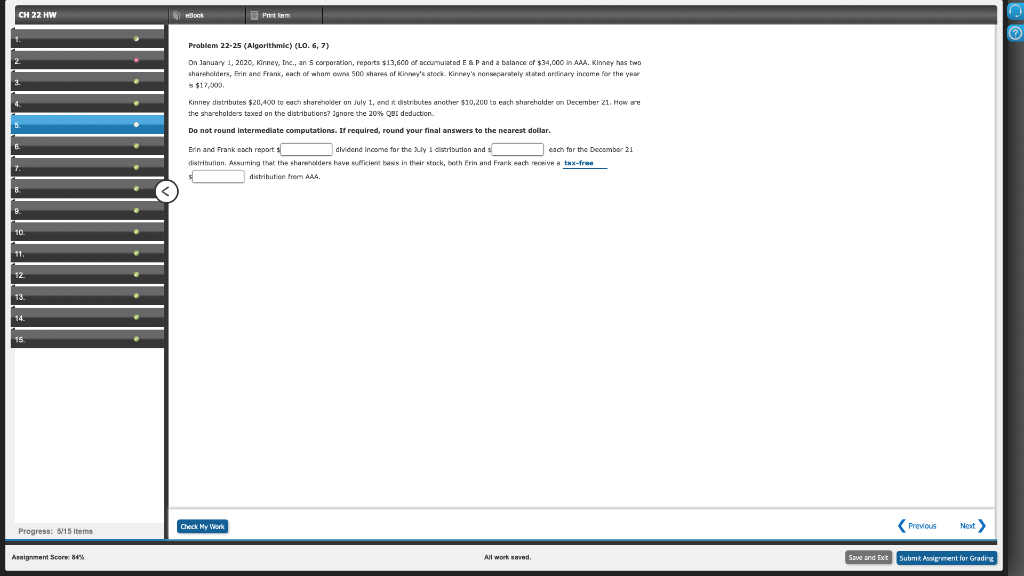

Question: CH 22 HW Book Print tem Problem 22-25 (Algorithmic) (LO. 6, 7) On January 1, 2020, Kinney, Inc., an corporation, reports $13,600 of accumulated E&P

CH 22 HW Book Print tem Problem 22-25 (Algorithmic) (LO. 6, 7) On January 1, 2020, Kinney, Inc., an corporation, reports $13,600 of accumulated E&P and a balance of $34,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nenseparately stated ordinary income for the year $12.03 Kinney distributes $20,400 to each shareholder on July 1, and it distributes another $10,200 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% Qer deduction Do not round Intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each reports dividend income for the ruly I distribution and each for the December 21 distribution. Assuming that the shareholders have sufficient basis in their stock, both Erin and Frank each receive a tax-free distribution from AAA. 11. 12 14. 15 Check My Work Progress: 5/15 items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts