will have a certain number of shares accentue based on the payoff is generates. Bare on your understanding of a hedge portfolio and assuming 365 dar-based como de fotong so to bind the value of the can cation (Hint a hounds four decimal places Step 1 The total number of shares of Le teek in the portfolio Sin Theronthaltestellt Step free of the correlated Type here to search OG a POP Inces Stock price po Payoff Price Decreases Stock price P[d) Payoff Investors use options and stocks, based on the range in which a stock is likely to go up or go down to create portfolios that help them generate riskless payoffs. This is called creating a hedge portfolio. Suppose you sell one call option on Learn Corps stock to create a riskless hedged portfolio. Your hedge portfolio will have a certain number of shares and a certain value based on the payoff it generates. Based on your understanding of a hedge portfolio and assuming 365 day-based compounding, complete the following steps to find the value of the call option. (Hint. Please round all answers to four decimal places.) Step 1: The total number of shares of LC's stock in the portfolio is Step 2: The payoff from the portfolio if the stock is downs Step 3. If the annual risk-free rate is 39, the current value of the portfolio if the stock is down will be Step 41 The current value of the option if the stock w down is After you find the value of your aption, you discuss it with a friend. She way she use the information you gave her to replicate the option pavoffs This is called a replicating portfolio According to your understanding your friend will see the same number of shares of CarstockShe sat the bones an amount equal to the prewentue of the hedge portales payoff at 99 Grade It Now Save & Corvin Type here to search o a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts