Question: Ch 06: Assignment - Accounting for Financial Management Attempts Keep the Highest / 6 12. The tax system Provisions of the U.S. Tax Code for

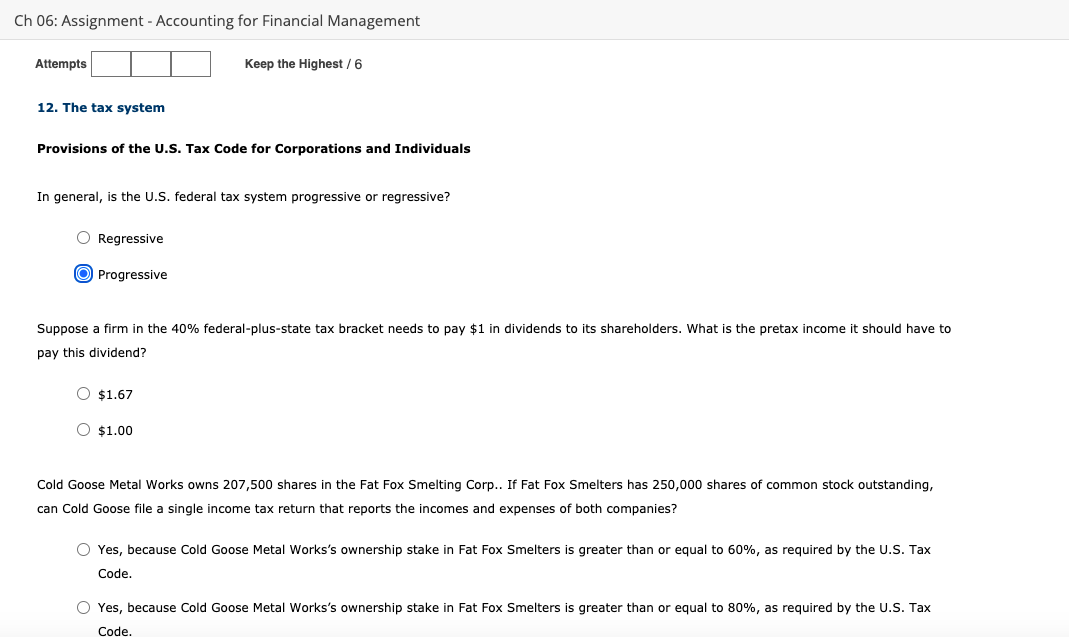

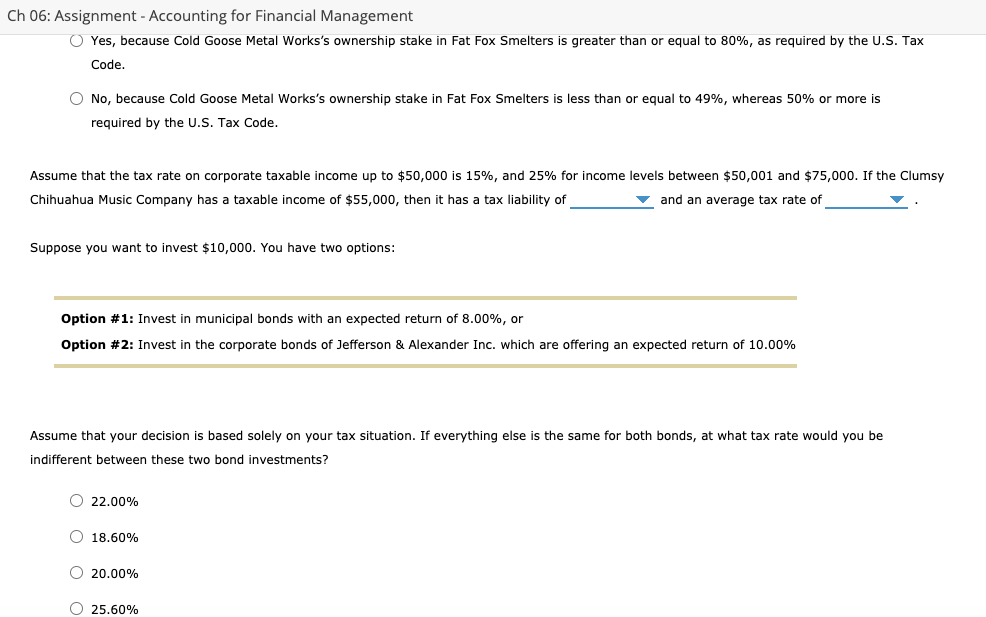

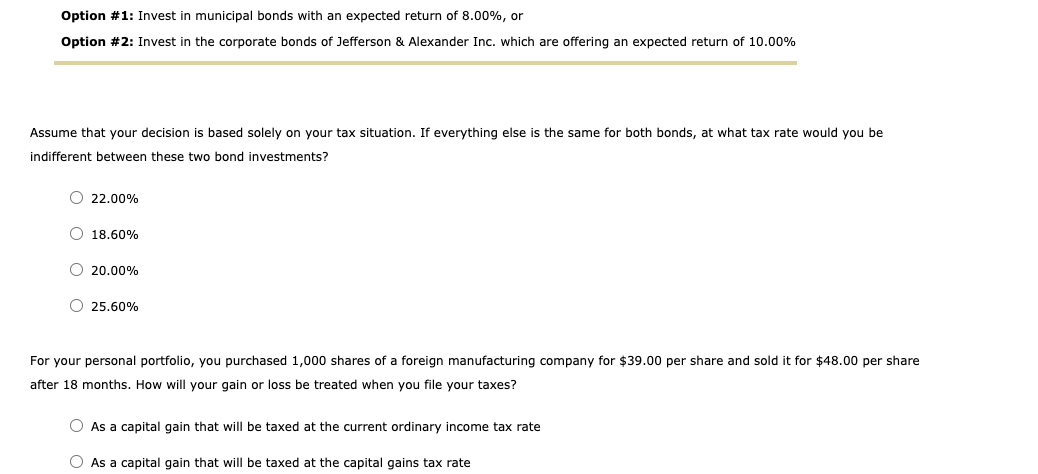

Ch 06: Assignment - Accounting for Financial Management Attempts Keep the Highest / 6 12. The tax system Provisions of the U.S. Tax Code for Corporations and Individuals In general, is the U.S. federal tax system progressive or regressive? O Regressive O Progressive Suppose firm in the 40% federal-plus-state tax bracket needs to pay $1 in dividends to its shareholders. What is the pretax income it should have to pay this dividend? O $1.67 O $1.00 Cold Goose Metal Works owns 207,500 shares in the Fat Fox Smelting Corp.. If Fat Fox Smelters has 250,000 shares of common stock outstanding, can Cold Goose file a single income tax return that reports the incomes and expenses of both companies? Yes, because Cold Goose Metal Works's ownership stake in Fat Fox Smelters is greater than or equal to 60%, as required by the U.S. Tax Code. Yes, because Cold Goose Metal Works's ownership stake in Fat Fox Smelters is greater than or equal to 80%, as required by the U.S. Tax Code. Ch 06: Assignment - Accounting for Financial Management Yes, because Cold Goose Metal Works's ownership stake in Fat Fox Smelters is greater than or equal to 80%, as required by the U.S. Tax Code. O No, because Cold Goose Metal Works's ownership stake in Fat Fox Smelters is less than or equal to 49%, whereas 50% or more is required by the U.S. Tax Code. Assume that the tax rate on corporate taxable income up to $50,000 is 15%, and 25% for income levels between $50,001 and $75,000. If the Clumsy Chihuahua Music Company has a taxable income of $55,000, then it has tax liability of and an average tax rate of Suppose you want to invest $10,000. You have two options: Option #1: Invest in municipal bonds with an expected return of 8.00%, or Option #2: Invest in the corporate bonds of Jefferson & Alexander Inc. which are offering an expected return of 10.00% Assume that your decision is based solely on your tax situation. If everything else is the same for both bonds, at what tax rate would you be indifferent between these two bond investments? O 22.00% O 18.60% O 20.00% 0 25.60% Option #1: Invest in municipal bonds with an expected return of 8.00%, or Option #2: Invest in the corporate bonds of Jefferson & Alexander Inc. which are offering an expected return of 10.00% Assume that your decision is based solely on your tax situation. If everything else is the same for both bonds, at what tax rate would you be indifferent between these two bond investments? O 22.00% O 18.60% 0 20.00% 0 25.60% For your personal portfolio, you purchased 1,000 shares of a foreign manufacturing company for $39.00 per share and sold it for $48.00 per share after 18 months. How will your gain or loss be treated when you file your taxes? O As a capital gain that will be taxed at the current ordinary income tax rate As a capital gain that will be taxed at the capital gains tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts