Question: Ch5 In class assignment-Answers to be submitted in Canvas A company reports the following amounts at 12/31/YR2 (before any year-end adjustment). Management estimates 9% of

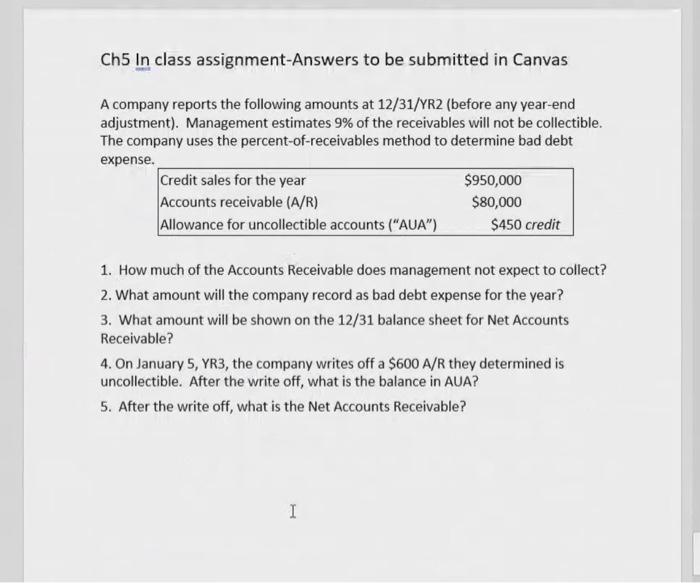

Ch5 In class assignment-Answers to be submitted in Canvas A company reports the following amounts at 12/31/YR2 (before any year-end adjustment). Management estimates 9% of the receivables will not be collectible. The company uses the percent-of-receivables method to determine bad debt expense. Credit sales for the year $950,000 Accounts receivable (A/R) $80,000 Allowance for uncollectible accounts ("AUA") $450 credit 1. How much of the Accounts Receivable does management not expect to collect? 2. What amount will the company record as bad debt expense for the year? 3. What amount will be shown on the 12/31 balance sheet for Net Accounts Receivable? 4. On January 5, YR3, the company writes off a $600 A/R they determined is uncollectible. After the write off, what is the balance in AUA? 5. After the write off, what is the Net Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts