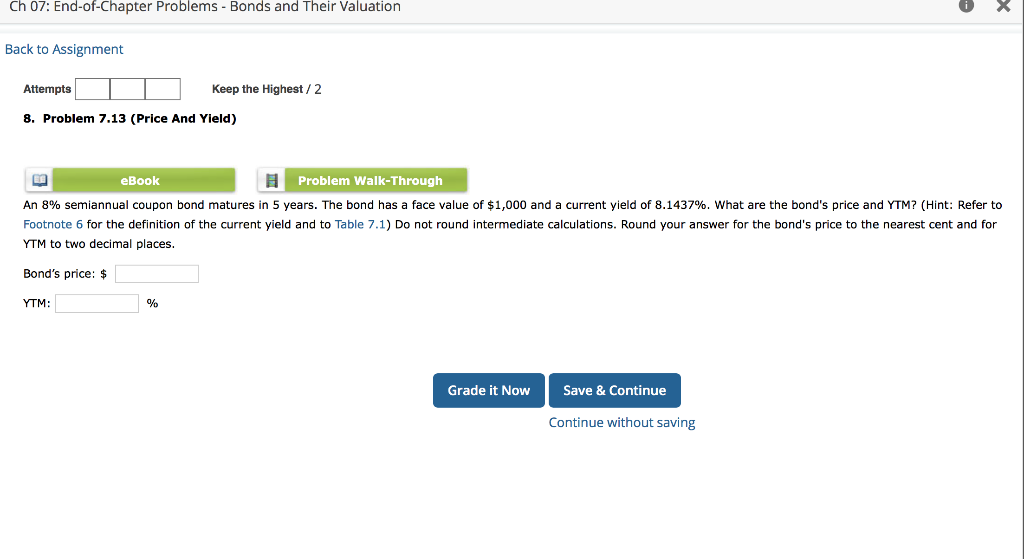

Question: Ch 07: End-of-Chapter Problems - Bonds and Their Valuation Back to Assignment Attempts Keep the Highest / 2 8. Problem 7.13 (Price And Yield) ER

Ch 07: End-of-Chapter Problems - Bonds and Their Valuation Back to Assignment Attempts Keep the Highest / 2 8. Problem 7.13 (Price And Yield) ER eBook Problem Walk-Through An 8% semiannual coupon bond matures in 5 years. The bond has a face value of $1,000 and a current yield of 8.1437%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: $ YTM: % Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts