Question: CHAP 14 - Q2 THE DROPDOWN OPTIONS ARE IN THE NEXT IMAGE Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial

CHAP 14 - Q2

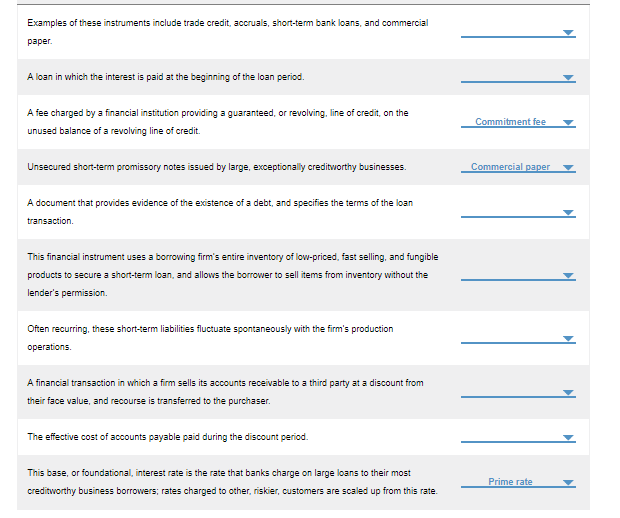

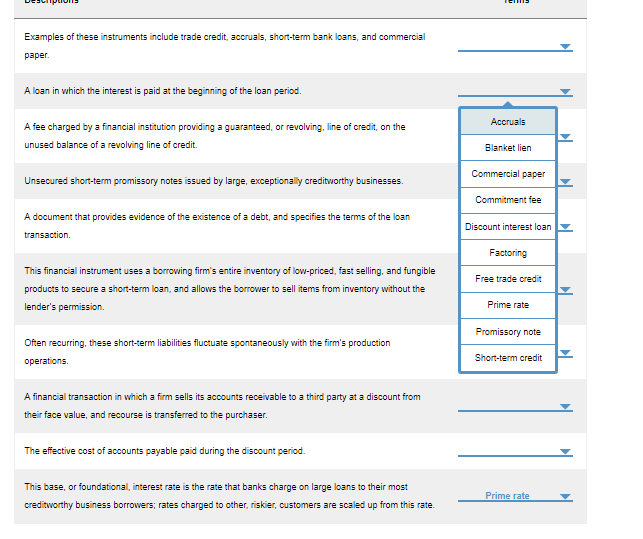

THE DROPDOWN OPTIONS ARE IN THE NEXT IMAGE

Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial paper A loan in which the interest is paid at the beginning of the loan period. A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of a revolving line of credit. Commitment fee Unsecured short-term promissory notes issued by large, exceptionally creditworthy businesses Commercial paper A document that provides evidence of the existence of a debt, and specifies the terms of the loan transaction This financial instrument uses a borrowing firm's entire inventory of low-priced, fast selling, and fungible products to secure a short-term loan, and allows the borrower to sell items from inventory without the lender's permission Often recurring, these short-term liabilities fluctuate spontaneously with the firm's production operations A financial transaction in which a firm sells its accounts receivable to a third party at a discount from their face value, and recourse is transferred to the purchaser The effective cost of accounts payable paid during the discount period. This base, or foundational interest rate is the rate that banks charge on large loans to their most creditworthy business borrowers, rates charged to other riskier customers are scaled up from this rate rate Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial paper. A loan in which the interest is paid at the beginning of the loan period. Accruals A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of a revolving line of credit. Blanket lien Commercial paper Unsecured short-term promissory notes issued by large, exceptionally creditworthy businesses Commitment fee A document that provides evidence of the existence of a debt, and specifies the terms of the loan transaction. Discount interest loan Factoring Free trade credit This financial instrument uses a borrowing firm's entire inventory of low-priced, fast selling, and fungible products to secure a short-term loan, and allows the borrower to sell items from inventory without the lender's permission. Prime rate Promissory note Often recurring, these short-term liabilities fluctuate spontaneously with the firm's production operations. Short-term credit A financial transaction in which a firm sells its accounts receivable to a third party at a discount from their face value, and recourse is transferred to the purchaser. The effective cost of accounts payable paid during the discount period. This base, or foundational, interest rate is the rate that banks charge on large loans to their most creditworthy business borrowers; rates charged to other riskier, customers are scaled up from this rate. Prime rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts