Question: Ch11 & 13 0 Saved Help Save & Exit Submit (The following information applies to the questions displayed below.) Gilligan Corporation was established on February

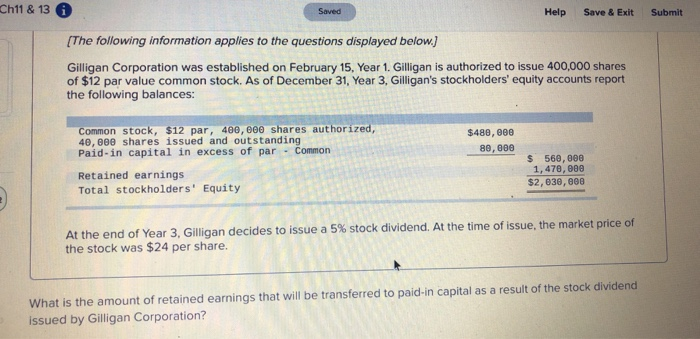

Ch11 & 13 0 Saved Help Save & Exit Submit (The following information applies to the questions displayed below.) Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 400,000 shares of $12 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: $480,000 80,000 Common Common stock, $12 par, 400,000 shares authorized, 40,000 shares issued and outstanding Paid in capital in excess of par Retained earnings Total stockholders' Equity $ 560,000 1,470,000 $2,630,000 At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $24 per share. What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts