Question: Challenge question. In the chapter text, we dealt exclusively with a single lump sum, but often we may be looking at several lump-sum values simultaneously.

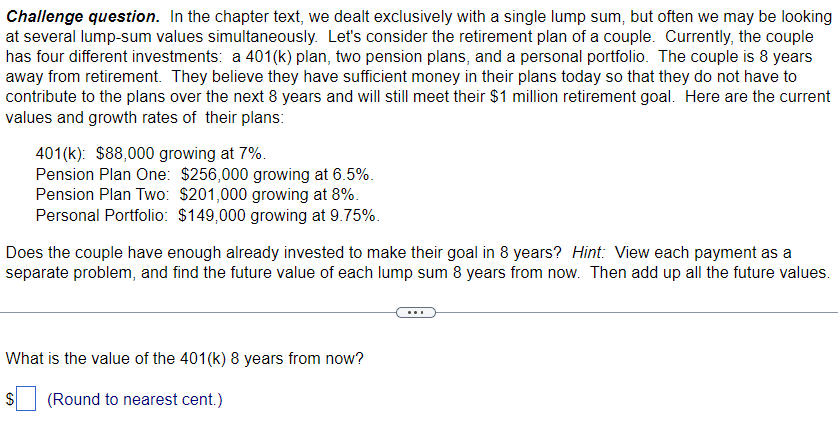

Challenge question. In the chapter text, we dealt exclusively with a single lump sum, but often we may be looking at several lump-sum values simultaneously. Let's consider the retirement plan of a couple. Currently, the couple has four different investments: a 401(k) plan, two pension plans, and a personal portfolio. The couple is 8 years away from retirement. They believe they have sufficient money in their plans today so that they do not have to contribute to the plans over the next 8 years and will still meet their $1 million retirement goal. Here are the current values and growth rates of their plans: 401(k): $88,000 growing at 7%. Pension Plan One: $256,000 growing at 6.5%. Pension Plan Two: $201,000 growing at 8%. Personal Portfolio: $149,000 growing at 9.75%. Does the couple have enough already invested to make their goal in 8 years? Hint: View each payment as a separate problem, and find the future value of each lump sum 8 years from now. Then add up all the future values. What is the value of the 401(k)8 years from now? $ (Round to nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts