Question: CH 24Homework Exercises - ACCT 1 Ch 24 HW - LOP3 LOP3 Help Save & Exit Submit Check my work Required information The following information

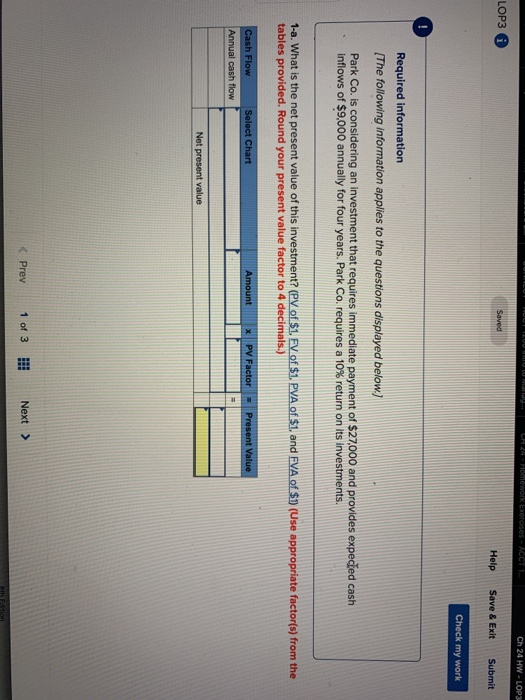

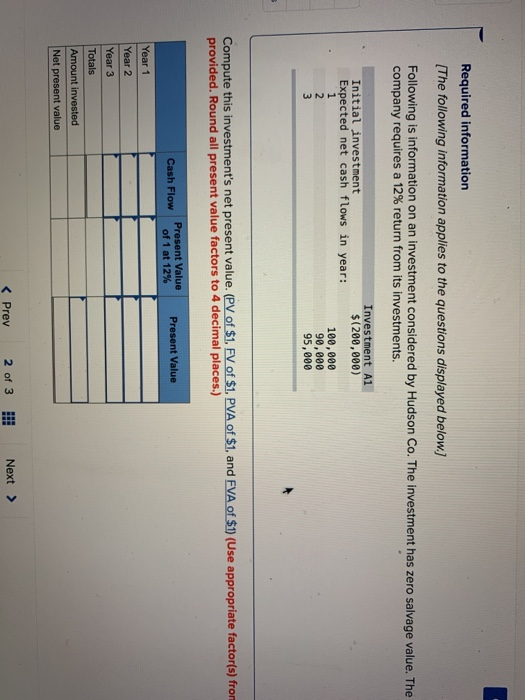

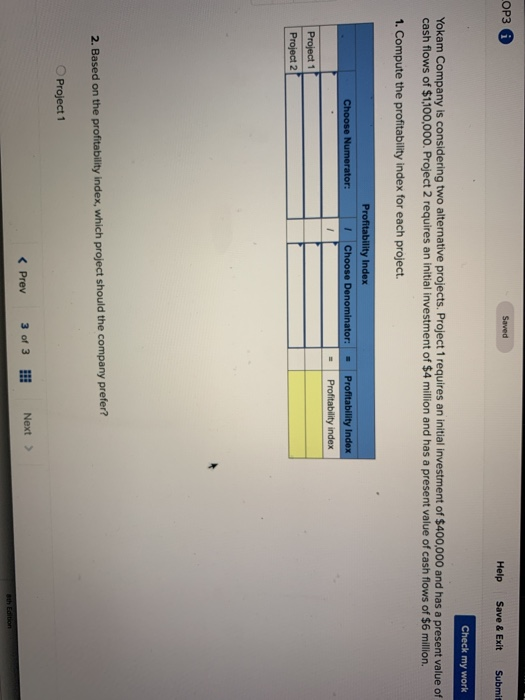

CH 24Homework Exercises - ACCT 1 Ch 24 HW - LOP3 LOP3 Help Save & Exit Submit Check my work Required information The following information applies to the questions displayed below.) Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 10% return on its investments. 1-a. What is the net present value of this investment? (PV of $1. FV of $1. PVA of $1, and FVA of $1 (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) Select Chart Amount x PV Factor Present Value Cash Flow Annual cash flow Net present value Required information [The following information applies to the questions displayed below.) Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 12% return from its investments. Investment Al $(200,000) Initial investment Expected net cash flows in year: 100,000 90,000 95,000 Compute this investment's net present value. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from provided. Round all present value factors to 4 decimal places.) Cash Flow Present Value of 1 at 12% Present Value Year 1 Year 2 Year 3 Totals Amount invested Net present value OP3 Saved Help Save & Exit Submit Check my work Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4 million and has a present value of cash flows of $6 million. 1. Compute the profitability index for each project. Profitability Index Choose Denominator: Choose Numerator: - Profitability Index Profitability index Project 1 | Project 27 2. Based on the profitability index, which project should the company prefer? Project 1 th Edition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts