# Ch. 6 Homework 1. EX.06.01 2. EX.06.03 3. EX.06.04 4. EX.06.09 5. PR.06.01A Progress: 1/5...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

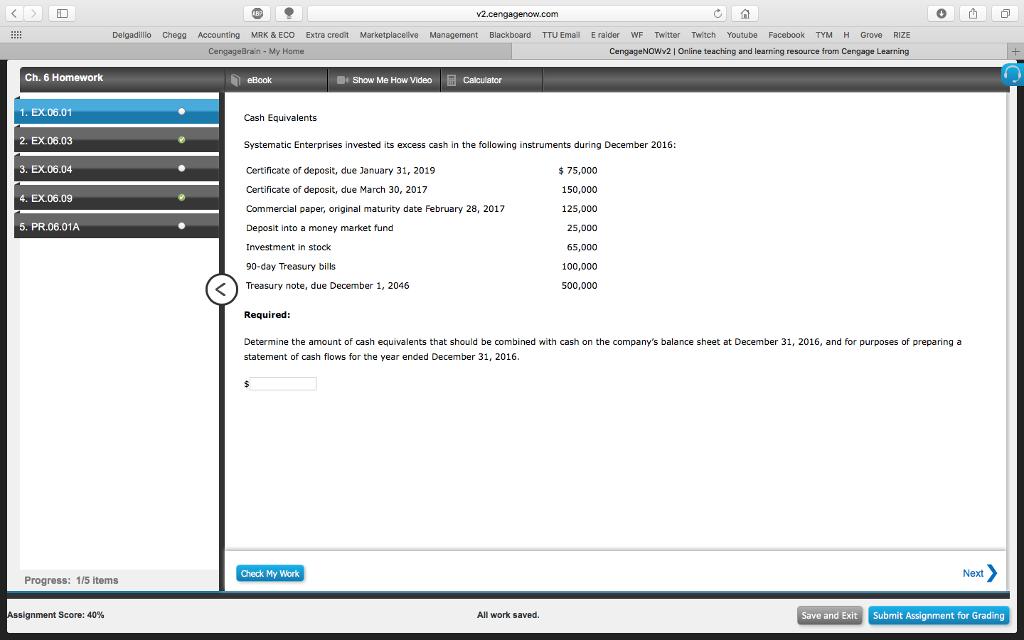

# Ch. 6 Homework 1. EX.06.01 2. EX.06.03 3. EX.06.04 4. EX.06.09 5. PR.06.01A Progress: 1/5 items Assignment Score: 40% v2.cengagenow.com Delgadillo Chegg Accounting MRK & ECO Extra credit Marketplacelive Management Blackboard TTU Email CengageBrain - My Home LBP eBook Cash Equivalents Systematic Enterprises invested its excess cash in the following instruments during December 2016: Certificate of deposit, due January 31, 2019 $ 75,000 Certificate of deposit, due March 30, 2017 150,000 125,000 25,000 65,000 100,000 500,000 Commercial paper, original maturity date February 28, 2017 Deposit into a money market fund Investment in stock 90-day Treasury bills Treasury note, due December 1, 2046 Required: Show Me How Video Calculator $ Check My Work Determine the amount of cash equivalents that should be combined with cash on the company's balance sheet at December 31, 2016, and for purposes preparing a statement of cash flows for the year ended December 31, 2016. O n E raider E raider WF Twitter Twitch Youtube Facebook TYM H Grove RIZE CengageNOWv2 | Online teaching and learning resource from Cengage Learning All work saved. Next> n Save and Exit Submit Assignment for Grading # Ch. 6 Homework 1. EX.06.01 2. EX.06.03 3. EX.06.04 4. EX.06.09 5. PR.06.01A Progress: 1/5 items Assignment Score: 40% v2.cengagenow.com Delgadillo Chegg Accounting MRK & ECO Extra credit Marketplacelive Management Blackboard TTU Email CengageBrain - My Home LBP eBook Cash Equivalents Systematic Enterprises invested its excess cash in the following instruments during December 2016: Certificate of deposit, due January 31, 2019 $ 75,000 Certificate of deposit, due March 30, 2017 150,000 125,000 25,000 65,000 100,000 500,000 Commercial paper, original maturity date February 28, 2017 Deposit into a money market fund Investment in stock 90-day Treasury bills Treasury note, due December 1, 2046 Required: Show Me How Video Calculator $ Check My Work Determine the amount of cash equivalents that should be combined with cash on the company's balance sheet at December 31, 2016, and for purposes preparing a statement of cash flows for the year ended December 31, 2016. O n E raider E raider WF Twitter Twitch Youtube Facebook TYM H Grove RIZE CengageNOWv2 | Online teaching and learning resource from Cengage Learning All work saved. Next> n Save and Exit Submit Assignment for Grading

Expert Answer:

Answer rating: 100% (QA)

Cash Equivalent Cash equivalents are highly liquid assets that can be converted into cash within a ... View the full answer

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these accounting questions

-

Systematic Enterprises invested its excess cash in the following instruments during December 2010: Certificate of deposit, due January 31, 2013 ......... $ 75,000 Certificate of deposit, due March...

-

Systematic Enterprises invested its excess cash in the following instruments during December 2012: Certificate of deposit, due January 31, 2015...........................$ 75,000 Certificate of...

-

Systematic Enterprises invested its excess cash in the following instruments during December 2017: Certificate of deposit, due January 31, 2020 ............................... $ 75,000 Certificate of...

-

Find the net torque on the wheel in the figure below about the axle through O perpendicular to the page, taking a = 7.00 cm and b = 25.0 cm. (Indicate the direction with the sign of your answer....

-

Why is the notion of value problematic when discussing environmental ethics?

-

A pendulum is constructed from a bob of mass \(m\) on one end of a light string of length \(D\). The other end of string is attached to the top of a circular cylinder of radius \(R\) \((R <2 D /...

-

Can you create a graphic of the Fairmont payroll systems company expenses that highlight general accounting clerk, Mary Perez, has company expenses for FICA (social security), Medicare and 401K,...

-

Ryan Richards, controller for Grange Retailers, has assembled the following data to assist in the preparation of a cash budget for the third quarter of 2010: a. Sales: May (actual) ......$100,000...

-

Find the x and y intercept For the equation y= 2 x+1, Part: 0/3 Part 1 of 3 (a) Find the x-intercept. The x-intercept is DD

-

Managers often assume a strictly linear relationship between cost and the level of activity. Under what conditions would this be a valid or invalid assumption?

-

What are the characteristics of a multi business company which would greatly benefit from a portfolio approach?

-

Forensic Psychology's Role in the Legal SystemResources PSYC Discussion Participation Scoring Guide . In this unit, you were introduced to forensic psychology as a subfield of psychology as well as...

-

Why is proper inventory valuation so important? Why does an understated ending inventory understate net income for the period by the same amount? Why does an error in ending inventory affect two...

-

Do liquids dissolve structures blocking their path, or do they merely circumnavigate them? Discuss the impact of increased liquidity and gaseousness on hierarchical social structures. Is the current...

-

Decision making is management"s most important function. Do you agree? Why or why not?

-

During the first quarter of the year, Swifty Corporation generated sales revenue of $1375000 on sales of 55000 units of its wireless earbuds. The break-even point is 22000 units. What is the...

-

Alpha Company paid janitors $5 per hour to clean the production area. It initially set the standard cost of janitorial work at $4.50 per hour, and 530 hours were worked by the janitors. Question What...

-

The 2017 financial statements of the U.S. government are available at: https://www.fiscal.treasury.gov/fsreports/rpt/finrep/fr/fr_index.htm Use these to answer the following questions: a. Statement...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1 and 2. On September 1, Irene opened a retail store that specializes in sports car...

-

Frank, age 35, and Joyce, age 34, are married and file a joint income tax return for 2012. Their salaries for the year total $83,000 and they have taxable interest income of $4,000. They have no...

-

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first...

-

In Problem 102, using an interest rate of 10 percent, what uniform series over the closed interval [1,8] is equivalent to the cash flow profile shown? Data from problem 102 Consider the following...

-

In Problem 102, using an interest rate of 8 percent, what single sum of money occurring at the end of year 8 is equivalent to the cash flow profile shown? Data from problem 102 Consider the following...

-

Consider the following cash flow profile: With a compounded annual interest rate of 6 percent, what single sum of money at the end of the sixth year will be equivalent to the cash flow series? EOY...

Study smarter with the SolutionInn App