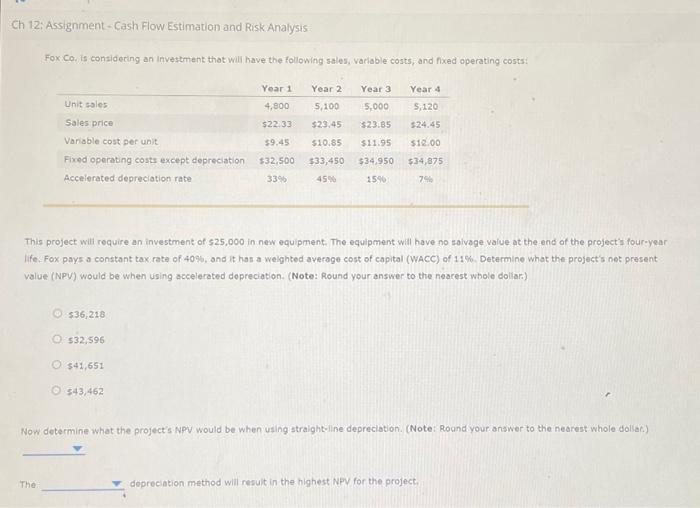

Question: Ch 12: Assignment - Cash Flow Estimation and Risk Analysis Fox Co. is considering an investment that will have the following sales, variable costs, and

Ch 12: Assignment - Cash Flow Estimation and Risk Analysis Fox Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: This project wili require an investment of 525,000 in new equipment. The equipment will have no saivage value at the end of the projects four-year Iife. Fox pays a constant tax rate of 40%, and it hes a welghted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be when using accelerated depreciation. (Note: Round your answer to the nearest wbole doliar) $36,216$32,596$41,651$43,462 Now determine what the project's NPV would be when using straighteline depreciation. (Note: Round your answer to the nearest whole dollac.) dopreciation method will resuit in the highest NPV for the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts