Question: Ch 4: Homework X C Solved: Presented Below is Infor x + om/courses/29824/assignments/2930498?module_item_id=9827940 View Policies Current Attempt in Progress Presented below is information related to

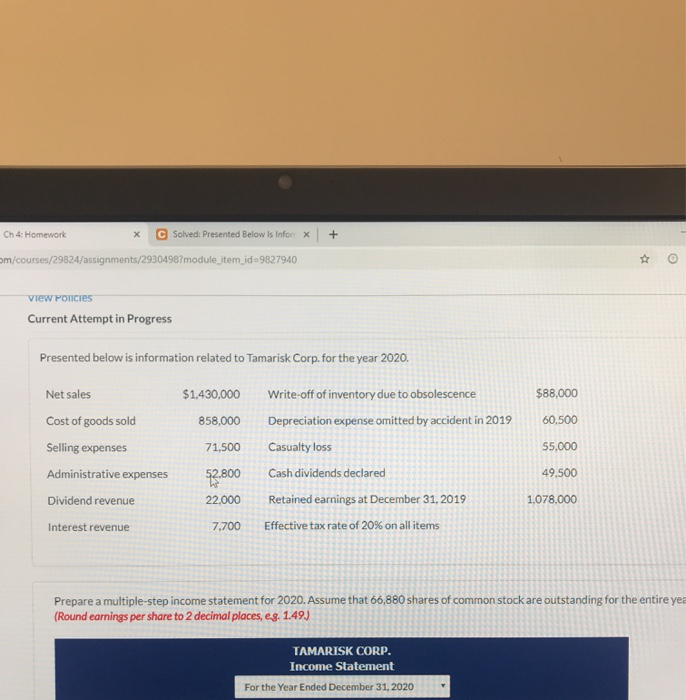

Ch 4: Homework X C Solved: Presented Below is Infor x + om/courses/29824/assignments/2930498?module_item_id=9827940 View Policies Current Attempt in Progress Presented below is information related to Tamarisk Corp. for the year 2020. Net sales $1,430,000 Write-off of inventory due to obsolescence $88,000 Cost of goods sold 858,000 Depreciation expense omitted by accident in 2019 Casualty loss Selling expenses 60,500 55,000 49,500 Administrative expenses 71,500 52.800 22,000 7.700 Dividend revenue Cash dividends declared Retained earnings at December 31, 2019 Effective tax rate of 20% on all items 1.078.000 Interest revenue Prepare a multiple-step income statement for 2020. Assume that 66,880 shares of common stock are outstanding for the entire yea (Round earnings per share to 2 decimal places, e.g. 1.49.) TAMARISK CORP. Income Statement For the Year Ended December 31, 2020 Ch 4: Homework X C Solved: Presented Below is Infor x + om/courses/29824/assignments/2930498?module_item_id=9827940 View Policies Current Attempt in Progress Presented below is information related to Tamarisk Corp. for the year 2020. Net sales $1,430,000 Write-off of inventory due to obsolescence $88,000 Cost of goods sold 858,000 Depreciation expense omitted by accident in 2019 Casualty loss Selling expenses 60,500 55,000 49,500 Administrative expenses 71,500 52.800 22,000 7.700 Dividend revenue Cash dividends declared Retained earnings at December 31, 2019 Effective tax rate of 20% on all items 1.078.000 Interest revenue Prepare a multiple-step income statement for 2020. Assume that 66,880 shares of common stock are outstanding for the entire yea (Round earnings per share to 2 decimal places, e.g. 1.49.) TAMARISK CORP. Income Statement For the Year Ended December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts