Question: Challenge, Critical Thinking, & Other Applications 15. Sanchez is eligible to receive retirement benefits of $901.01 at age 65, but decides to start receiving them

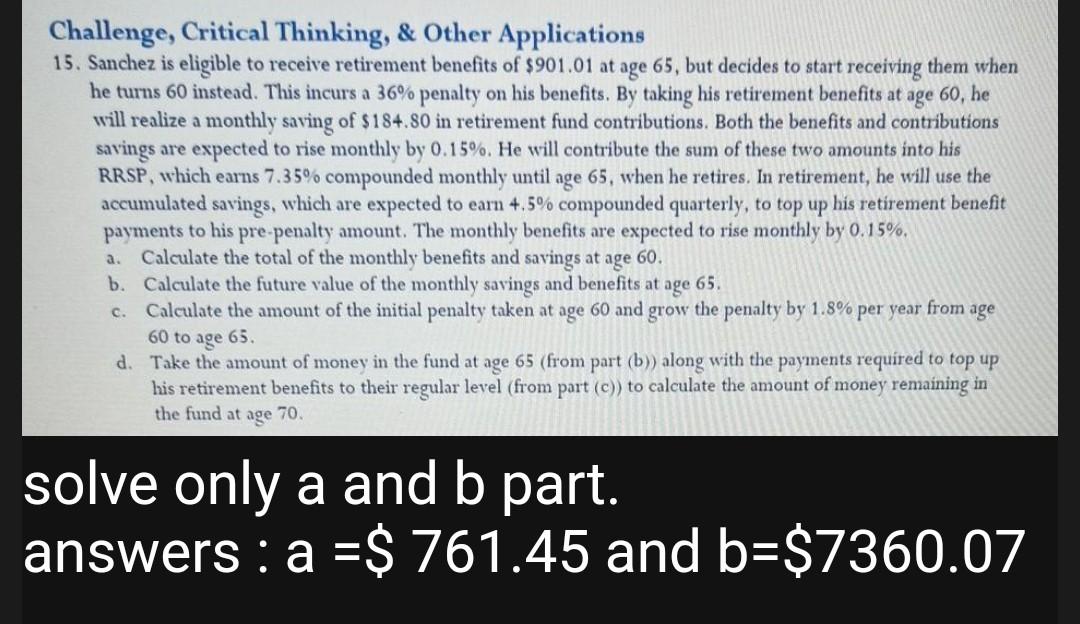

Challenge, Critical Thinking, & Other Applications 15. Sanchez is eligible to receive retirement benefits of $901.01 at age 65, but decides to start receiving them when he turns 60 instead. This incurs a 36% penalty on his benefits. By taking his retirement benefits at age 60, he will realize a monthly saving of $184.80 in retirement fund contributions. Both the benefits and contributions savings are expected to rise monthly by 0.15%. He will contribute the sum of these two amounts into his RRSP, which earns 7.35% compounded monthly until age 65, when he retires. In retirement, he will use the accumulated savings, which are expected to earn 4,5% compounded quarterly, to top up his retirement benefit payments to his pre-penalty amount. The monthly benefits are expected to rise monthly by 0.15%, a. Calculate the total of the monthly benefits and savings at age b. Calculate the future value of the monthly savings and benefits at Calculate the amount of the initial penalty taken at age 60 and grow the penalty by 1.8% per year from age 60 to age 65. d. Take the amount of money in the fund at age 65 (from part (b)) along with the payments required to top up his retirement benefits to their regular level (from part (c)) to calculate the amount of money remaining in the fund at age 70 60. age 65, c. solve only a and b part. answers : a =$ 761.45 and b=$7360.07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts