Question: ch 15 study guide x2 B,C,&D answered please! I don't understand how to find the answers. BB company has $54 million of current assets and

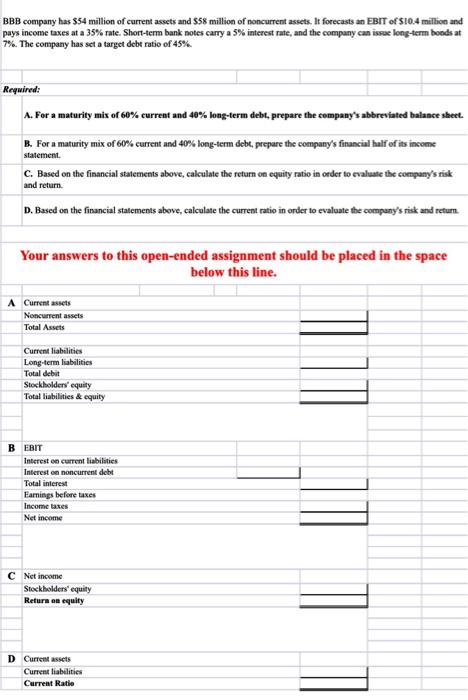

BB company has $54 million of current assets and $58 million of noncurrent assets. It forecasts an EBTT of $10.4 miltion and 1y income taxes at a 35% rate. Short-tern bank notes carry a 5% interest rate, and the corapany can issue long-term boeds at 6. The company has set a target debe ratio of 45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts