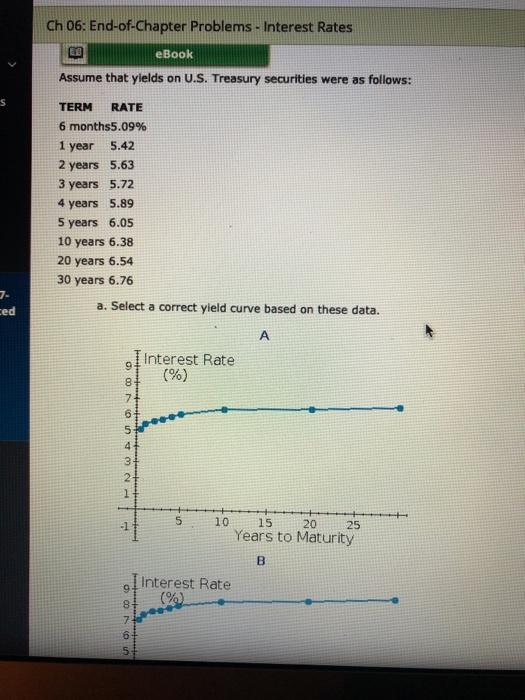

Question: Ch 06: End-of-Chapter Problems - Interest Rates eBook Assume that yields on U.S. Treasury securities were as follows: S TERM RATE 6 months5.09% 1 year

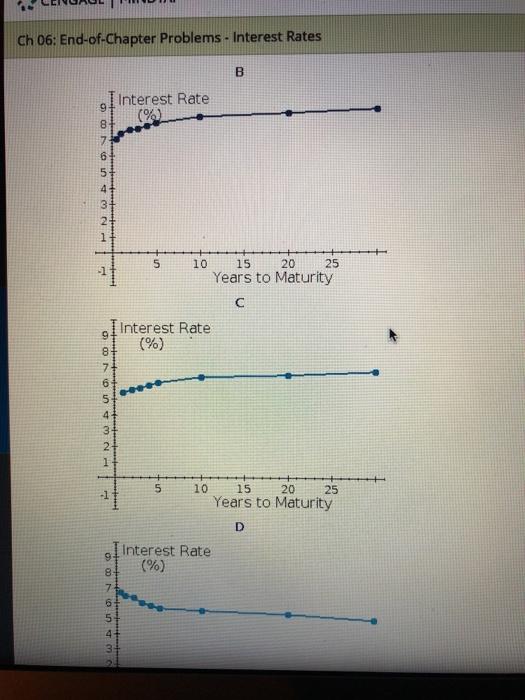

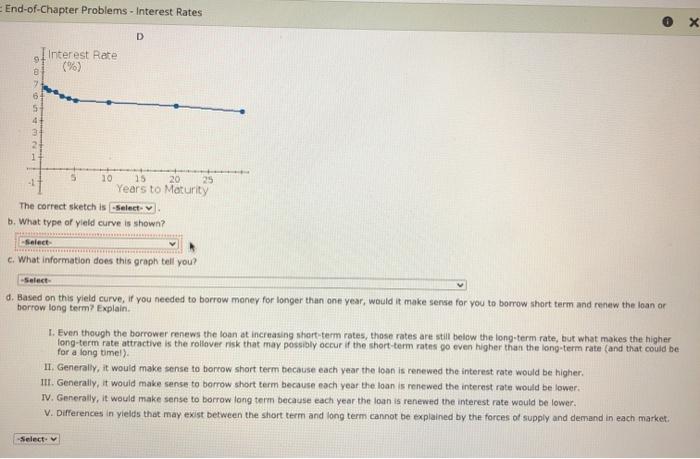

Ch 06: End-of-Chapter Problems - Interest Rates eBook Assume that yields on U.S. Treasury securities were as follows: S TERM RATE 6 months5.09% 1 year 5.42 2 years 5.63 3 years 5.72 4 years 5.89 5 years 6.05 10 years 6.38 20 years 6.54 30 years 6.76 ced a. Select a correct yield curve based on these data. Interest Rate 8 (%) 74 6 5 4 3+ 2+ 1 10 15 20 11 25 Years to Maturity B Interest Rate 9 8 INSAN 6 Ch 06: End-of-Chapter Problems - Interest Rates B Interest Rate 9 (%) 8 Nw5000 6 5 4+ 31 2 1 + 5 10 15 20 25 Years to Maturity I Interest Rate 9 (%) 8 1 Nov 00 5 10 . 15 20 25 Years to Maturity D Interest Rate 9 (%) 8 7 6 5 4 3 End-of-Chapter Problems - Interest Rates 0 x D Interest Rate 6 5 4 a 2 1 5 10 15 20 25 Years to Maturity The correct sketch is -Select- b. What type of yield curve is shown? Select c. What information does this graph tell you? d. Based on this yield curve, if you needed to borrow money for longer than one year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain. I. Even though the borrower renews the loan at increasing short-term rates, those rates are still below the long-term rate, but what makes the higher long-term rate attractive is the rollover risk that may possibly occur if the short-term rates go even higher than the long-term rate (and that could be for a long timel), 11. Generally, it would make sense to borrow short term because each year the loan is renewed the interest rate would be higher III. Generally, it would make sense to borrow short term because each year the loan is renewed the interest rate would be lower. IV. Generally, it would make sense to borrow long term because each year the loan is renewed the interest rate would be lower. V. Differences in yields that may exist between the short term and long term cannot be explained by the forces of supply and demand in each market. Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts