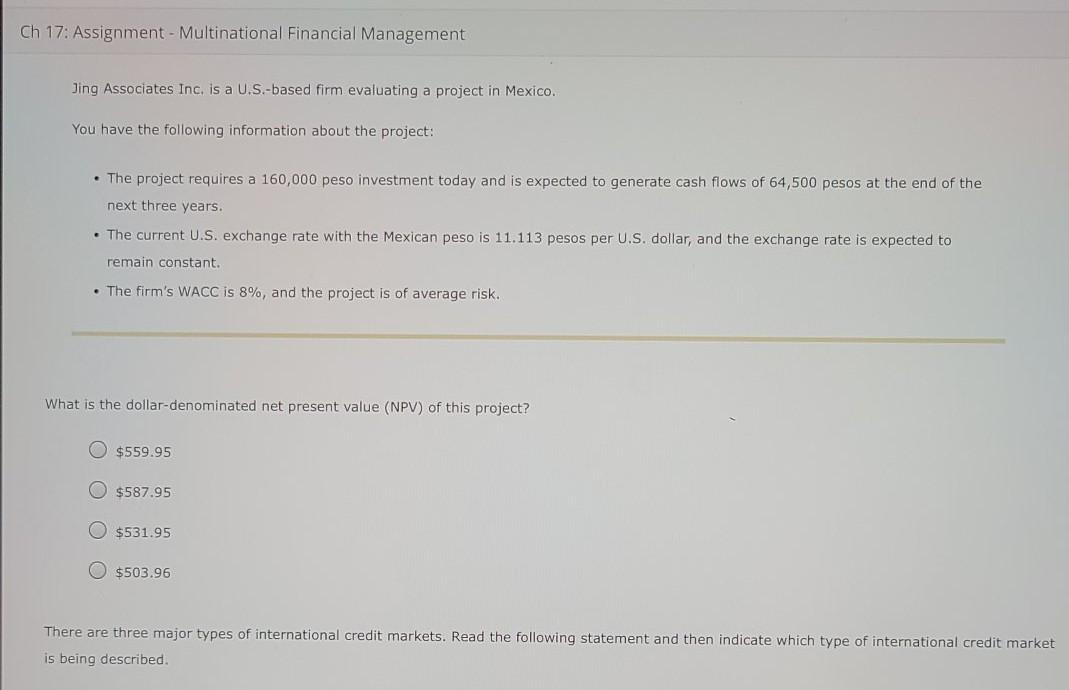

Question: Ch 17: Assignment - Multinational Financial Management Jing Associates Inc. is a U.S.-based firm evaluating a project in Mexico. You have the following information about

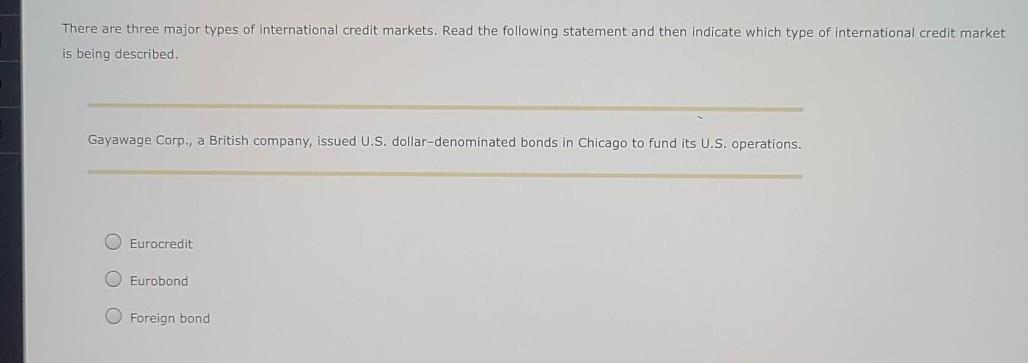

Ch 17: Assignment - Multinational Financial Management Jing Associates Inc. is a U.S.-based firm evaluating a project in Mexico. You have the following information about the project: The project requires a 160,000 peso investment today and is expected to generate cash flows of 64,500 pesos at the end of the next three years. The current U.S. exchange rate with the Mexican peso is 11.113 pesos per U.S. dollar, and the exchange rate is expected to remain constant. . The firm's WACC is 8%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? $559.95 O $587.95 O $531.95 O $503.96 There are three major types of international credit markets. Read the following statement and then indicate which type of international credit market is being described. There are three major types of international credit markets. Read the following statement and then indicate which type of international credit market is being described. Gayawage Corp., a British company, issued U.S. dollar-denominated bonds in Chicago to fund its U.S. operations. Eurocredit O Eurobond Foreign bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts