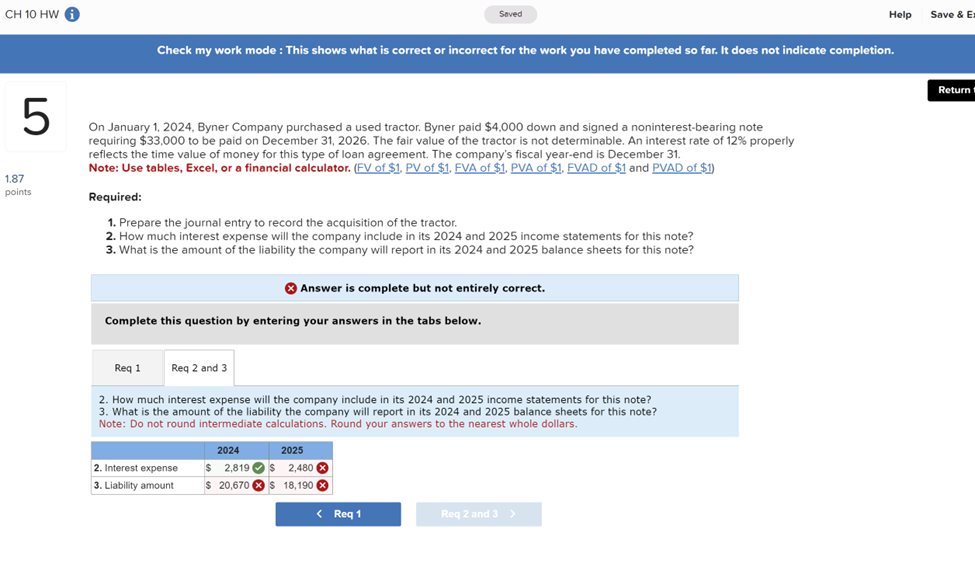

Question: CH 10 HW Saved Help Save & E Check my work mode : This shows what is correct or incorrect for the work you have

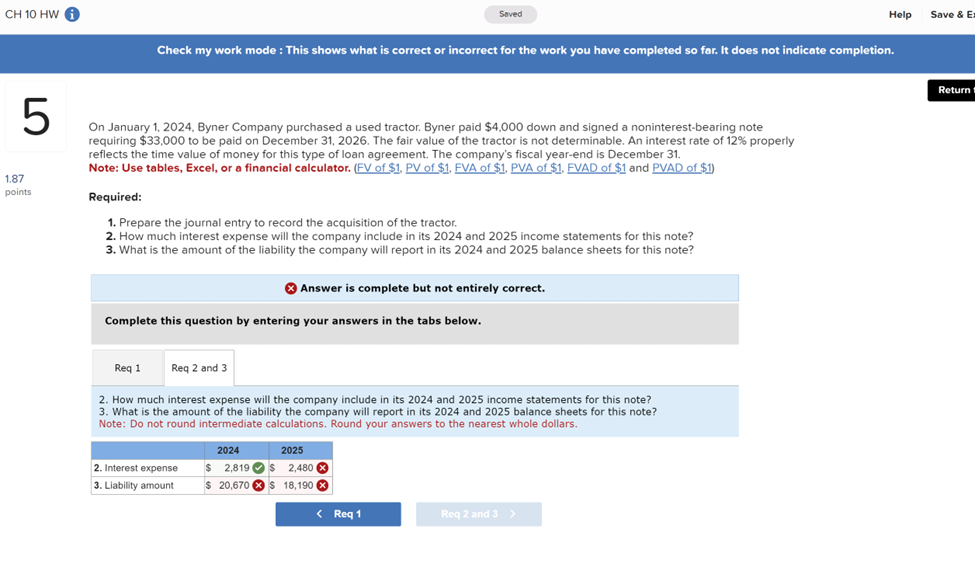

CH 10 HW Saved Help Save & E Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return 5 On January 1, 2024, Byner Company purchased a used tractor. Byner paid $4,000 down and signed a noninterest-bearing note requiring $33,000 to be paid on December 31, 2026. The fair value of the tractor is not determinable. An interest rate of 12% properly reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) 1,87 points Required: 1. Prepare the journal entry to record the acquisition of the tractor. 2. How much interest expense will the company include in its 2024 and 2025 income statements for this note? 3. What is the amount of the liability the company will report in its 2024 and 2025 balance sheets for this note?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts