Question: Ch 14-End-of-Chapter Problems - Capital Structure and Leverage X 5. Problem 14.07 (Financial Leverage Effects) EL eBook The Neal Company wants to estimate next year's

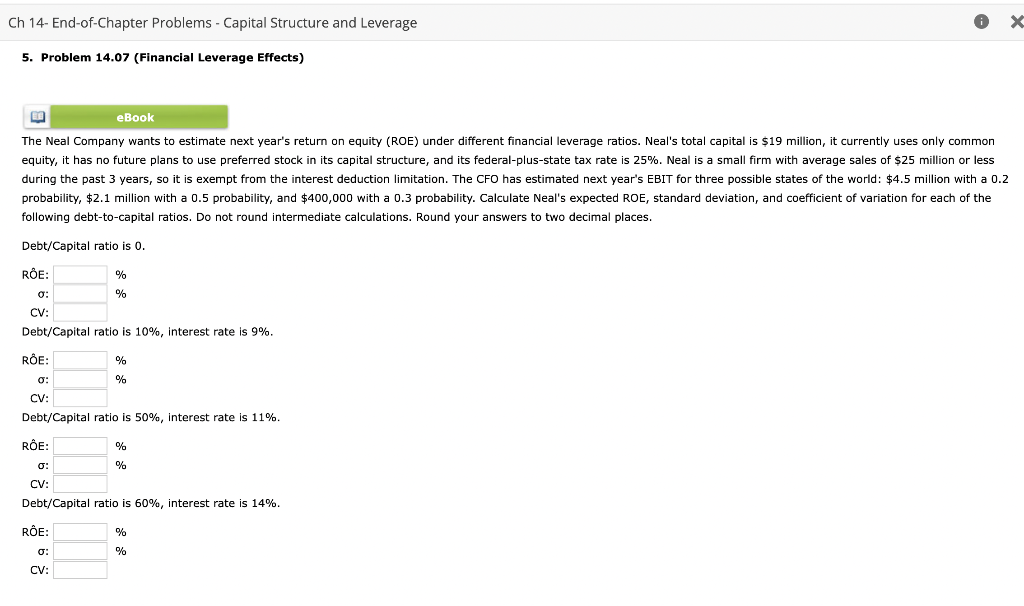

Ch 14-End-of-Chapter Problems - Capital Structure and Leverage X 5. Problem 14.07 (Financial Leverage Effects) EL eBook The Neal Company wants to estimate next year's return on equity (ROE) under different financial leverage ratios. Neal's total capital is $19 million, it currently uses only common equity, it has no future plans to use preferred stock in its capital structure, and its federal-plus-state tax rate is 25%. Neal is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. The CFO has estimated next year's EBIT for three possible states of the world: $4.5 million with a 0.2 probability, $2.1 million with a 0.5 probability, and $400,000 with a 0.3 probability. Calculate Neal's expected ROE, standard deviation, and coefficient of variation for each of the following debt-to-capital ratios. Do not round intermediate calculations. Round your answers to two decimal places. Debt/Capital ratio is 0. RE: % 0: % CV: Debt/Capital ratio is 10%, interest rate is 9%. RE: % o: % CV: Debt/Capital ratio is 50%, interest rate is 11%. RE: % 0: % CV: Debt/Capital ratio is 60%, interest rate is 14%. RE: % % 0: CV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts