Question: CH 6 GRAHAM RETURN Interview Notes: - Sean and Stacey Graham are married and want to file a joint return. - Stacey is a ninth-grade

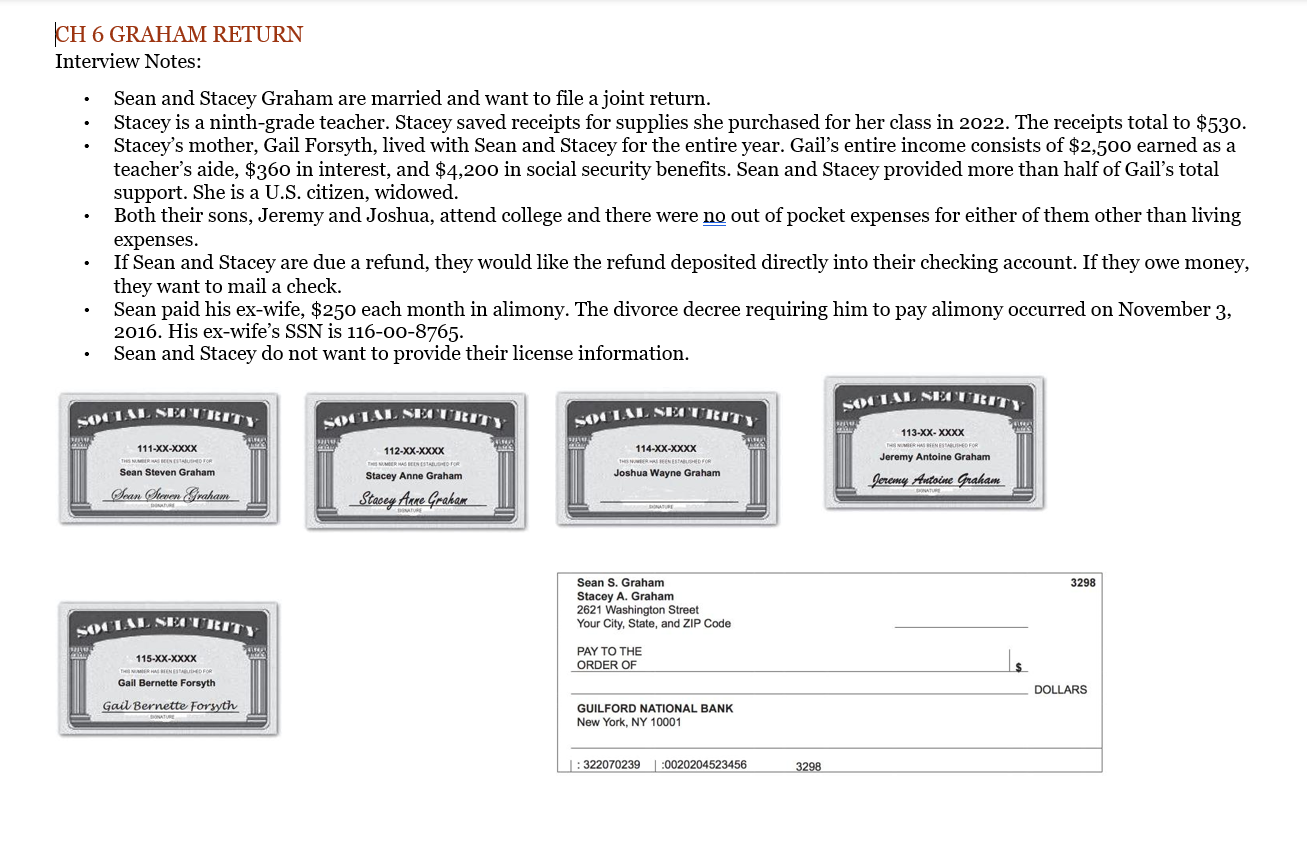

CH 6 GRAHAM RETURN Interview Notes: - Sean and Stacey Graham are married and want to file a joint return. - Stacey is a ninth-grade teacher. Stacey saved receipts for supplies she purchased for her class in 2022. The receipts total to $530. - Stacey's mother, Gail Forsyth, lived with Sean and Stacey for the entire year. Gail's entire income consists of \$2,500 earned as a teacher's aide, \$360 in interest, and \$4,200 in social security benefits. Sean and Stacey provided more than half of Gail's total support. She is a U.S. citizen, widowed. - Both their sons, Jeremy and Joshua, attend college and there were no out of pocket expenses for either of them other than living expenses. - If Sean and Stacey are due a refund, they would like the refund deposited directly into their checking account. If they owe money, they want to mail a check. - Sean paid his ex-wife, $250 each month in alimony. The divorce decree requiring him to pay alimony occurred on November 3, 2016. His ex-wife's SSN is 116-00-8765. - Sean and Stacey do not want to provide their license information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts