Question: changes if you submit or change the answer Assignment Scoring Your best submission for each question part is used for your score. 20. (-/3 Points)

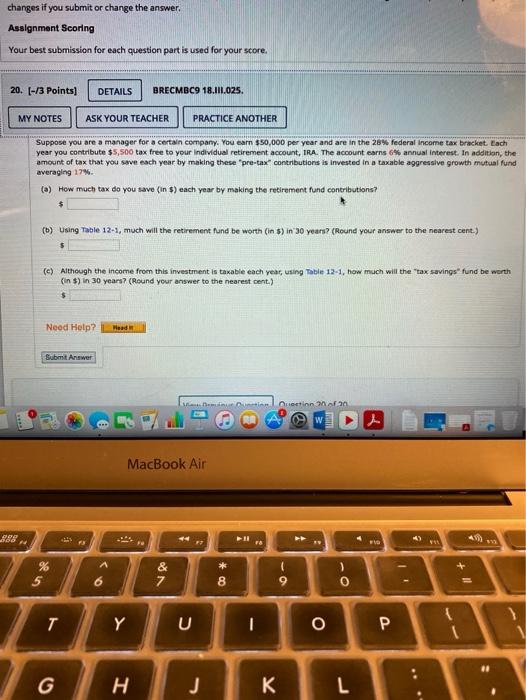

changes if you submit or change the answer Assignment Scoring Your best submission for each question part is used for your score. 20. (-/3 Points) DETAILS BRECMBC9 18.111.025. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Suppose you are a manager for a certain company. You earn $50,000 per year and are in the 28% federal income tax bracket. Each year you contribute $5,500 tax free to your individual retirement account, TRA. The account earns 6% annual interest. In addition, the amount of tax that you save each year by making these "pre-tax contributions is invested in a taxable aggressive growth mutual fund averaging 17% () How much tax do you save (in $) each year by making the retirement fund contributions? $ () Using Table 12-1, much will the retirement fund be worth (in $) in years? answer to the nearest cent.) (c) Although the income from this investment is taxable each year, using Table 12-1, how much will the tax savings" fund be worth (in $) in 30 years? (Round your answer to the nearest cent.) Need Help? Head Submit Answer notion of 20 0 W MacBook Air 888 u * % 5 & 7 ( 9 8 0 T Y I o P H J L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts