Question: ch.12 question 5 please show step by step You must evaluate the purchase of a proposed spectrometer for your company that will save the company

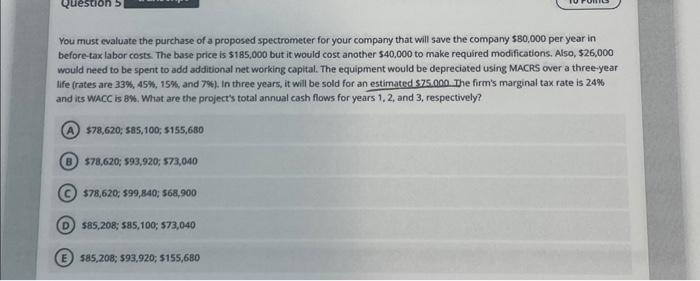

You must evaluate the purchase of a proposed spectrometer for your company that will save the company $80,000 per year in before-tax labor costs. The base price is $185,000 but it would cost another $40,000 to make required modifications. Also, $26,000 would need to be spent to add additional net working capltal. The equipment would be depreciated using MACRS over a three-year life (rates are 33%,45%,15%, and 7% ). In three years, it will be sold for an estimated 575.000 . The firm's marginal tax rate is 24% and its wacc is 8 . What are the project's total annual cash flows for years 1,2 , and 3 , respectively? $78,620;585,100;5155,680 $78,620;$93,920;573,040 $78,620;599,840;568,900 585,208;585,100;573,040 585,208;593,920;5155,680 You must evaluate the purchase of a proposed spectrometer for your company that will save the company $80,000 per year in before-tax labor costs. The base price is $185,000 but it would cost another $40,000 to make required modifications. Also, $26,000 would need to be spent to add additional net working capltal. The equipment would be depreciated using MACRS over a three-year life (rates are 33%,45%,15%, and 7% ). In three years, it will be sold for an estimated 575.000 . The firm's marginal tax rate is 24% and its wacc is 8 . What are the project's total annual cash flows for years 1,2 , and 3 , respectively? $78,620;585,100;5155,680 $78,620;$93,920;573,040 $78,620;599,840;568,900 585,208;585,100;573,040 585,208;593,920;5155,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts