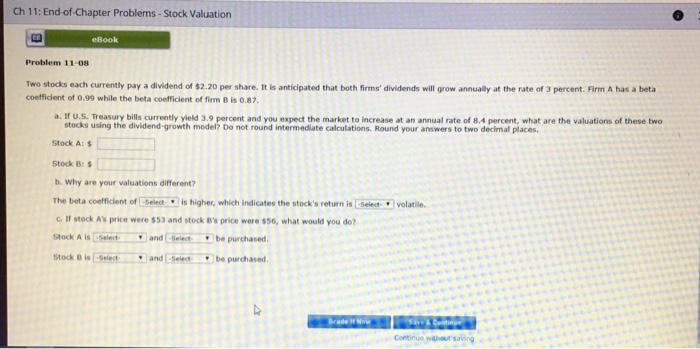

Question: Ch 11: End-of-Chapter Problems - Stock Valuation eBook Problem 11-08 both firms dividends will grow annually at the rate of percent. Firm A has a

Ch 11: End-of-Chapter Problems - Stock Valuation eBook Problem 11-08 both firms dividends will grow annually at the rate of percent. Firm A has a beta Two stocks each currently pay a dividend of $2.20 per share. coefficient of 0.99 while the beta coefficient of firm a. IF U.S. Treasury is currently yield 3.9 perce stocks using the dividend growth model? Do at the market to increase at an annual rate of 8.4 percent, what are the valuations of these two calculations. Round your answers to two decimal places Stock A: $ Stock : $ b. Why are your valuations The beta coefficient of If stock As price were

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts