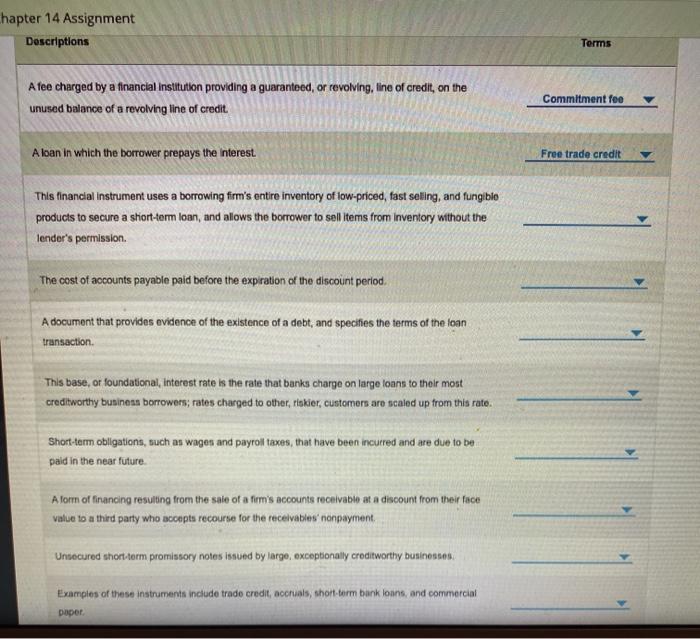

Question: hapter 14 Assignment Descriptions Terms A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of

hapter 14 Assignment Descriptions Terms A fee charged by a financial institution providing a guaranteed, or revolving, line of credit, on the unused balance of a revolving line of credit. Commitment fee Alban in which the borrower prepays the interest Free trade credit This financial instrument uses a borrowing firm's entire inventory of low-priced, fast selling, and fungible products to secure a shiort-term loan, and allows the borrower to sell items from Inventory without the lender's permission. The cost of accounts payable paid before the expiration of the discount period. A document that provides evidence of the existence of a debt, and specifies the terms of the loan transaction This base, or foundational, la 1, interest rate is the rate that banks charge on large loans to their most creditworthy business borrowers; rates charged to other, riskier, customers are scaled up from this rato Short-term obligations, such as wages and payroll taxes, that have been incurred and are due to be paid in the near future A form of financing resulting from the sale of a firm's accounts receivable at a discount from their face value to a third party who accepts recourse for the receivables' nonpayment. Untecured short-term promissory notes issued by largo, exceptionally creditworthy businesses Examples of these instruments include trade credit, accruals, short-term bank loans, and commercial poper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts