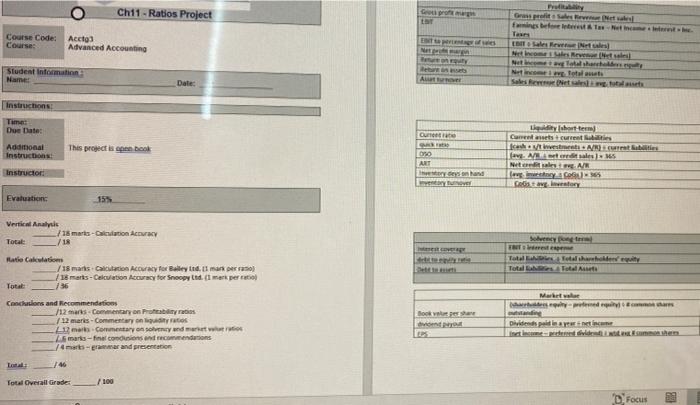

Question: Ch11 - Ratios Project LET Team Course Code: Courses Aceto Advanced Accounting Student Information Name: AL Date: Sales Berita Instructions Tiet Due Date: Additional Instructions

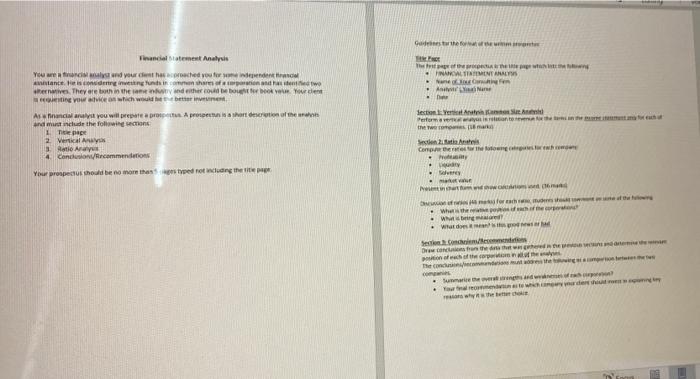

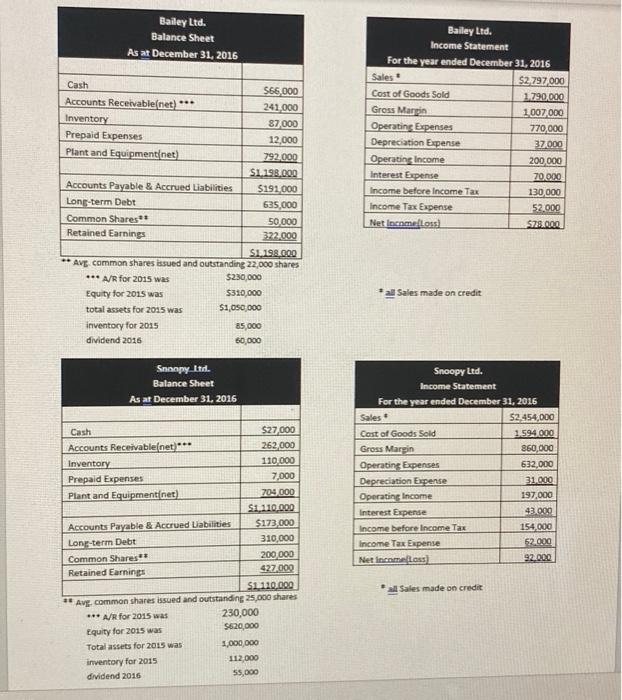

Ch11 - Ratios Project LET Team Course Code: Courses Aceto Advanced Accounting Student Information Name: AL Date: Sales Berita Instructions Tiet Due Date: Additional Instructions This project is open book Qur SMART DO ART stand Lyshort-term Care este cure Ich states ve Adales NAR GOGUE isang Instructor Evaluation 155 Vertical Analysis /18 marts-allation couracy Total Sony Teden Total Detailhawi Total Total Hatie Calculation / 15 marts Calculation Accuracy for you an essas 16 marts - Calculation Accuracy for Snoopytd. (I mer per Total 136 Conclusions and recommendations /12 marts Commentary on Prebytes 12 meris - Commentary on liquidity ratio 12 marts Commentary and that marks-incomuns encomendamos /4 marts and presentation Book Marbete sed quia - Dividends peldbereich Total Overall Grade: 100 Focus Gusttheo CE ALTAMENTS nem . Anne . Financial Statement Analysis You were and your cred you for an independent ang ngunich two They are in the new and the country. Your de in which would be Asinancial you will be pro Apresents a short descrtion of the and mude the following con LTE 2. W Ati Ara Conclusion/Recommendations Your prospects should be no more than typed noting the de Arte Perfor treem Sentines www016 for the When the Wing What does Seconds De Counter of the The the und . site worden w the Bailey Ltd. Balance Sheet As at December 31, 2016 . Cash 566,000 Accounts Receivable(net) ** 241,000 Inventory 87000 Prepaid Expenses 12,000 Plant and Equipment(net) 792000 $1.190.000 Accounts Payable & Accrued Liabilities $191,000 Long-term Debt 635,000 Common Sharese 50.000 Retained Earnings 322.000 S. 198.000 ** Avg. common shares issued and outstanding 22,000 shares *** A/R for 2015 was $230,000 Equity for 2015 was $310,000 total assets for 2015 was 51,050,000 inventory for 2015 85,000 dividend 2016 50,000 Bailey Ltd. Income Statement For the year ended December 31, 2016 Sales $2797 000 Cost of Goods Sold 1.790.000 Gross Marin 1007000 Operating Expenses 770,000 Depreciation Expense 37000 Operating Income 200 000 Interest Expense 70.000 Income before Income Tax 130 000 Income Tax Expense 52.000 Net Income Loss 578.000 Sales made on credit Snoopy Itd. Balance Sheet As at December 31, 2016 Sales Cash $27.000 Accounts Receivable net). 262.000 Inventory 110,000 Prepaid Expenses 7,000 Plant and Equipment net 709 000 S1110.000 Accounts Payable & Accrued abilities $173 000 Long-term Debt 310,000 Common Shares 200 000 Retained Earnings 427,000 S1110.000 ** Avg. common shares issued and outstanding 25,000 shares *** A/R for 2015 was 230,000 Equity for 2015 was 5620,000 Total assets for 2015 was 1,000,000 inventory for 2015 112,000 dividend 2016 55,000 Snoopy Ltd. Income Statement For the year ended December 31, 2016 52,454,000 Cost of Goods Sold 1594.000 Gross Marin 860,000 Operating Expenses 632,000 Depreciation Expense 31.000 Operating Income 197,000 Interest Expense 43.000 Income before Income Tax 154,000 Income Tax Expense 52.000 Net Income L.033) 92.000 al Sales made on credit Ch11 - Ratios Project LET Team Course Code: Courses Aceto Advanced Accounting Student Information Name: AL Date: Sales Berita Instructions Tiet Due Date: Additional Instructions This project is open book Qur SMART DO ART stand Lyshort-term Care este cure Ich states ve Adales NAR GOGUE isang Instructor Evaluation 155 Vertical Analysis /18 marts-allation couracy Total Sony Teden Total Detailhawi Total Total Hatie Calculation / 15 marts Calculation Accuracy for you an essas 16 marts - Calculation Accuracy for Snoopytd. (I mer per Total 136 Conclusions and recommendations /12 marts Commentary on Prebytes 12 meris - Commentary on liquidity ratio 12 marts Commentary and that marks-incomuns encomendamos /4 marts and presentation Book Marbete sed quia - Dividends peldbereich Total Overall Grade: 100 Focus Gusttheo CE ALTAMENTS nem . Anne . Financial Statement Analysis You were and your cred you for an independent ang ngunich two They are in the new and the country. Your de in which would be Asinancial you will be pro Apresents a short descrtion of the and mude the following con LTE 2. W Ati Ara Conclusion/Recommendations Your prospects should be no more than typed noting the de Arte Perfor treem Sentines www016 for the When the Wing What does Seconds De Counter of the The the und . site worden w the Bailey Ltd. Balance Sheet As at December 31, 2016 . Cash 566,000 Accounts Receivable(net) ** 241,000 Inventory 87000 Prepaid Expenses 12,000 Plant and Equipment(net) 792000 $1.190.000 Accounts Payable & Accrued Liabilities $191,000 Long-term Debt 635,000 Common Sharese 50.000 Retained Earnings 322.000 S. 198.000 ** Avg. common shares issued and outstanding 22,000 shares *** A/R for 2015 was $230,000 Equity for 2015 was $310,000 total assets for 2015 was 51,050,000 inventory for 2015 85,000 dividend 2016 50,000 Bailey Ltd. Income Statement For the year ended December 31, 2016 Sales $2797 000 Cost of Goods Sold 1.790.000 Gross Marin 1007000 Operating Expenses 770,000 Depreciation Expense 37000 Operating Income 200 000 Interest Expense 70.000 Income before Income Tax 130 000 Income Tax Expense 52.000 Net Income Loss 578.000 Sales made on credit Snoopy Itd. Balance Sheet As at December 31, 2016 Sales Cash $27.000 Accounts Receivable net). 262.000 Inventory 110,000 Prepaid Expenses 7,000 Plant and Equipment net 709 000 S1110.000 Accounts Payable & Accrued abilities $173 000 Long-term Debt 310,000 Common Shares 200 000 Retained Earnings 427,000 S1110.000 ** Avg. common shares issued and outstanding 25,000 shares *** A/R for 2015 was 230,000 Equity for 2015 was 5620,000 Total assets for 2015 was 1,000,000 inventory for 2015 112,000 dividend 2016 55,000 Snoopy Ltd. Income Statement For the year ended December 31, 2016 52,454,000 Cost of Goods Sold 1594.000 Gross Marin 860,000 Operating Expenses 632,000 Depreciation Expense 31.000 Operating Income 197,000 Interest Expense 43.000 Income before Income Tax 154,000 Income Tax Expense 52.000 Net Income L.033) 92.000 al Sales made on credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts