Question: work Help Save E Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does

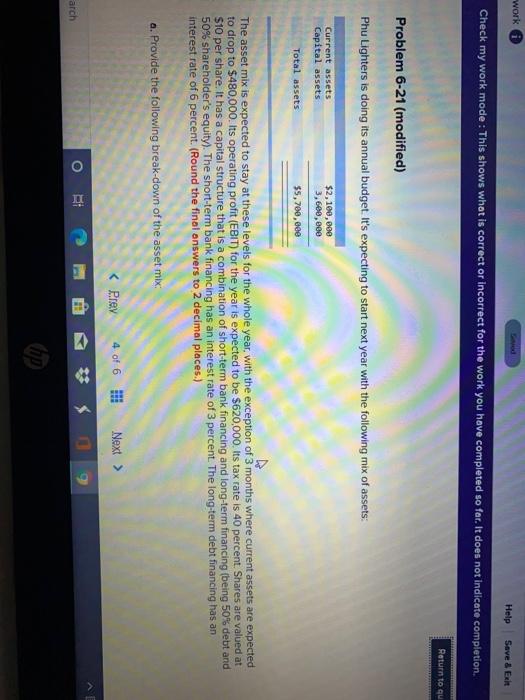

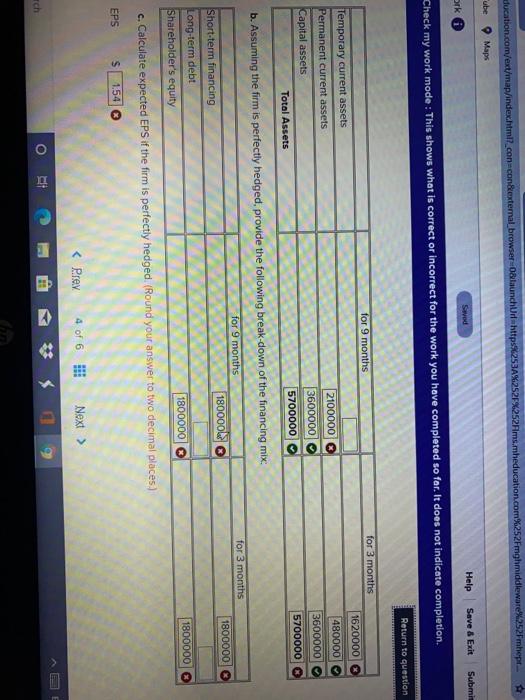

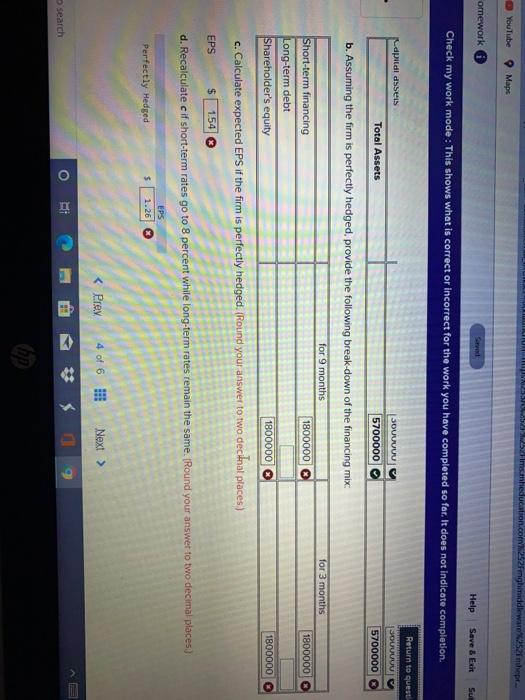

work Help Save E Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to qu Problem 6-21 (modified) Phu Lighters is doing its annual budget. It's expecting to start next year with the following mix of assets: Current assets Capital assets $2,100,000 3,600,000 Total assets $5,700,000 The asset mix is expected to stay at these levels for the whole year, with the exception of 3 months where current assets are expected to drop to $480,000. Its operating profit (EBIT) for the year is expected to be $620,000. Its tax rate is 40 percent. Shares are valued at $10 per share. It has a capital structure that is a combination of short-term bank financing and long-term financing (being 50% debt and 50% shareholder's equity). The short-term bank financing has an interest rate of 3 percent. The long-term debt financing has an interest rate of 6 percent. (Round the final answers to 2 decimal places.) a. Provide the following break-down of the asset mix: E arch Education.com/ext/map/index.html?_con-con external browser=0&launchurahttp%253A%252F%252Fims.mheducation.com%252Fmghmiddleware%252Fmhept. ube Maps Saved Help Save & Exit Submit ork Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question for 9 months for 3 months 1620000 Temporary current assets Permanent current assets 480000 2100000 36000001 3600000 Capital assets 5700000 5700000 Total Assets b. Assuming the firm is perfectly hedged, provide the following break-down of the financing mix for 9 months for 3 months 180000W 1800000 Short-term financing Long-term debt 1800000 1800000 Shareholder's equity c. Calculate expected EPS if the firm is perfectly hedged (Round your answer to two decimal places EPS S 1.54 E ich O 5 ms.mnheducation.com 252mghaddleware252 mer YouTube Maps omework Help Save & Exit Sub Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to quest dpildidseis STI SOUUUUU 5700000 for 3 months 1800000 SOUUUUU Total Assets 5700000 b. Assuming the firm is perfectly hedged, provide the following break-down of the financing mix for 9 months Short-term financing 1800000 Long-term debt Shareholder's equity 1800000 c. Calculate expected EPS If the firm is perfectly hedged. (Round your answer to two decinal places) EPS $ 154 d. Recalculate cif short-term rates go to 8 percent while long-term rates remain the same. (Round your answer to two decimal places) 1800000 EPS 1.26 Perfectly Hedged O BH Search * work Help Save E Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to qu Problem 6-21 (modified) Phu Lighters is doing its annual budget. It's expecting to start next year with the following mix of assets: Current assets Capital assets $2,100,000 3,600,000 Total assets $5,700,000 The asset mix is expected to stay at these levels for the whole year, with the exception of 3 months where current assets are expected to drop to $480,000. Its operating profit (EBIT) for the year is expected to be $620,000. Its tax rate is 40 percent. Shares are valued at $10 per share. It has a capital structure that is a combination of short-term bank financing and long-term financing (being 50% debt and 50% shareholder's equity). The short-term bank financing has an interest rate of 3 percent. The long-term debt financing has an interest rate of 6 percent. (Round the final answers to 2 decimal places.) a. Provide the following break-down of the asset mix: E arch Education.com/ext/map/index.html?_con-con external browser=0&launchurahttp%253A%252F%252Fims.mheducation.com%252Fmghmiddleware%252Fmhept. ube Maps Saved Help Save & Exit Submit ork Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question for 9 months for 3 months 1620000 Temporary current assets Permanent current assets 480000 2100000 36000001 3600000 Capital assets 5700000 5700000 Total Assets b. Assuming the firm is perfectly hedged, provide the following break-down of the financing mix for 9 months for 3 months 180000W 1800000 Short-term financing Long-term debt 1800000 1800000 Shareholder's equity c. Calculate expected EPS if the firm is perfectly hedged (Round your answer to two decimal places EPS S 1.54 E ich O 5 ms.mnheducation.com 252mghaddleware252 mer YouTube Maps omework Help Save & Exit Sub Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to quest dpildidseis STI SOUUUUU 5700000 for 3 months 1800000 SOUUUUU Total Assets 5700000 b. Assuming the firm is perfectly hedged, provide the following break-down of the financing mix for 9 months Short-term financing 1800000 Long-term debt Shareholder's equity 1800000 c. Calculate expected EPS If the firm is perfectly hedged. (Round your answer to two decinal places) EPS $ 154 d. Recalculate cif short-term rates go to 8 percent while long-term rates remain the same. (Round your answer to two decimal places) 1800000 EPS 1.26 Perfectly Hedged O BH Search *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts