Question: Ch 07: Assignment. Bonds and Their Valuation Back to Assignment Attempts 1 Keep the Highest 1/3 6. Problem 7.09 (Vield to Maturity) ebook Harrimon Industries

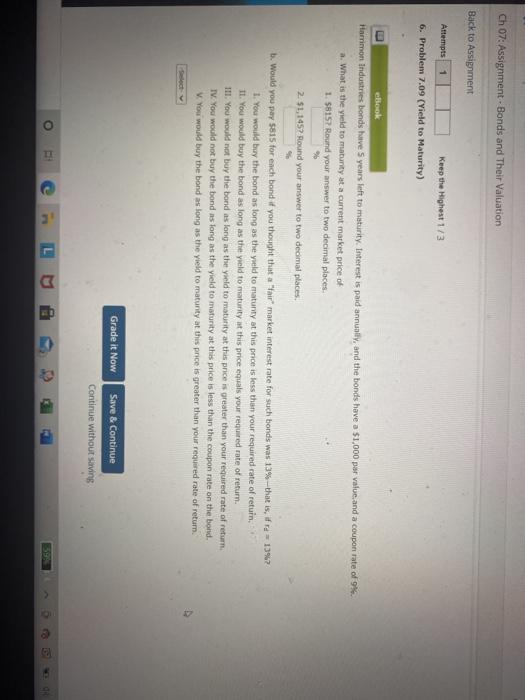

Ch 07: Assignment. Bonds and Their Valuation Back to Assignment Attempts 1 Keep the Highest 1/3 6. Problem 7.09 (Vield to Maturity) ebook Harrimon Industries bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 9% a. What is the yield to maturity at a current market price of 1. $8157 Round your answer to two decimal places. 2. $1,1457 Round your answer to two decimal places. b. Would you pay $815 for each bond if you thought that a "fair market interest rate for such bonds was 13%-that is, ofre -1392 1. You would buy the bond as long as the yield to matunity at this price is less than your required rate of retuin, 11. You would buy the bond as long as the yield to matunity at this price equals your required rate of retum. III: You would not buy the bond as long as the yield to maturity at this price is greater than your required rate of return IV. You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond, You would buy the bond as long as the yield to maturity at this price is greater than your required rate of return Grade it Now Save & Continue Continue without saving 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts